Exempt

This property is Exempt Commercial

R14360032126090

E APACHE ST N TULSA 74115

$5,845,926

$0

General Information

| Situs Address | E APACHE ST N TULSA 74115 |

|---|---|

| Owner Name |

CITY OF TULSA

|

| Owner Mailing Address | 175 E 2ND ST FL 14 TULSA , OK 74103 |

| Account Type | Exempt Com |

| Parcel ID | 14360-03-21-26090 |

| Land Area | 35.70 acres / 1,555,054 sq ft |

| School District | T-1A |

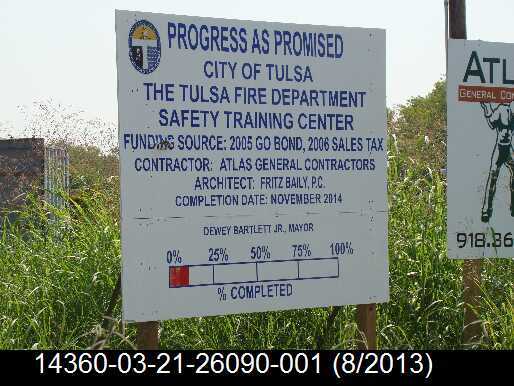

| Legal Description | Subdivision: FIRE SAFETY TRAINING CENTER (14360) Legal: LOT 1 BLOCK 1 Section: 21 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2015 | Commercial | 9,871 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Fire Station Staffed | Complete HVAC | |||||

| 2025 | 2015 | Commercial | 19,880 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Complete HVAC | |||||

| 2025 | 2015 | Commercial | 270 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | School - Classroom | Complete HVAC | |||||

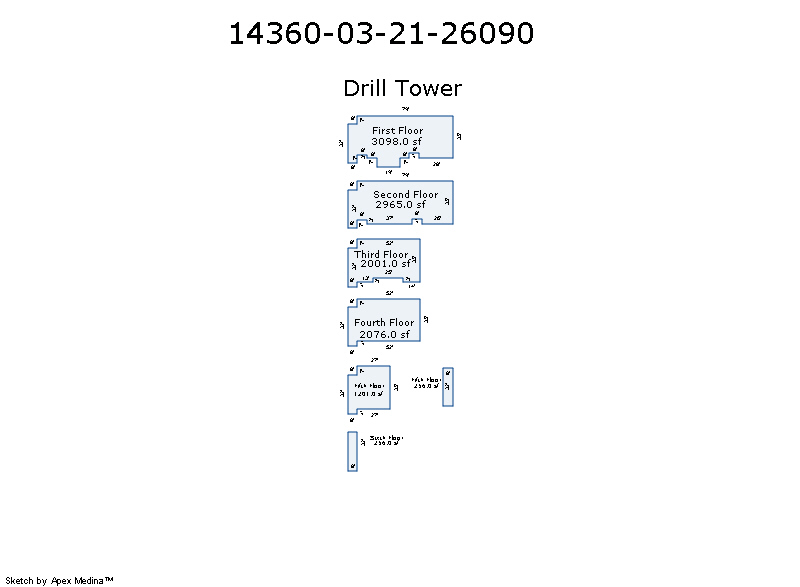

| 2025 | 2015 | Commercial | 11,853 sqft | 6.00 | 10 | 0.00 | |

| 4.00 | School - Classroom | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2015 | Commercial | 9,871 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Fire Station Staffed | Complete HVAC | |||||

| 2024 | 2015 | Commercial | 19,880 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Complete HVAC | |||||

| 2024 | 2015 | Commercial | 270 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | School - Classroom | Complete HVAC | |||||

| 2024 | 2015 | Commercial | 11,853 sqft | 6.00 | 10 | 0.00 | |

| 4.00 | School - Classroom | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2015 | Commercial | 9,871 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Fire Station Staffed | Complete HVAC | |||||

| 2023 | 2015 | Commercial | 19,880 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Complete HVAC | |||||

| 2023 | 2015 | Commercial | 270 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | School - Classroom | Complete HVAC | |||||

| 2023 | 2015 | Commercial | 11,853 sqft | 6.00 | 10 | 0.00 | |

| 4.00 | School - Classroom | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $3,211 | $5,845,926 | - |

| Total Taxable Value (Capped) | $3,211 | $5,007,731 | - |

| Improvement Value | $0 | $0 | - |

| Land Value | $3,211 | $0 | - |

| Assessment Ratio | 11% | 0% | 0% |

| Gross Assessed Value | $353 | $0 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $353 | $0 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $45 | $0 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/11/2021 | TULSA COMMUNITY COLLEGE | CITY OF TULSA | $0 | Warranty Deed | 2023061158 |

Sales/Documents

| Sale Date | 3/11/2021 |

|---|---|

| Grantor | TULSA COMMUNITY COLLEGE |

| Grantee | CITY OF TULSA |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2023061158 |