General Information

| Situs Address | 930 E 36 ST N TULSA 74106 |

|---|---|

| Owner Name |

THOMAS, ANGELIA

|

| Owner Mailing Address | 2407 N ROCKFORD AVE TULSA , OK 741064013 |

| Account Type | Commercial |

| Parcel ID | 07600-02-24-00650 |

| Land Area | 0.25 acres / 10,888 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: CHANDLER FRATES SECOND ADDN (07600) Legal: LT 1 BLK 1 Section: 24 Township: 20 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

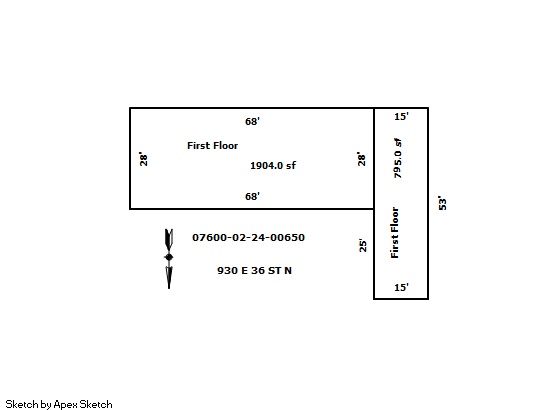

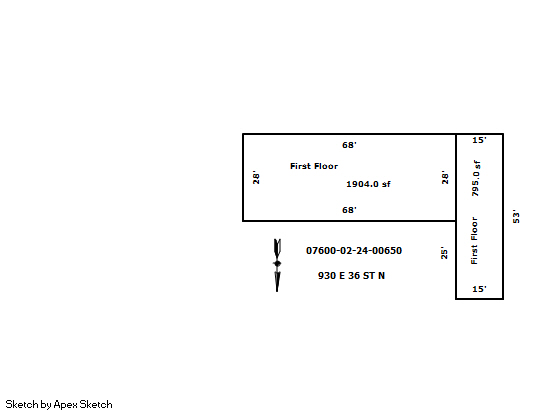

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1960 | Commercial | 1,904 sqft | 1.00 | 11 | 0.00 | |

| 1.00 | Retail Store | Space Heater | |||||

| 2025 | 1960 | Commercial | 795 sqft | 1.00 | 13 | 0.00 | |

| 1.00 | Service Garage | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1960 | Commercial | 795 sqft | 1.00 | 13 | 0.00 | |

| 1.00 | Service Garage | Space Heater | |||||

| 2024 | 1960 | Commercial | 1,904 sqft | 1.00 | 11 | 0.00 | |

| 1.00 | Retail Store | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1960 | Commercial | 1,904 sqft | 1.00 | 11 | 0.00 | |

| 1.00 | Retail Store | Space Heater | |||||

| 2023 | 1960 | Commercial | 795 sqft | 1.00 | 13 | 0.00 | |

| 1.00 | Service Garage | Space Heater | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $242,900 | $242,900 | $242,900 |

| Total Taxable Value (Capped) | $45,431 | $47,703 | $50,088 |

| Improvement Value | $232,000 | $232,000 | $232,000 |

| Land Value | $10,900 | $10,900 | $10,900 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $4,997 | $5,248 | $5,509 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $4,997 | $5,248 | $5,509 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $634 | $680 | $713 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/3/2021 | OFFORD, MARCUS | THOMAS, ANGELIA | $0 | Terminate TOD Affidavit | 2021018619 |

| 7/19/2018 | OFFORD, MARCUS R | THOMAS, ANGELIA | $0 | Transfer on Death | 2018066462 |

Sales/Documents

| Sale Date | 2/3/2021 |

|---|---|

| Grantor | OFFORD, MARCUS |

| Grantee | THOMAS, ANGELIA |

| Sale Price | $0 |

| Deed Type | Terminate TOD Affidavit |

| Document Number | 2021018619 |

| Sale Date | 7/19/2018 |

| Grantor | OFFORD, MARCUS R |

| Grantee | THOMAS, ANGELIA |

| Sale Price | $0 |

| Deed Type | Transfer on Death |

| Document Number | 2018066462 |