General Information

| Situs Address | 2729 W CHARLES PAGE BV S TULSA 74127 |

|---|---|

| Owner Name |

PIONEER PLACE APARTMENTS LLC

|

| Owner Mailing Address | 2944 S DELAWARE AVE TULSA , OK 741145807 |

| Account Type | Commercial |

| Parcel ID | 17275-92-03-03660 |

| Land Area | 1.16 acres / 50,315 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: HALE SUB (17275) Legal: LTS 17 THRU 23 & S10 VAC ALLEY ADJ ON N LESS E3 LT 23 & E3 S10 VAC ALLEY ADJ ON N BLK 13 Section: 03 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

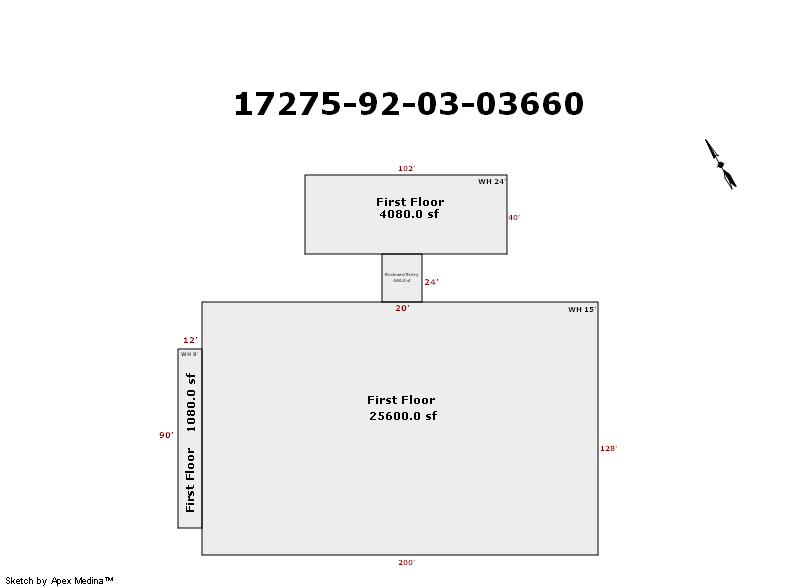

| 2025 | 1940 | Commercial | 30,760 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Forced Air | |||||

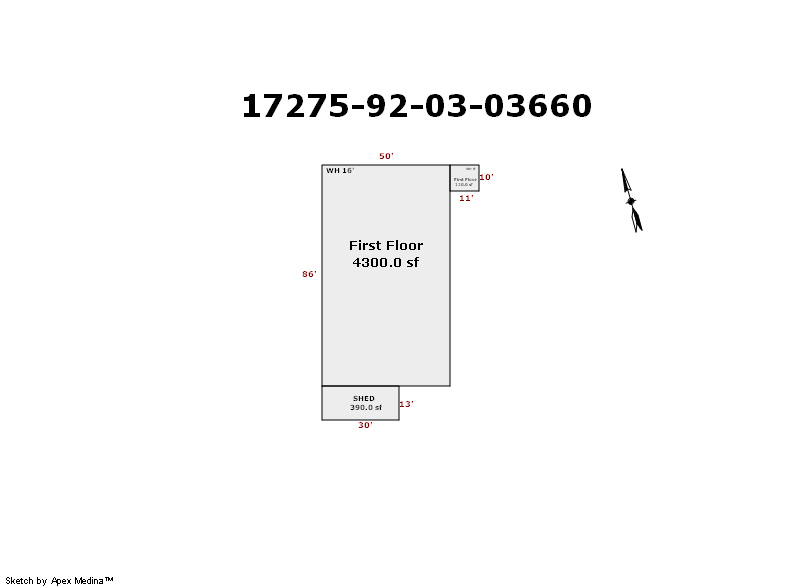

| 2025 | 1996 | Commercial | 4,410 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Indust Lght Manufacturing | None | |||||

