General Information

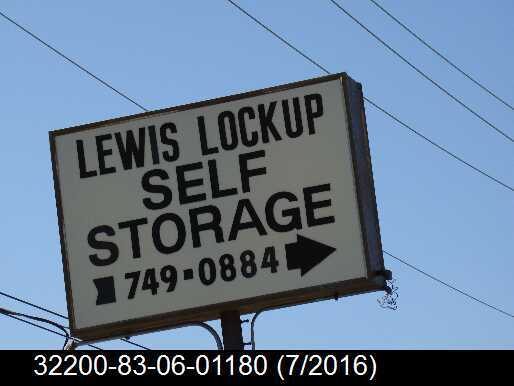

| Situs Address | 6350-B S LEWIS AV E TULSA 74136 |

|---|---|

| Owner Name |

LEWIS LOCKUP STORAGE LLC

|

| Owner Mailing Address | PO BOX 701833 TULSA , OK 741701833 |

| Account Type | Commercial |

| Parcel ID | 32200-83-06-01180 |

| Land Area | 1.46 acres / 63,810 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: PECAN ACRES (32200) Legal: LT 18 LESS PRT BEG SECR LT 18 TH N175 W150 S175 E150 POB Section: 06 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

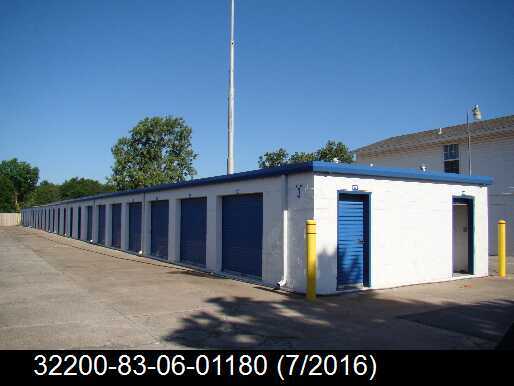

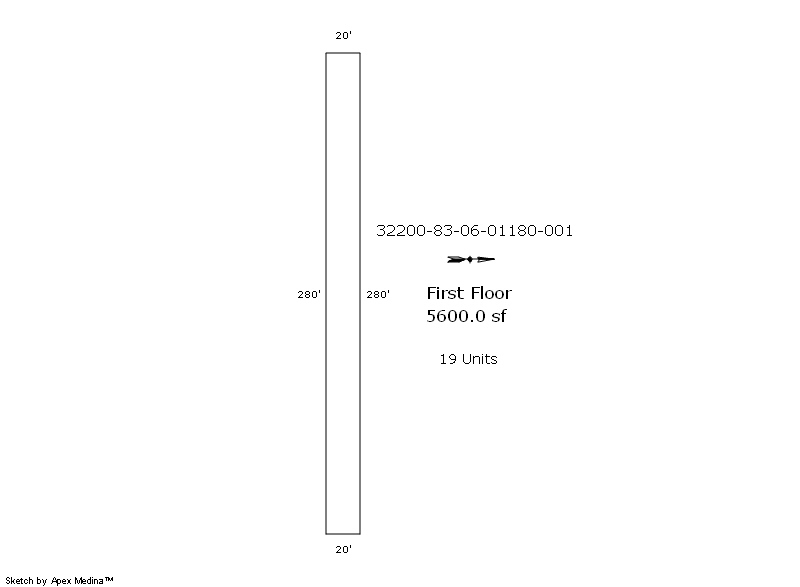

| 2025 | 1988 | Commercial | 5,600 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Mini Warehouse | None | |||||

