General Information

| Situs Address | 7737 E 42 PL S TULSA 74145 |

|---|---|

| Owner Name |

7737 CENTER LLC C/O JOE MCGRAW

|

| Owner Mailing Address | 10900 S LOUISVILLE AVE TULSA , OK 74137 |

| Account Type | Commercial |

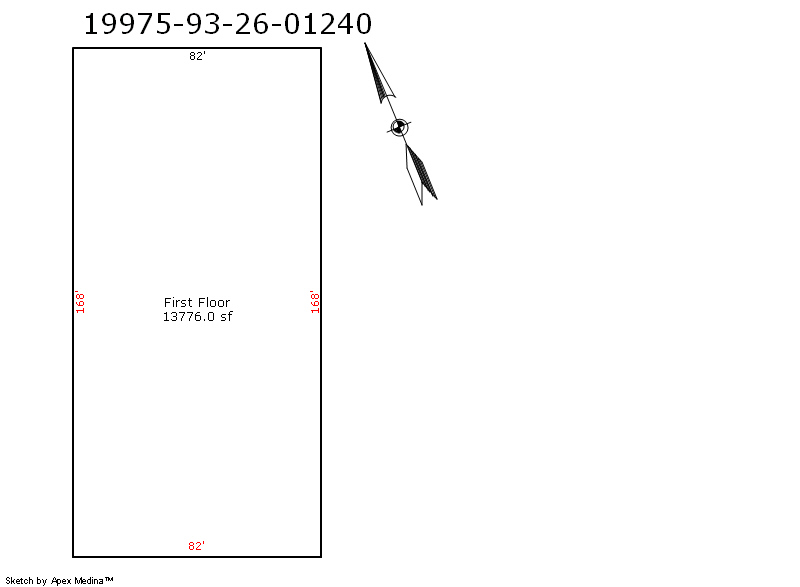

| Parcel ID | 19975-93-26-01240 |

| Land Area | 1.71 acres / 74,419 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: INDUSTRIAL EQUIPMENT CTR (19975) Legal: LT 1 LESS BEG NEC TH S600.84 W444.30 TH ON CRV RT 166.52 N245.36 NW282.93 NE445 SE732.64 POB BLK 2 Section: 26 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

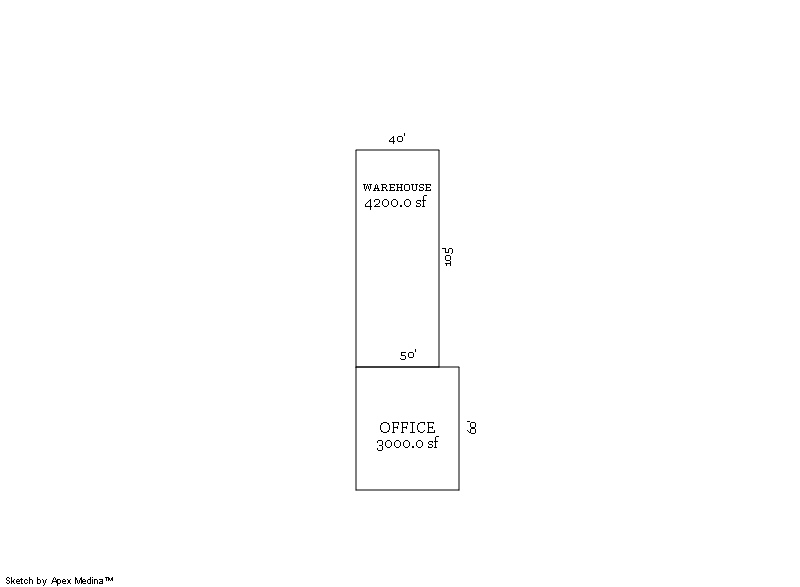

| 2025 | 1980 | Commercial | 4,200 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Forced Air | |||||

| 2025 | 1980 | Commercial | 3,000 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2025 | 1997 | Commercial | 13,776 sqft | 1.00 | 16 | 0.00 | |

| 2.00 | Industrial Flex Mall Building | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1980 | Commercial | 4,200 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Forced Air | |||||

| 2024 | 1980 | Commercial | 3,000 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2024 | 1997 | Commercial | 13,776 sqft | 1.00 | 16 | 0.00 | |

| 2.00 | Industrial Flex Mall Building | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1980 | Commercial | 3,000 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2023 | 1980 | Commercial | 4,200 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Forced Air | |||||

| 2023 | 1997 | Commercial | 13,776 sqft | 1.00 | 16 | 0.00 | |

| 2.00 | Industrial Flex Mall Building | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $911,000 | $911,000 | $911,000 |

| Total Taxable Value (Capped) | $911,000 | $911,000 | $911,000 |

| Improvement Value | $724,900 | $724,900 | $724,900 |

| Land Value | $186,100 | $186,100 | $186,100 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $100,210 | $100,210 | $100,210 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $100,210 | $100,210 | $100,210 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $12,718 | $12,978 | $12,978 |

| Last Notice Date | 2/2/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 10/11/2005 | MCGRAW, JOSEPH R | 7737 CENTER LLC | $0 | Quit Claim Deed | 2005121904 |

Sales/Documents

| Sale Date | 10/11/2005 |

|---|---|

| Grantor | MCGRAW, JOSEPH R |

| Grantee | 7737 CENTER LLC |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2005121904 |