General Information

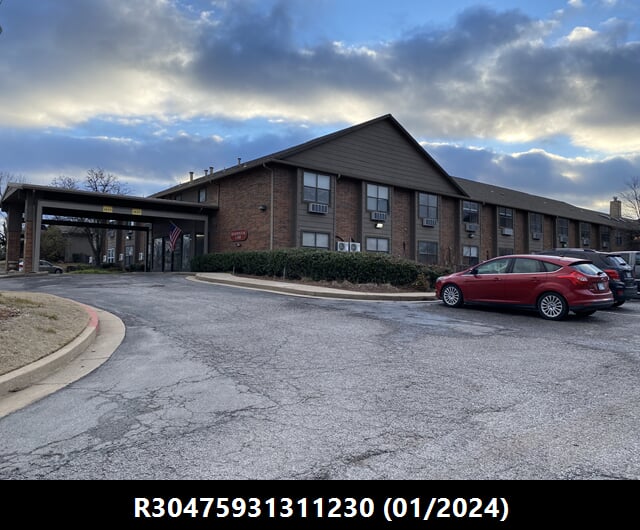

| Situs Address | 2130 S 85 AV E TULSA 74129 |

|---|---|

| Owner Name |

2130 SOUTH 85TH EAST AVE LLC

|

| Owner Mailing Address | 2925 10TH AVE N PALM SPRINGS , FL 33461 |

| Account Type | Commercial |

| Parcel ID | 30475-93-13-11230 |

| Land Area | 1.70 acres / 74,100 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: O'CONNOR PARK 2ND (30475) Legal: S90 E376 LT 1 & N150 E220 LT 2 & N55 W132 E352 LT 2 Section: 13 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

