Exempt

This property is Exempt Commercial

R29450920210540

555 N DENVER AV W TULSA 74103

$3,617,139

$0

General Information

| Situs Address | 555 N DENVER AV W TULSA 74103 |

|---|---|

| Owner Name |

THE BOARD OF COUNTY COMMISSIONERS OF TULSA COUNTY

|

| Owner Mailing Address | 218 W 6TH ST FL 9 TULSA , OK 741191014 |

| Account Type | Exempt Com |

| Parcel ID | 29450-92-02-10540 |

| Land Area | 2.13 acres / 92,587 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: NORTH TULSA (29450) Legal: LTS 1 THRU 7 LESS BEG SWC LT 4 TH N60 SE43.52 SE86.85 W103.10 POB BLK 9 Section: 02 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

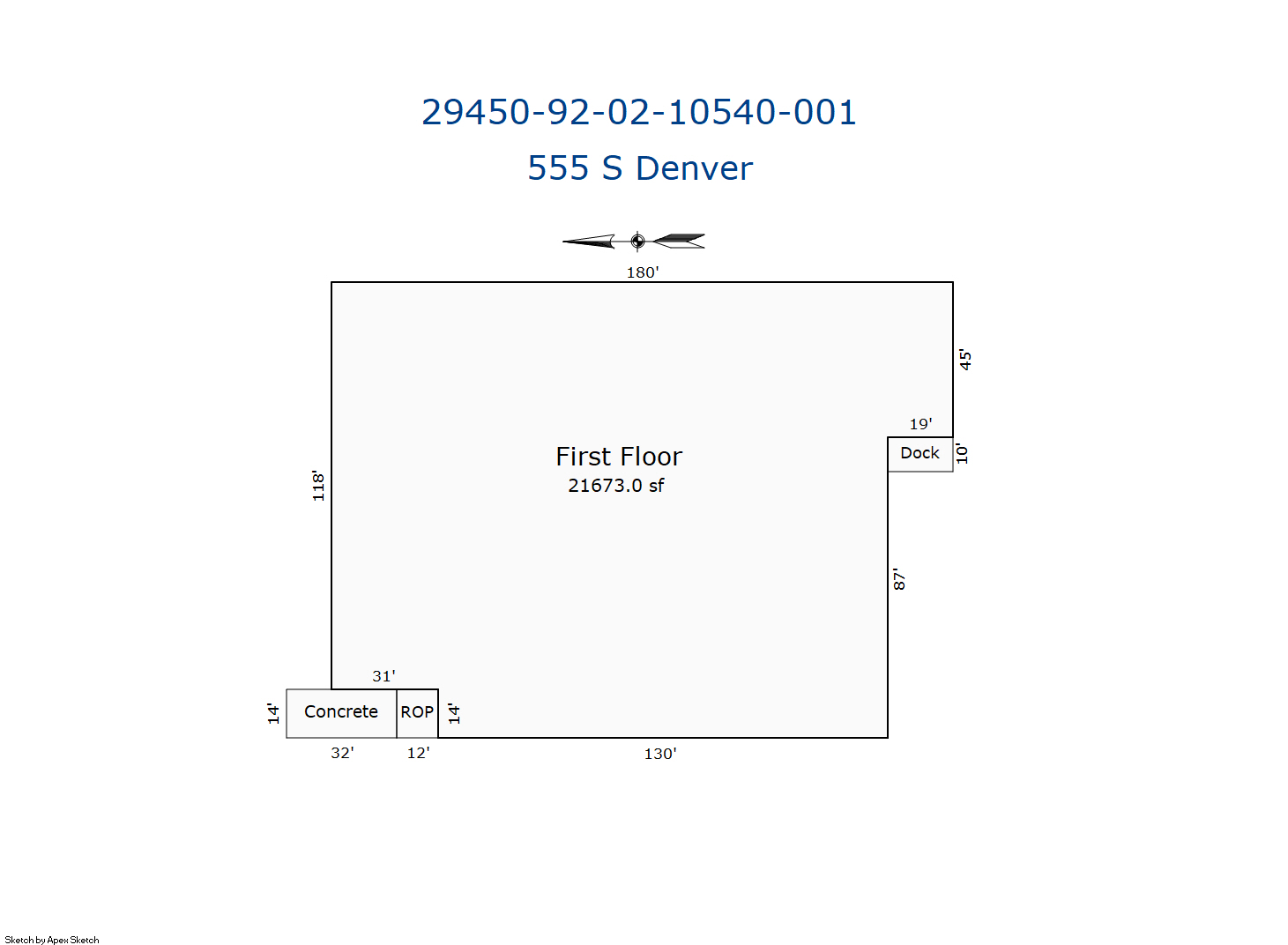

| 2025 | 1964 | Commercial | 27,073 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

