General Information

| Situs Address | 2643 E 26 ST S TULSA 74114 |

|---|---|

| Owner Name |

HANSON, WALKER & DIANA

|

| Owner Mailing Address | 209 N MAIN ST TULSA , OK 741032005 |

| Account Type | Residential |

| Parcel ID | 32650-93-17-06870 |

| Land Area | 0.28 acres / 12,137 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: PERAGEN ADDN RESUB L3-4 B1 WOODY CREST & PRT J P HARTER'S (32650) Legal: LT 9 BLK 1 & PRT W215 N457.50 E/2 LT 2 J P HARTER'S SUB BEG SECR LT 6 BLK 1 PERAGEN ADD TH E82.75 S5.20 WLY83.10 N6.95 POB Section: 17 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

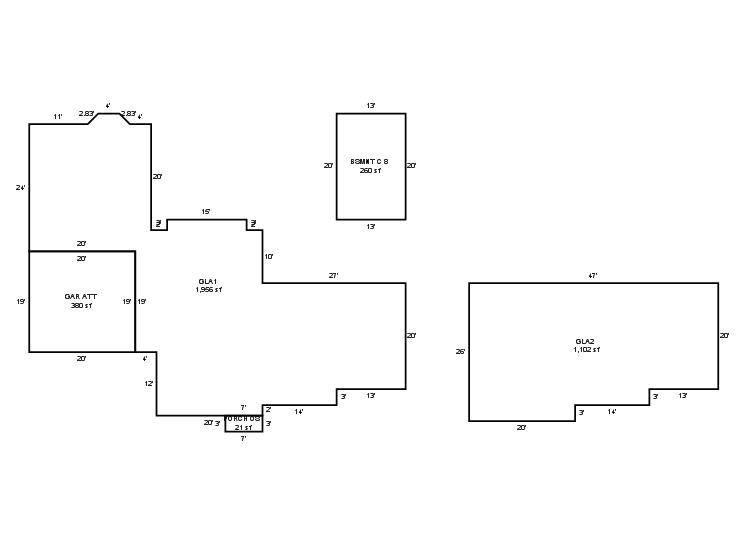

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1935 | Residential | 3,058 sqft | 2.00 | 8 | 3.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1935 | Residential | 3,058 sqft | 2.00 | 8 | 3.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1935 | Residential | 3,058 sqft | 2.00 | 8 | 3.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $551,977 | $567,673 | $660,600 |

| Total Taxable Value (Capped) | $358,313 | $376,228 | $395,040 |

| Improvement Value | $428,951 | $444,647 | $537,574 |

| Land Value | $123,026 | $123,026 | $123,026 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $39,415 | $41,385 | $43,455 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $39,415 | $41,385 | $43,455 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $5,002 | $5,360 | $5,628 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/3/2019 | RANSDELL, JOHN DAVID JR | HANSON, WALKER & DIANA | $325,000 | General Warranty Deed | 2019041742 |

| 12/17/2009 | SANDERSON, GEORGE A JR TRUSTEE GEORGE A SANDERSON JR TRUST | RANSDELL, JOHN DAVID JR | $295,000 | General Warranty Deed | 2009129307 |

| 10/27/1998 | $0 | General Warranty Deed | 2000081783 BK-06125PG-01129 |

Sales/Documents

| Sale Date | 5/3/2019 |

|---|---|

| Grantor | RANSDELL, JOHN DAVID JR |

| Grantee | HANSON, WALKER & DIANA |

| Sale Price | $325,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2019041742 |

| Sale Date | 12/17/2009 |

| Grantor | SANDERSON, GEORGE A JR TRUSTEE GEORGE A SANDERSON JR TRUST |

| Grantee | RANSDELL, JOHN DAVID JR |

| Sale Price | $295,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2009129307 |

| Sale Date | 10/27/1998 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000081783 BK-06125PG-01129 |