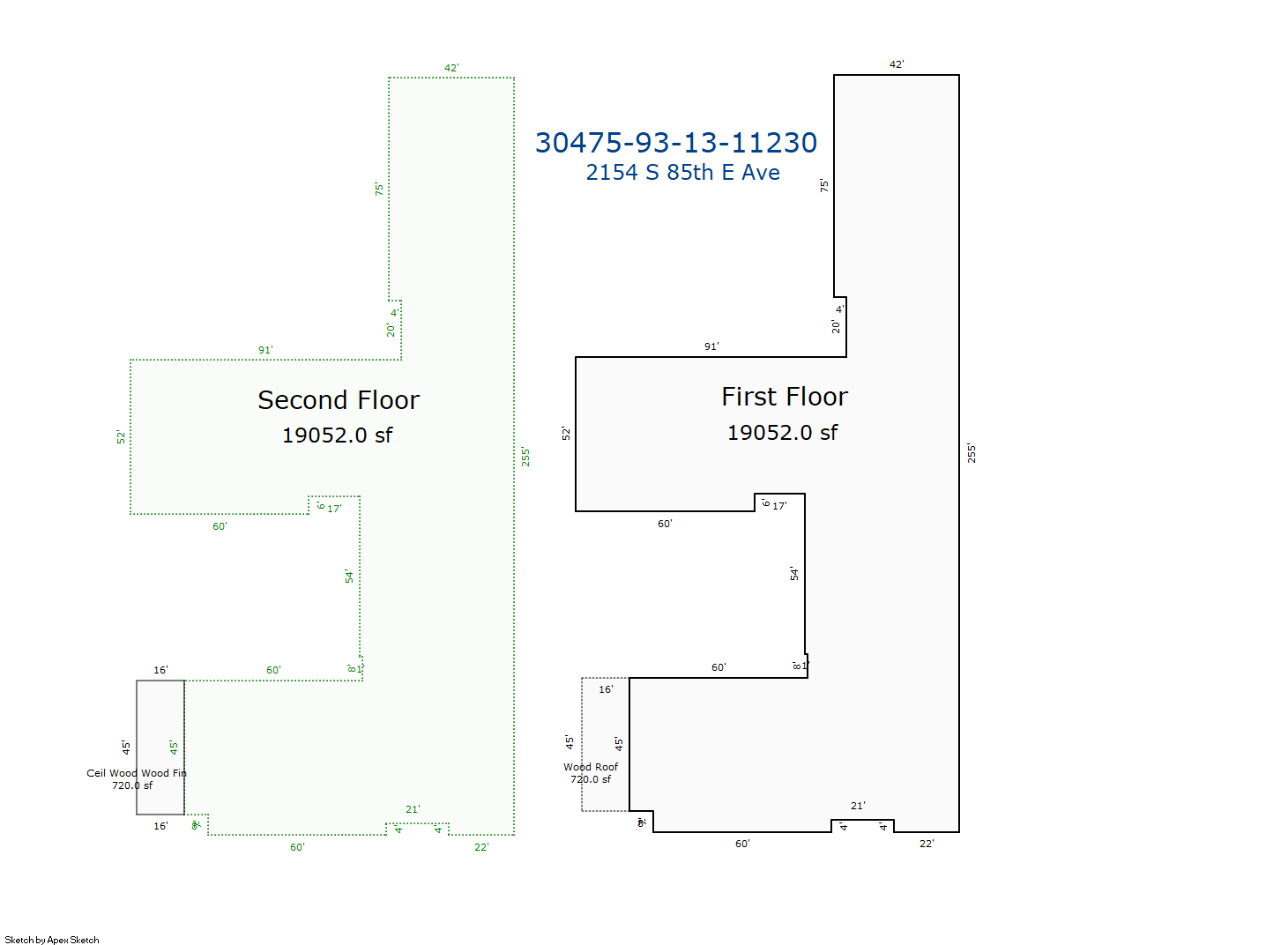

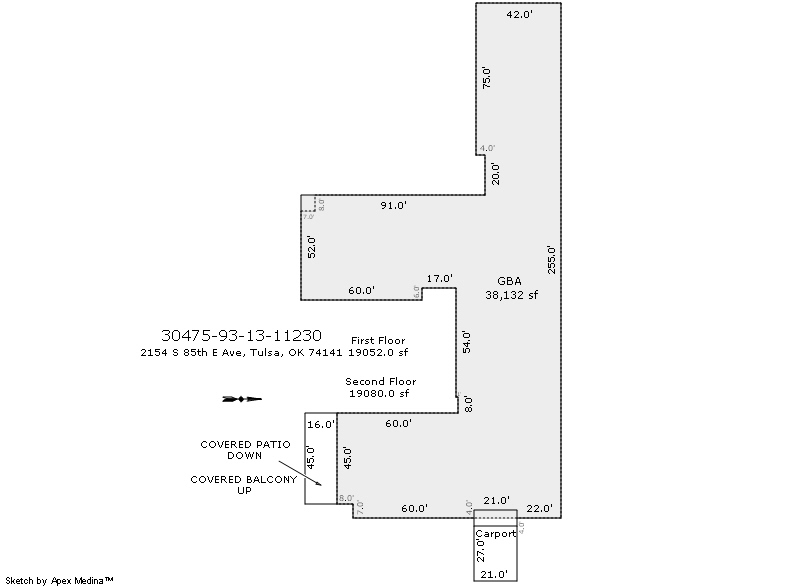

| 2024 | 1990 | Commercial | 38,132 sqft | 2.00 | 9 | 0.00 | |

| 1.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

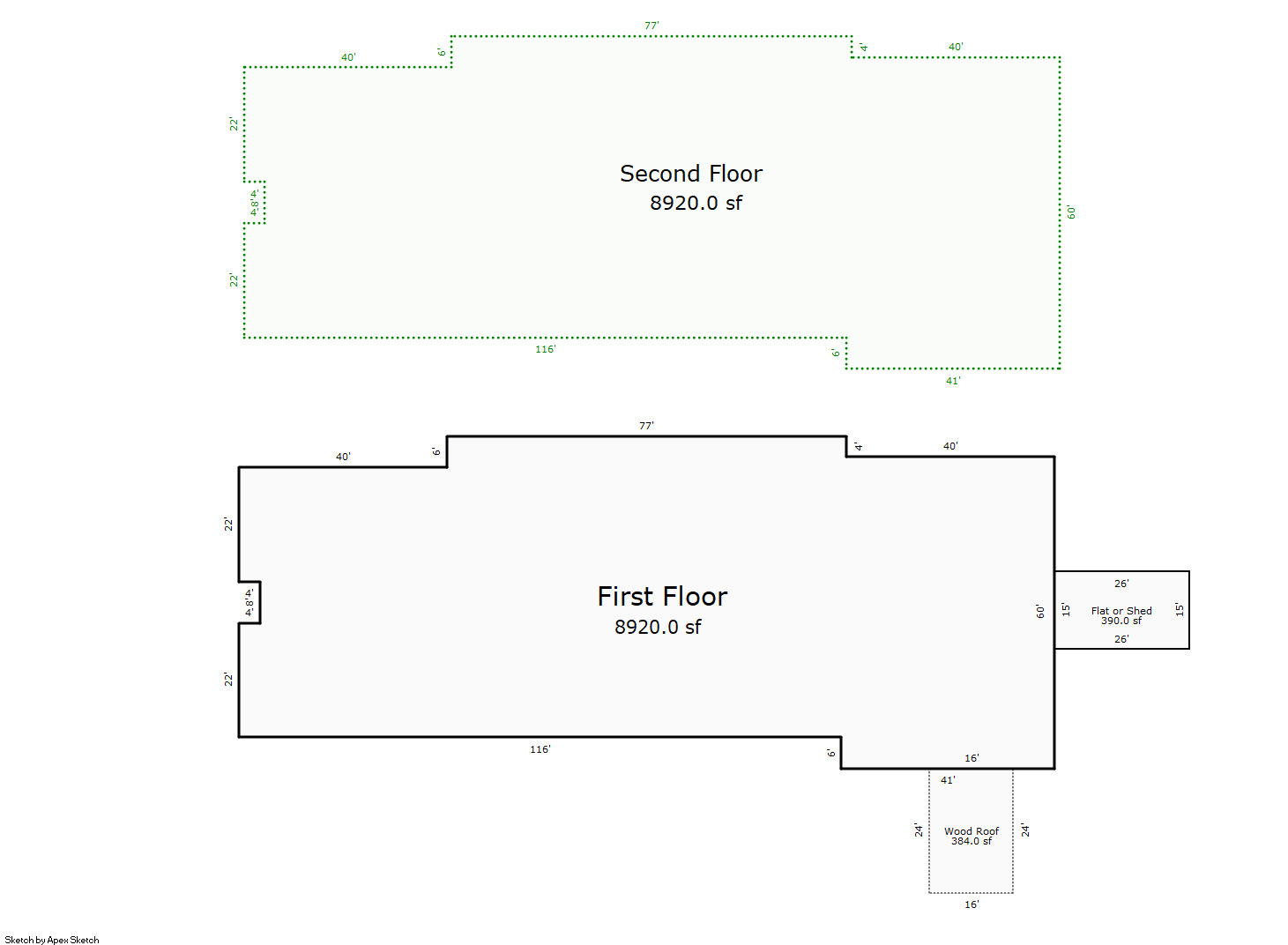

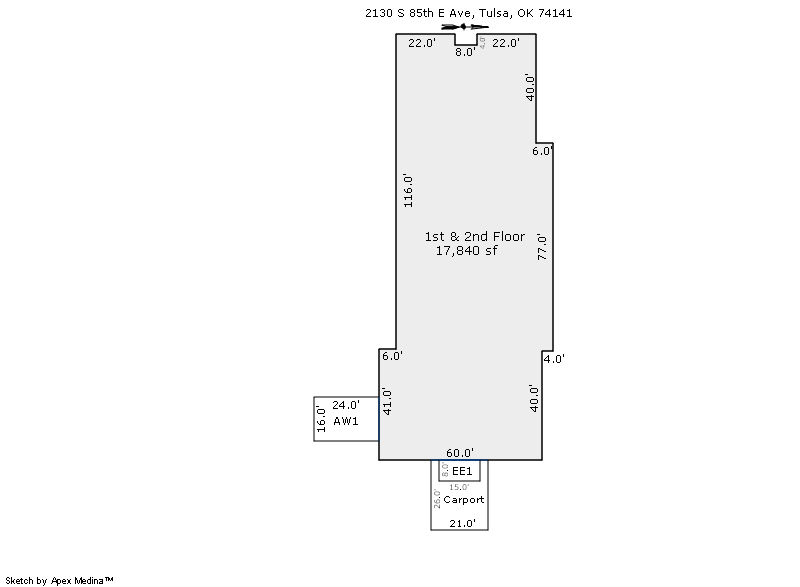

| 2024 | 1994 | Commercial | 17,840 sqft | 2.00 | 9 | 0.00 | |

| 2.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1990 | Commercial | 38,132 sqft | 2.00 | 9 | 0.00 | |

| 1.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

| 2023 | 1994 | Commercial | 17,840 sqft | 2.00 | 9 | 0.00 | |

| 2.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 1990 | Commercial | 38,132 sqft | 2.00 | 9 | 0.00 | |

| 1.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

| 2022 | 1994 | Commercial | 17,840 sqft | 2.00 | 9 | 0.00 | |

| 2.00 | Convlsnt Hosp Nursing Home | Complete HVAC | |||||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $2,308,100 | $2,308,100 | $2,308,100 |

