General Information

| Situs Address | 312 S KENOSHA AV E TULSA 741202431 |

|---|---|

| Owner Name |

SHARP, DAVID P REVOCABLE TRUST

|

| Owner Mailing Address | C/O DAVID P SHARP TTEE PO BOX 50322 TULSA, OK 741500322 |

| Account Type | Commercial |

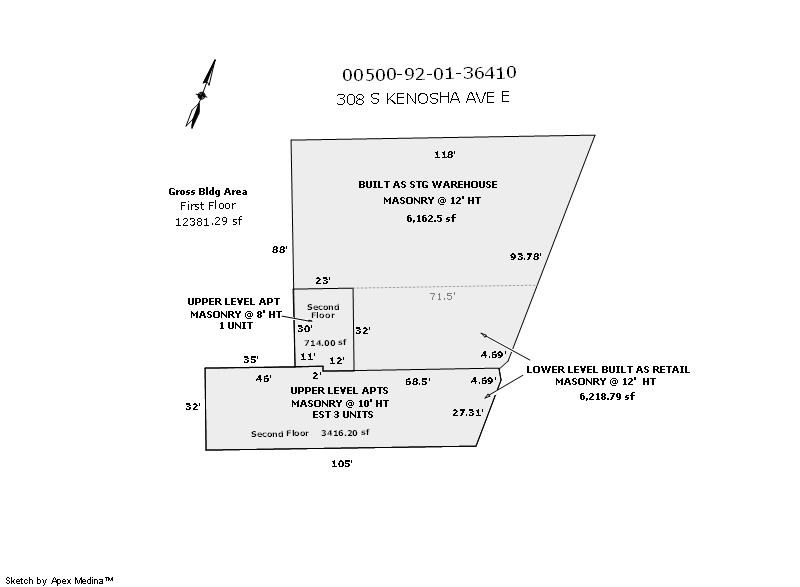

| Parcel ID | 00500-92-01-36410 |

| Land Area | 0.30 acres / 12,885 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: TULSA-ORIGINAL TOWN (00500) Legal: E50 S120 LT 8 & E35 W50 S32 LT 8 & S120 LT 9 BLK 113 Section: 01 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1925 | Commercial | 6,162 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2025 | 1925 | Commercial | 6,219 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Hot Water Radiant | |||||

| 2025 | 1925 | Commercial | 4,130 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Multiple - Residential | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1925 | Commercial | 6,219 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Hot Water Radiant | |||||

| 2024 | 1925 | Commercial | 6,162 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2024 | 1925 | Commercial | 4,130 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Multiple - Residential | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1925 | Commercial | 4,130 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Multiple - Residential | Space Heater | |||||

| 2023 | 1925 | Commercial | 6,162 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2023 | 1925 | Commercial | 6,219 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Hot Water Radiant | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $379,600 | $379,600 | $379,600 |

| Total Taxable Value (Capped) | $333,216 | $349,877 | $367,371 |

| Improvement Value | $218,500 | $218,500 | $218,500 |

| Land Value | $161,100 | $161,100 | $161,100 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $36,654 | $38,486 | $40,411 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $36,654 | $38,486 | $40,411 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $4,652 | $4,984 | $5,234 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/28/2017 | SHARP, DAVID P | SHARP, DAVID P REVOCABLE TRUST | $0 | Warranty Deed | 2017017732 |

| 7/19/1991 | WILLIAM DEAN & KATHLEEN L | DAVID P. SHARP SHARP DEV | $105,000 | History | 2000000190 BK-05310PG-01295 |

Sales/Documents

| Sale Date | 2/28/2017 |

|---|---|

| Grantor | SHARP, DAVID P |

| Grantee | SHARP, DAVID P REVOCABLE TRUST |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2017017732 |

| Sale Date | 7/19/1991 |

| Grantor | WILLIAM DEAN & KATHLEEN L |

| Grantee | DAVID P. SHARP SHARP DEV |

| Sale Price | $105,000 |

| Deed Type | History |

| Document Number | 2000000190 BK-05310PG-01295 |