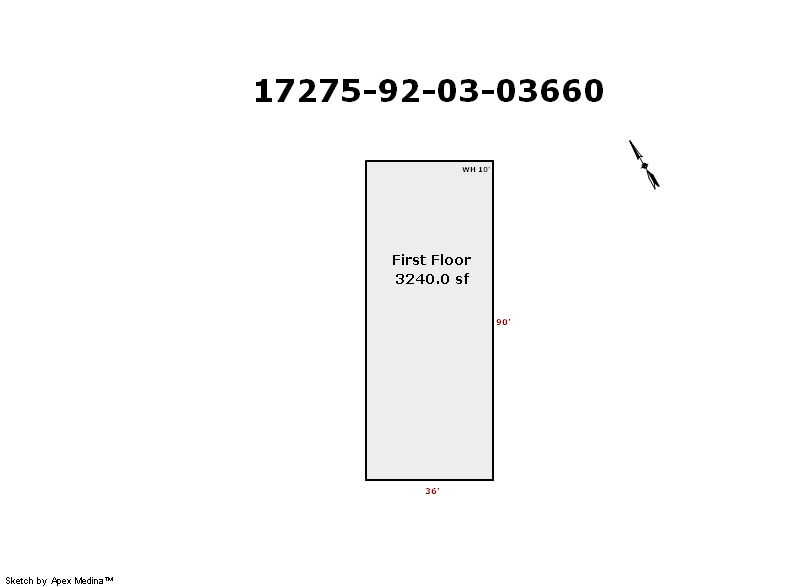

| 2025 | 1945 | Commercial | 3,240 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Warm and Cool Air Zone | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1940 | Commercial | 30,760 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Forced Air | |||||

| 2024 | 1996 | Commercial | 4,410 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Indust Lght Manufacturing | None | |||||

| 2024 | 1945 | Commercial | 3,240 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Warm and Cool Air Zone | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1940 | Commercial | 30,760 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Forced Air | |||||

| 2023 | 1996 | Commercial | 4,410 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Indust Lght Manufacturing | None | |||||

| 2023 | 1945 | Commercial | 3,240 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Warm and Cool Air Zone | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $569,100 | $569,100 | - |

| Total Taxable Value (Capped) | $569,100 | $569,100 | - |

| Improvement Value | $493,600 | $493,600 | - |

| Land Value | $75,500 | $75,500 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $62,601 | $62,601 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $62,601 | $62,601 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $7,945 | $8,107 | - |

| Last Notice Date | 2/2/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/23/2021 | PMC REAL ESTATE LLC | PIONEER PLACE APARTMENTS LLC | $225,000 | General Warranty Deed | 2021110969 |

| 12/5/2013 | PURE CASTINGS INC | EMPIRE CASTINGS | $0 | Corrected Quit Claim Deed | 2013122472 |

| 11/25/2013 | EMPIRE CASTINGS INC C/O EMPIRE CASTINGS INC | PMC REAL ESTATE LLC | $280,001 | General Warranty Deed | 2013122473 |

| 6/12/2002 | $0 | Quit Claim Deed | 2000038760 BK-06846PG-00629 | ||

| 3/12/1996 | MARK CONTROLS CORP MR UNDERWOO | PURE CASTINGS CO | $57,500 | Special Warranty Deed | 1996200314 |

Sales/Documents

| Sale Date | 9/23/2021 |

|---|---|

| Grantor | PMC REAL ESTATE LLC |

| Grantee | PIONEER PLACE APARTMENTS LLC |

| Sale Price | $225,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2021110969 |

| Sale Date | 12/5/2013 |

| Grantor | PURE CASTINGS INC |

| Grantee | EMPIRE CASTINGS |

| Sale Price | $0 |

| Deed Type | Corrected Quit Claim Deed |

| Document Number | 2013122472 |

| Sale Date | 11/25/2013 |

| Grantor | EMPIRE CASTINGS INC C/O EMPIRE CASTINGS INC |

| Grantee | PMC REAL ESTATE LLC |

| Sale Price | $280,001 |

| Deed Type | General Warranty Deed |

| Document Number | 2013122473 |

| Sale Date | 6/12/2002 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000038760 BK-06846PG-00629 |

| Sale Date | 3/12/1996 |

| Grantor | MARK CONTROLS CORP MR UNDERWOO |

| Grantee | PURE CASTINGS CO |

| Sale Price | $57,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 1996200314 |