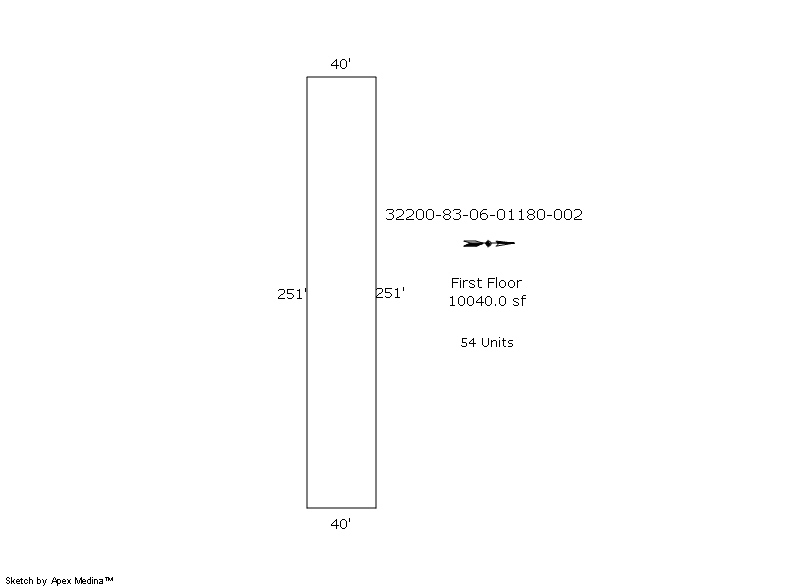

| 2025 | 1988 | Commercial | 10,040 sqft | 1.00 | 9 | 0.00 | |

| 2.00 | Mini Warehouse | None | |||||

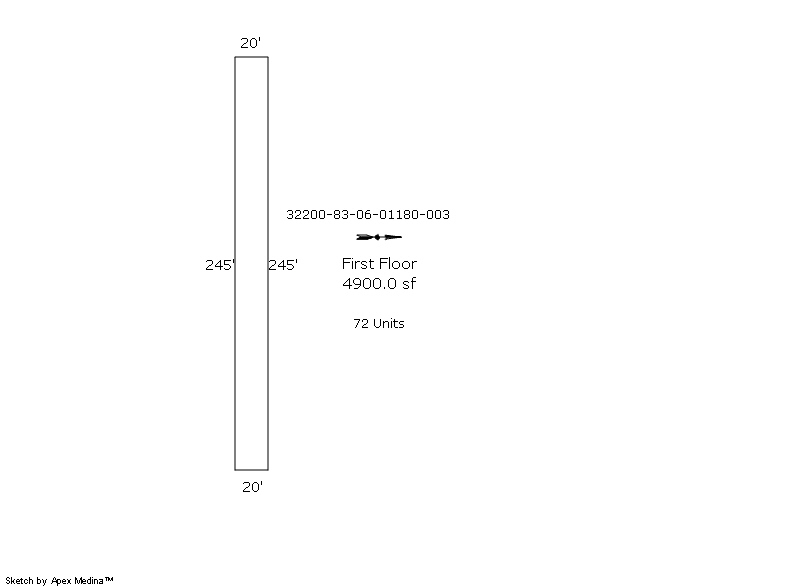

| 2025 | 1988 | Commercial | 4,900 sqft | 1.00 | 9 | 0.00 | |

| 3.00 | Mini Warehouse | None | |||||

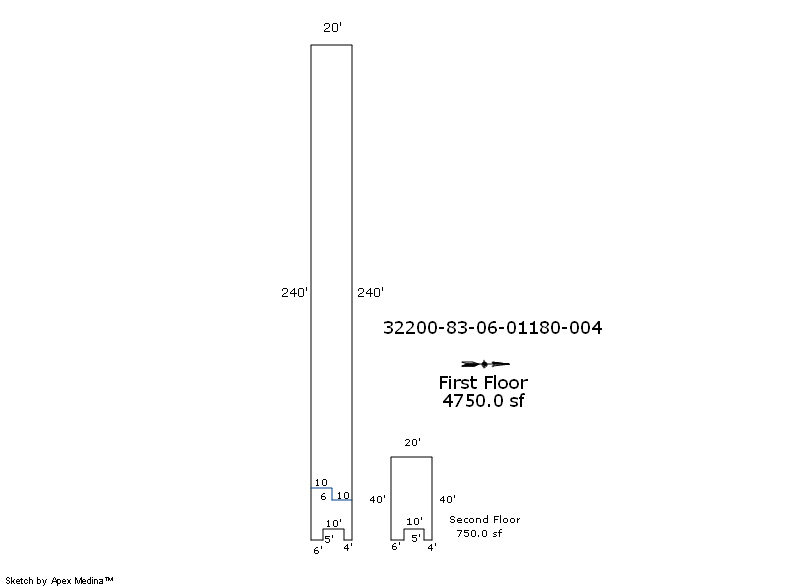

| 2025 | 1988 | Commercial | 750 sqft | 2.00 | 10 | 0 | |

| 4.00 | Office-Apartment | Complete HVAC | |||||

| 2025 | 1988 | Commercial | 4,750 sqft | 1.00 | 9 | 0.00 | |

| 4.00 | Mini Warehouse | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1988 | Commercial | 5,600 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Mini Warehouse | None | |||||

| 2024 | 1988 | Commercial | 10,040 sqft | 1.00 | 9 | 0.00 | |

| 2.00 | Mini Warehouse | None | |||||

| 2024 | 1988 | Commercial | 4,900 sqft | 1.00 | 9 | 0.00 | |

| 3.00 | Mini Warehouse | None | |||||

| 2024 | 1988 | Commercial | 5,500 sqft | 2.00 | 9 | 0.00 | |

| 4.00 | Mini Warehouse | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1988 | Commercial | 5,600 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Mini Warehouse | None | |||||

| 2023 | 1988 | Commercial | 10,040 sqft | 1.00 | 9 | 0.00 | |

| 2.00 | Mini Warehouse | None | |||||

| 2023 | 1988 | Commercial | 4,900 sqft | 1.00 | 9 | 0.00 | |

| 3.00 | Mini Warehouse | None | |||||

| 2023 | 1988 | Commercial | 5,500 sqft | 2.00 | 9 | 0.00 | |

| 4.00 | Mini Warehouse | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $708,700 | $708,700 | - |

| Total Taxable Value (Capped) | $708,700 | $708,700 | - |

| Improvement Value | $389,600 | $389,600 | - |

| Land Value | $319,100 | $319,100 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $77,957 | $77,957 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $77,957 | $77,957 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $9,894 | $10,096 | - |

| Last Notice Date | 2/2/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/13/2016 | LINDER ENTERPRISES LLC | LEWIS LOCKUP STORAGE LLC | $675,000 | General Warranty Deed | 2016066447 |

| 10/26/2006 | 6350 S LEWIS LLC | LINDER ENTERPRISES LLC | $985,000 | General Warranty Deed | 2006124336 |

| 9/29/2000 | SOUTH LEWIS PROPERTIES LTD | OAKLEY PROPERTIES LLC | $800,000 | General Warranty Deed | 2000081107 BK-06422PG-02328 |

Sales/Documents

| Sale Date | 7/13/2016 |

|---|---|

| Grantor | LINDER ENTERPRISES LLC |

| Grantee | LEWIS LOCKUP STORAGE LLC |

| Sale Price | $675,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016066447 |

| Sale Date | 10/26/2006 |

| Grantor | 6350 S LEWIS LLC |

| Grantee | LINDER ENTERPRISES LLC |

| Sale Price | $985,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2006124336 |

| Sale Date | 9/29/2000 |

| Grantor | SOUTH LEWIS PROPERTIES LTD |

| Grantee | OAKLEY PROPERTIES LLC |

| Sale Price | $800,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2000081107 BK-06422PG-02328 |