General Information

| Situs Address | 4015 N GARRISON AV E TULSA 741263206 |

|---|---|

| Owner Name |

SIMON, CHARLET

|

| Owner Mailing Address | 704 N YUKON AVE TULSA , OK 741275227 |

| Account Type | Residential |

| Parcel ID | 07675-02-13-00730 |

| Land Area | 0.20 acres / 8,804 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: CHANDLER FRATES FOURTH ADDN (07675) Legal: LT 3 LESS BEG NEC SWLY47.95 SELY65.90 TO A PT ON SL NELY11.13 TO SECR NWLY60.62 POB BLK 3 Section: 13 Township: 20 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

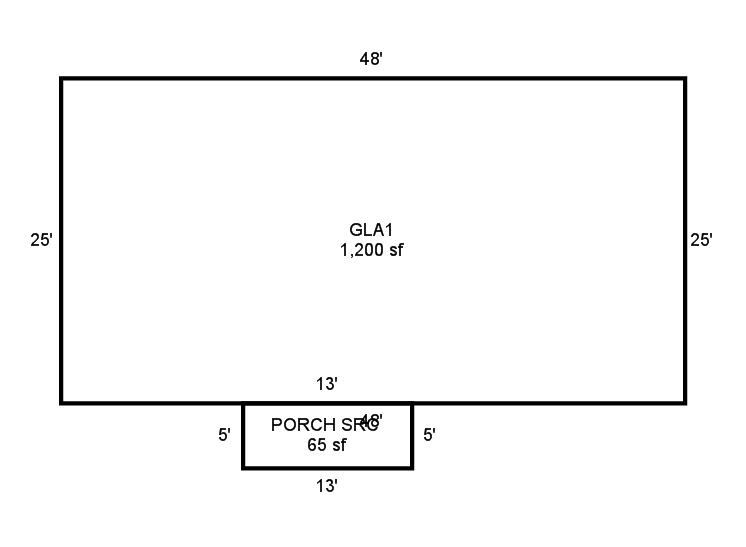

| 2025 | 1956 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Vinyl | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1956 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Vinyl | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1956 | Residential | 1,200 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Vinyl | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $48,535 | $55,824 | $67,000 |

| Total Taxable Value (Capped) | $44,310 | $46,526 | $48,852 |

| Improvement Value | $38,435 | $45,724 | $56,900 |

| Land Value | $10,100 | $10,100 | $10,100 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $4,874 | $5,118 | $5,374 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $4,874 | $5,118 | $5,374 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $619 | $663 | $696 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/29/2019 | SIMON, CHARLET | SIMON, CHARLET | $0 | District Court Order | 2019082756 |

| 5/31/2019 | HOLMES, HELEN M | SIMON, CHARLET | $25,000 | Warranty Deed | 2019047883 |

| 8/9/2005 | HOLMES, HAYWOOD S | HOLMES, HELEN M | $0 | Quit Claim Deed | 2005093267 |

Sales/Documents

| Sale Date | 8/29/2019 |

|---|---|

| Grantor | SIMON, CHARLET |

| Grantee | SIMON, CHARLET |

| Sale Price | $0 |

| Deed Type | District Court Order |

| Document Number | 2019082756 |

| Sale Date | 5/31/2019 |

| Grantor | HOLMES, HELEN M |

| Grantee | SIMON, CHARLET |

| Sale Price | $25,000 |

| Deed Type | Warranty Deed |

| Document Number | 2019047883 |

| Sale Date | 8/9/2005 |

| Grantor | HOLMES, HAYWOOD S |

| Grantee | HOLMES, HELEN M |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2005093267 |