| Total Taxable Value (Capped) | $2,308,100 | $2,308,100 | $2,308,100 |

| Improvement Value | $2,085,800 | $2,085,800 | $2,085,800 |

| Land Value | $222,300 | $222,300 | $222,300 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $253,891 | $253,891 | $253,891 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $253,891 | $253,891 | $253,891 |

| School District | T-1A | ||

| Tax Rate | 133.32 | 126.91 | 129.51 |

| Estimated taxes | $33,849 | $32,221 | $32,881 |

| Last Notice Date | 3/3/2020 | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/27/2024 | HEATHERIDGE REALTY LLC | 2130 SOUTH 85TH EAST AVE LLC | $3,500,000 | Special Warranty Deed | 2024054689 |

| 6/6/2019 | HEATHERIDGE & LEISURE VILLAGE JDEK LLC | HEATHERIDGE REALTY LLC | $2,791,000 | Special Warranty Deed | 2019052352 |

| 6/30/2014 | HEATHERIDGE ASSISTED LIVING CENTER LLC | HEATHERIDGE & LEISURE VILLAGE JDEK LLC | $3,767,500 | Special Warranty Deed | 2014056031 |

| 12/30/1993 | $0 | General Warranty Deed | 2000074109 BK-05579PG-02170 |

Sales/Documents

| Sale Date | 6/27/2024 |

|---|---|

| Grantor | HEATHERIDGE REALTY LLC |

| Grantee | 2130 SOUTH 85TH EAST AVE LLC |

| Sale Price | $3,500,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2024054689 |

| Sale Date | 6/6/2019 |

| Grantor | HEATHERIDGE & LEISURE VILLAGE JDEK LLC |

| Grantee | HEATHERIDGE REALTY LLC |

| Sale Price | $2,791,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2019052352 |

| Sale Date | 6/30/2014 |

| Grantor | HEATHERIDGE ASSISTED LIVING CENTER LLC |

| Grantee | HEATHERIDGE & LEISURE VILLAGE JDEK LLC |

| Sale Price | $3,767,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2014056031 |

| Sale Date | 12/30/1993 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000074109 BK-05579PG-02170 |