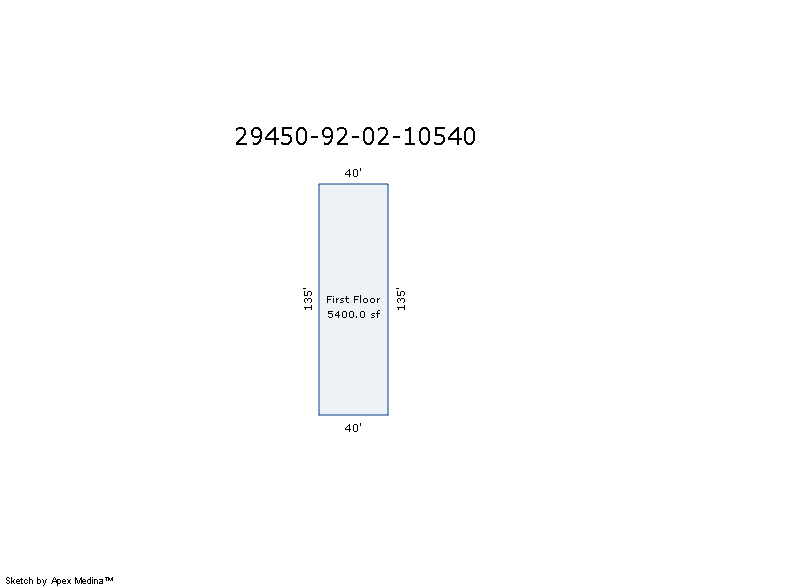

| 2025 | 1964 | Commercial | 5,952 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Complete HVAC | |||||

