Exempt

This property is Partial Exemption

R00500920130550

101 N GREENWOOD AV E TULSA 74120

$735,616

$65,406

General Information

| Situs Address | 101 N GREENWOOD AV E TULSA 74120 |

|---|---|

| Owner Name |

GREENWOOD CHAMBER OF COMMERCE INC, THE

|

| Owner Mailing Address | 116 N GREENWOOD AVE TULSA , OK 741201409 |

| Account Type | Partial Exempt |

| Parcel ID | 00500-92-01-30550 |

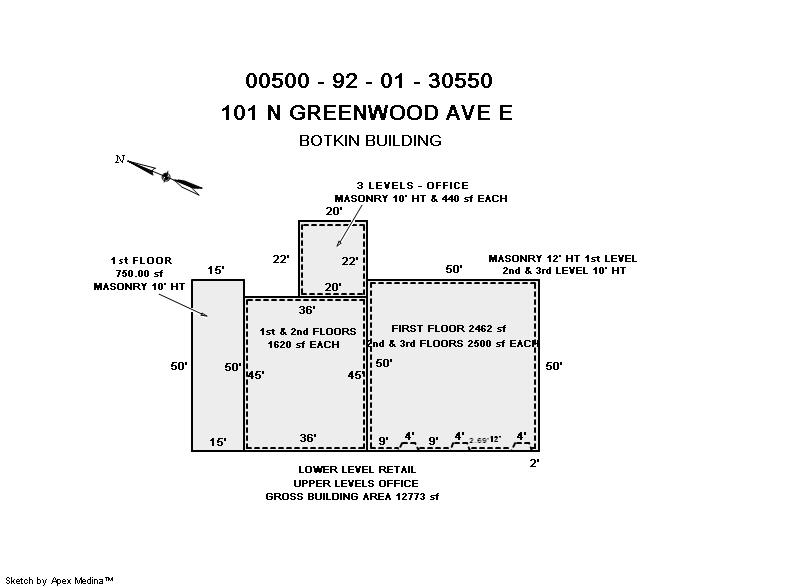

| Land Area | 0.37 acres / 16,155 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: TULSA-ORIGINAL TOWN (00500) Legal: PRT LTS 5 & 6 BEG SWC LT 5 TH ELY140 NLY78 TO SWLY R/W I-244 TH NWLY ALG R/W 70.22 TH WLY86.88 TO WL LT 6 TH SLY124.15 POB BLK 47 Section: 01 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

