General Information

| Situs Address | 2543 E 19 ST S TULSA 74104 |

|---|---|

| Owner Name |

WERTH, JOSEPH ANDREW IV

|

| Owner Mailing Address | 56 E JACKSON ST OSWEGO , IL 605436907 |

| Account Type | Residential |

| Parcel ID | 23025-93-08-17130 |

| Land Area | 0.20 acres / 8,662 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: LEWISTON GARDENS AMD SUB L12&15 GLEN ACRES (23025) Legal: LT 19 BLK 6 Section: 08 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

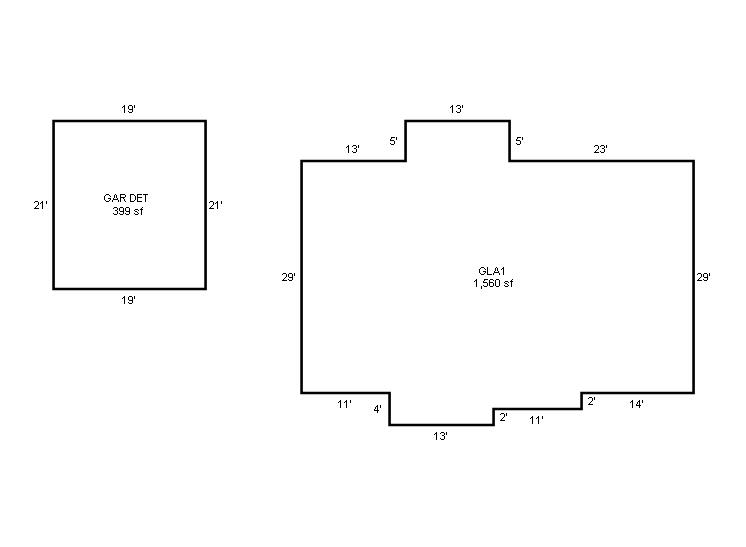

| 2025 | 1939 | Residential | 1,560 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1939 | Residential | 1,560 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1939 | Residential | 1,560 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $337,498 | $298,212 | $334,700 |

| Total Taxable Value (Capped) | $275,625 | $298,212 | $313,122 |

| Improvement Value | $232,522 | $193,236 | $229,724 |

| Land Value | $104,976 | $104,976 | $104,976 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $30,318 | $32,803 | $34,444 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $30,318 | $32,803 | $34,444 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 134.01 |

| Estimated taxes | $3,848 | $4,248 | $4,616 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/13/2023 | ARNOLD, FRANCES C | WERTH, JOSEPH ANDREW IV | $340,000 | Warranty Deed | 2023013034 |

| 10/19/2018 | BROWNLEE, GREGORY SCOTT | ARNOLD, FRANCES C | $250,000 | Warranty Deed | 2018099218 |

| 10/24/2012 | REPPE, ROBERT MCDONIEL | BROWNLEE, GREGORY SCOTT | $187,000 | Warranty Deed | 2012106051 |

| 9/1/1999 | $132,000 | Warranty Deed | 2000051944 BK-06273PG-00410 | ||

| 4/1/1999 | $75,000 | History | 2000051945 BK-06197PG-01265 |

Sales/Documents

| Sale Date | 2/13/2023 |

|---|---|

| Grantor | ARNOLD, FRANCES C |

| Grantee | WERTH, JOSEPH ANDREW IV |

| Sale Price | $340,000 |

| Deed Type | Warranty Deed |

| Document Number | 2023013034 |

| Sale Date | 10/19/2018 |

| Grantor | BROWNLEE, GREGORY SCOTT |

| Grantee | ARNOLD, FRANCES C |

| Sale Price | $250,000 |

| Deed Type | Warranty Deed |

| Document Number | 2018099218 |

| Sale Date | 10/24/2012 |

| Grantor | REPPE, ROBERT MCDONIEL |

| Grantee | BROWNLEE, GREGORY SCOTT |

| Sale Price | $187,000 |

| Deed Type | Warranty Deed |

| Document Number | 2012106051 |

| Sale Date | 9/1/1999 |

| Grantor | |

| Grantee | |

| Sale Price | $132,000 |

| Deed Type | Warranty Deed |

| Document Number | 2000051944 BK-06273PG-00410 |

| Sale Date | 4/1/1999 |

| Grantor | |

| Grantee | |

| Sale Price | $75,000 |

| Deed Type | History |

| Document Number | 2000051945 BK-06197PG-01265 |