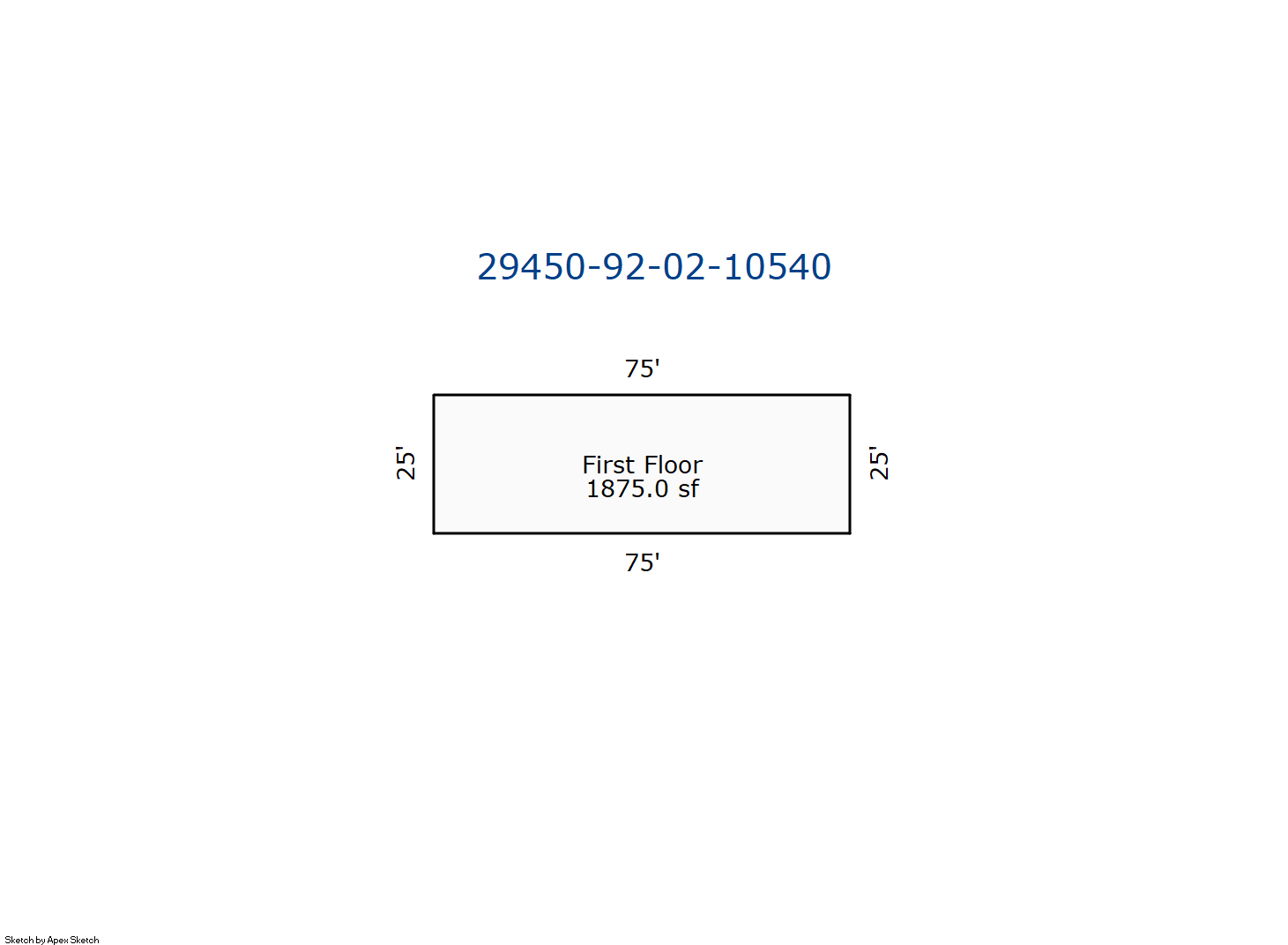

| 2025 | 1980 | Commercial | 1,875 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

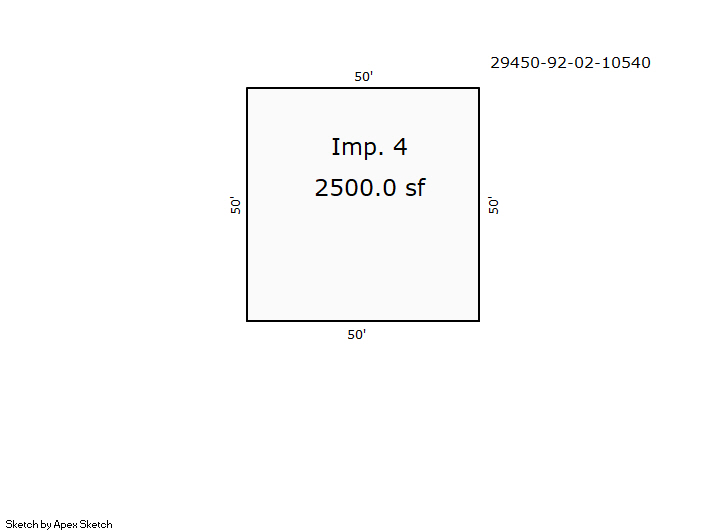

| 2025 | 2019 | Commercial | 2,500 sqft | 1.00 | 16 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1964 | Commercial | 27,073 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2024 | 1964 | Commercial | 5,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Complete HVAC | |||||

| 2024 | 1980 | Commercial | 1,875 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

| 2024 | 2019 | Commercial | 2,500 sqft | 1.00 | 16 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1964 | Commercial | 27,073 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2023 | 1964 | Commercial | 5,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Storage Warehouse | Complete HVAC | |||||

| 2023 | 1980 | Commercial | 1,875 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

| 2023 | 2019 | Commercial | 2,500 sqft | 1.00 | 16 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $3,393,090 | $3,706,623 | $3,617,139 |

| Total Taxable Value (Capped) | $1,358,197 | $1,426,107 | $1,508,804 |

| Improvement Value | $0 | $0 | $0 |

| Land Value | $0 | $0 | $0 |

| Assessment Ratio | 0% | 0% | 0% |

| Gross Assessed Value | $0 | $0 | $0 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $0 | $0 | $0 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $0 | $0 | $0 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 10/24/1996 | JACKSON POWDER COATING | TULSA CO COMMISSIONERS | $62,500 | General Warranty Deed | 1996200145 |

| 2/1/1990 | EXECUTIVE COFFEE SERVICE | JACKSON POWDER COATING INC | $72,500 | Warranty Deed | 1990960291 |

| 1/26/1983 | $0 | General Warranty Deed | 2000071425 BK-04664PG-01690 |

Sales/Documents

| Sale Date | 10/24/1996 |

|---|---|

| Grantor | JACKSON POWDER COATING |

| Grantee | TULSA CO COMMISSIONERS |

| Sale Price | $62,500 |

| Deed Type | General Warranty Deed |

| Document Number | 1996200145 |

| Sale Date | 2/1/1990 |

| Grantor | EXECUTIVE COFFEE SERVICE |

| Grantee | JACKSON POWDER COATING INC |

| Sale Price | $72,500 |

| Deed Type | Warranty Deed |

| Document Number | 1990960291 |

| Sale Date | 1/26/1983 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000071425 BK-04664PG-01690 |