General Information

| Situs Address | 11501 E 22 PL S TULSA 74129 |

|---|---|

| Owner Name |

A-V 23 EAST OWNER LLC

|

| Owner Mailing Address | C/O SHELTER GROWTH CAPITAL PARTNERS 750 WASHINGTON BLVD STE 1050 STAMFORD, CT 069013722 |

| Account Type | Commercial |

| Parcel ID | 06090-94-17-12170 |

| Land Area | 0.89 acres / 38,573 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: BURRIS SQUARE (06090) Legal: LT 2 BLK 1 Section: 17 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

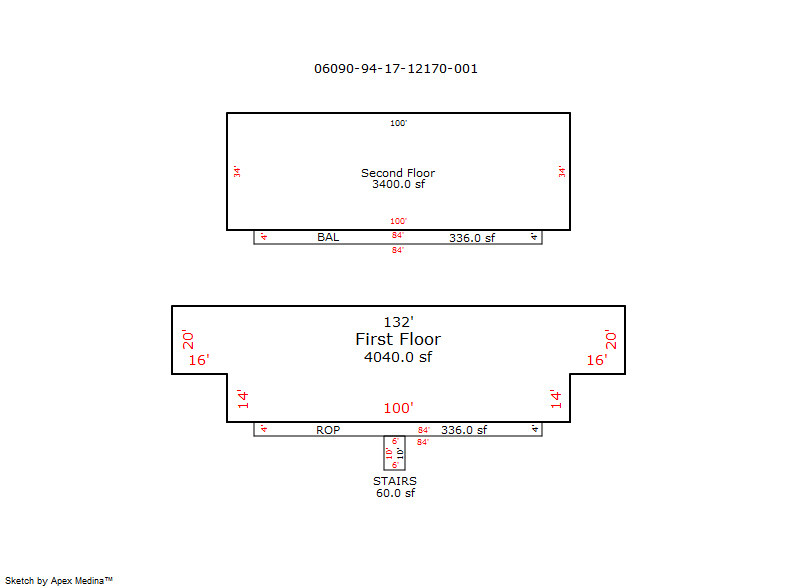

| 2025 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

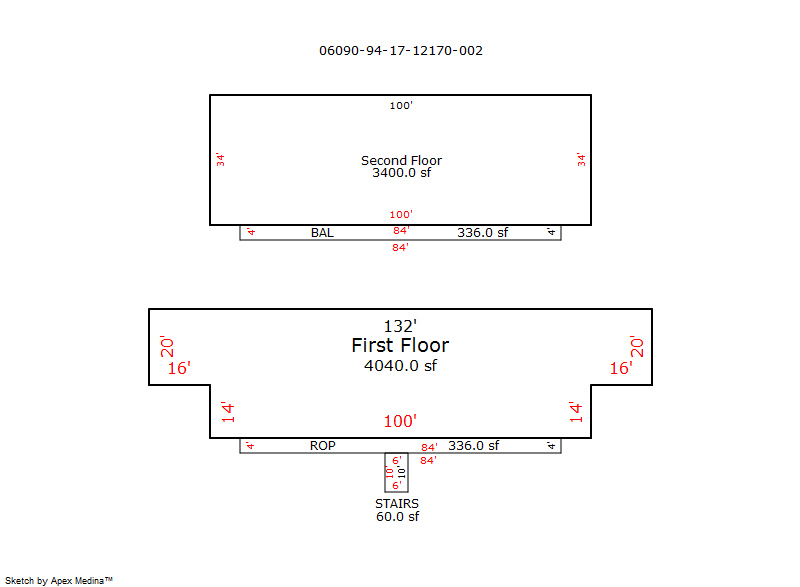

| 2025 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

| 2024 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

| 2023 | 1971 | Multiple Unit | 7,440 sqft | 2.00 | 10 | 0.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Masonry Veneer | Central Air to Air | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $972,100 | $950,000 | - |

| Total Taxable Value (Capped) | $972,100 | $950,000 | - |

| Improvement Value | $875,700 | $853,600 | - |

| Land Value | $96,400 | $96,400 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $106,931 | $104,500 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $106,931 | $104,500 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $13,571 | $13,534 | - |

| Last Notice Date | 3/1/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/5/2021 | IRONWOOD REAL ESTATE ETAL; BROADWAY RIDGE LLC | A-V 23 EAST OWNER LLC | $14,500,000 | Special Warranty Deed | 2021091917 |

| 1/6/2020 | NELSON, MICHAEL | IRONWOOD REAL ESTATE ETAL;BROADWAY RIDGE LLC | $7,285,000 | Special Warranty Deed | 2020002070 |

| 9/27/2018 | BURR, ROGER R | NELSON, MICHAEL | $0 | Special Warranty Deed | 2019097564 |

| 9/26/1989 | $0 | General Warranty Deed | 2000012733 BK-05209PG-02119 |

Sales/Documents

| Sale Date | 8/5/2021 |

|---|---|

| Grantor | IRONWOOD REAL ESTATE ETAL; BROADWAY RIDGE LLC |

| Grantee | A-V 23 EAST OWNER LLC |

| Sale Price | $14,500,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2021091917 |

| Sale Date | 1/6/2020 |

| Grantor | NELSON, MICHAEL |

| Grantee | IRONWOOD REAL ESTATE ETAL;BROADWAY RIDGE LLC |

| Sale Price | $7,285,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2020002070 |

| Sale Date | 9/27/2018 |

| Grantor | BURR, ROGER R |

| Grantee | NELSON, MICHAEL |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2019097564 |

| Sale Date | 9/26/1989 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000012733 BK-05209PG-02119 |