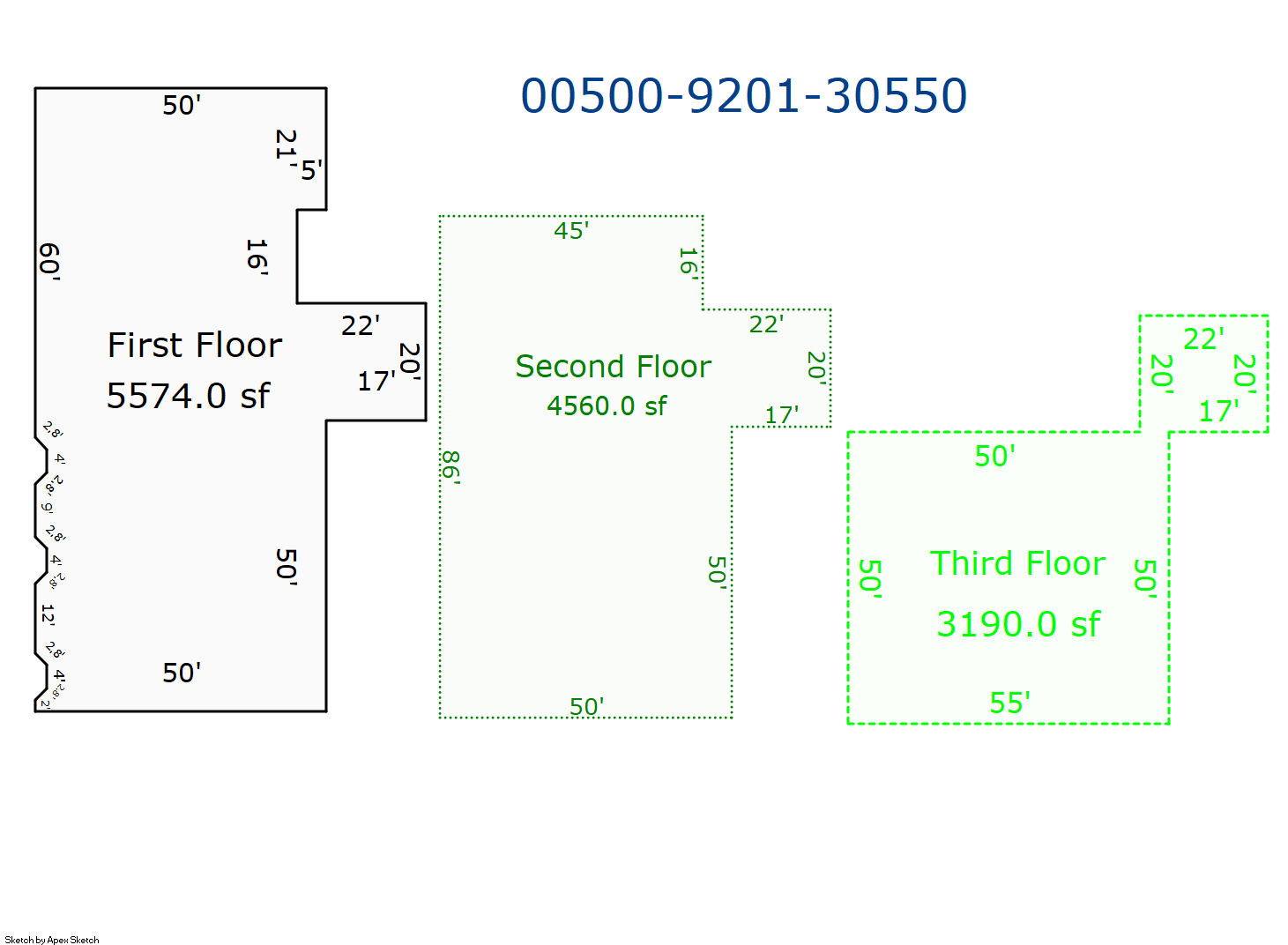

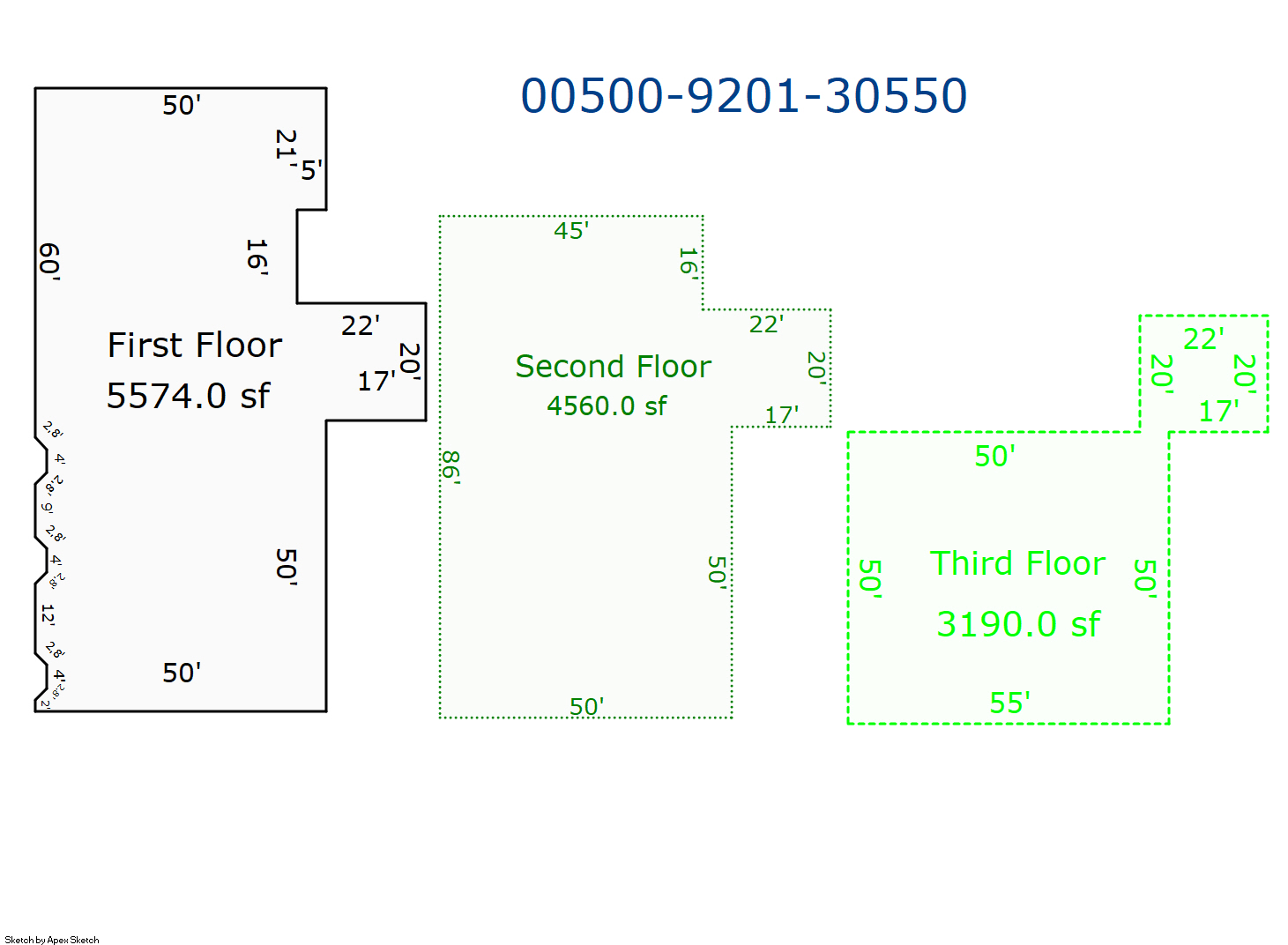

| 2025 | 1930 | Commercial | 13,324 sqft | 3.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Complete HVAC | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1930 | Commercial | 13,324 sqft | 3.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1930 | Commercial | 13,324 sqft | 3.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Complete HVAC | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $735,616 | $735,616 | $735,616 |

| Total Taxable Value (Capped) | $539,317 | $566,284 | $594,597 |

| Improvement Value | $476,856 | $476,856 | $476,856 |

| Land Value | $258,760 | $258,760 | $258,760 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $59,325 | $62,292 | $65,406 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $59,325 | $62,292 | $65,406 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 134.01 |

| Estimated taxes | $7,529 | $8,067 | $8,765 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/18/1981 | TULSA URBAN RENEWAL AUTH | GREENWOOD CHAMBER OF COMMERCE INC | $0 | Special Warranty Deed | 1999996481 |

Sales/Documents

| Sale Date | 9/18/1981 |

|---|---|

| Grantor | TULSA URBAN RENEWAL AUTH |

| Grantee | GREENWOOD CHAMBER OF COMMERCE INC |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 1999996481 |