Exempt

This property is Exempt Commercial

R23015830637874

6910 S YORKTOWN AV E TULSA 74136

$2,864,895

$0

General Information

| Situs Address | 6910 S YORKTOWN AV E TULSA 74136 |

|---|---|

| Owner Name |

UNITED STATES POSTAL SERVICE

|

| Owner Mailing Address | 333 W 4TH ST TULSA , OK 741033819 |

| Account Type | Exempt Com |

| Parcel ID | 23015-83-06-37874 |

| Land Area | 3.94 acres / 171,718 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: LEWIS VILLAGE (23015) Legal: LT 8 LESS BEG SWC LT 7 TH N210.11 W10 S214.43 NELY10.90 POB & LESS S230 BLK 1 Section: 06 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

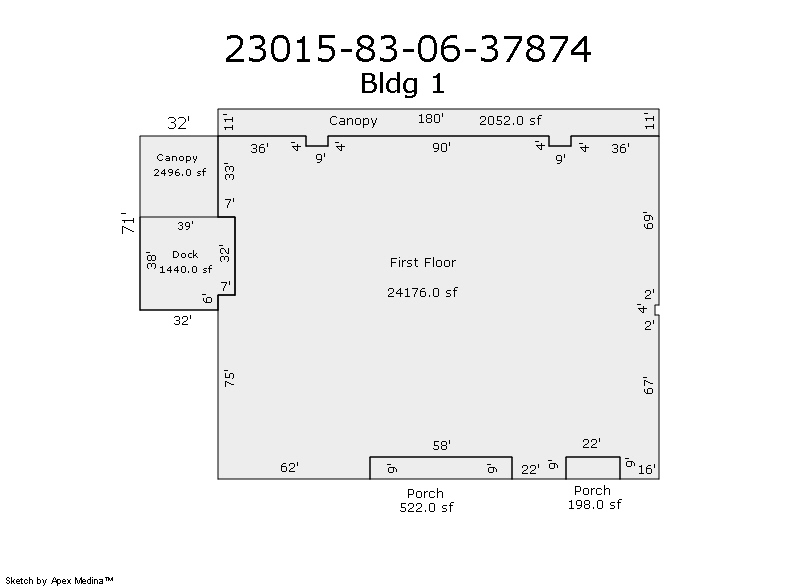

| 2024 | 1970 | Commercial | 24,176 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Post Office | Forced Air | |||||

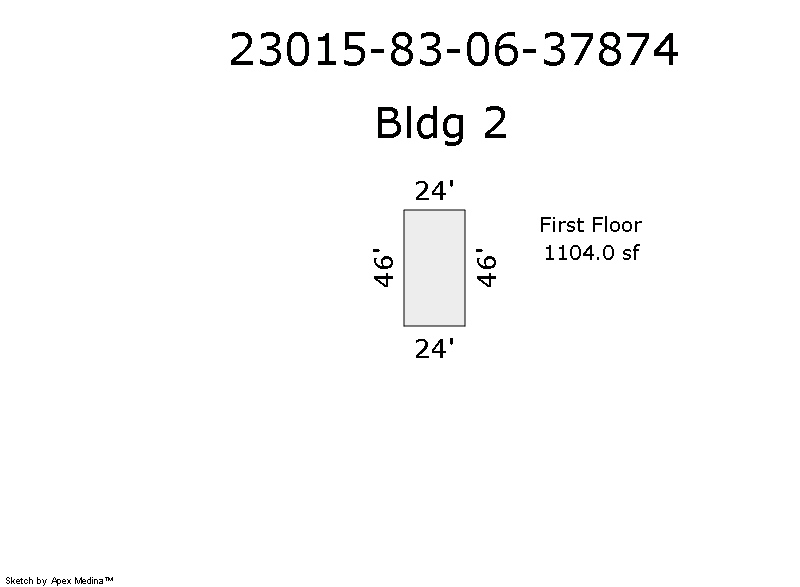

| 2024 | 1970 | Commercial | 1,104 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Car Wash - Drive thru | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1970 | Commercial | 24,176 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Post Office | Forced Air | |||||

| 2023 | 1970 | Commercial | 1,104 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Car Wash - Drive thru | None | |||||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 1970 | Commercial | 24,176 sqft | 1.00 | 8 | 0.00 | |

| 1.00 | Post Office | Forced Air | |||||

| 2022 | 1970 | Commercial | 1,104 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Car Wash - Drive thru | None | |||||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $2,685,440 | $2,783,193 | $2,864,895 |

| Total Taxable Value (Capped) | $2,685,440 | $2,783,193 | $2,864,895 |

| Improvement Value | $0 | $0 | $0 |

| Land Value | $0 | $0 | $0 |

| Assessment Ratio | 0% | 0% | 0% |

| Gross Assessed Value | $0 | $0 | $0 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $0 | $0 | $0 |

| School District | T-1A | ||

| Tax Rate | 133.32 | 126.91 | 129.51 |

| Estimated taxes | $0 | $0 | $0 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/17/1980 | $0 | History | 2000051788 BK-04510PG-01915 |

Sales/Documents

| Sale Date | 11/17/1980 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2000051788 BK-04510PG-01915 |