Exempt

This property is Exempt Commercial

R32925931803570

2727 S ROCKFORD RD E TULSA 74114

$29,614,059

$0

General Information

| Situs Address | 2727 S ROCKFORD RD E TULSA 74114 |

|---|---|

| Owner Name |

PHILBROOK MUSEUM OF ART INC

|

| Owner Mailing Address | PO BOX 52510 TULSA , OK 74152 |

| Account Type | Exempt Com |

| Parcel ID | 32925-93-18-03570 |

| Land Area | 23.40 acres / 1,019,199 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: PHILBROOK AMD (32925) Legal: ALL PHILBROOK Section: 18 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1925 | Commercial | 88,722 sqft | 2.00 | 12 | 0.00 | |

| 1.00 | Multipurpose Buildings | Complete HVAC | |||||

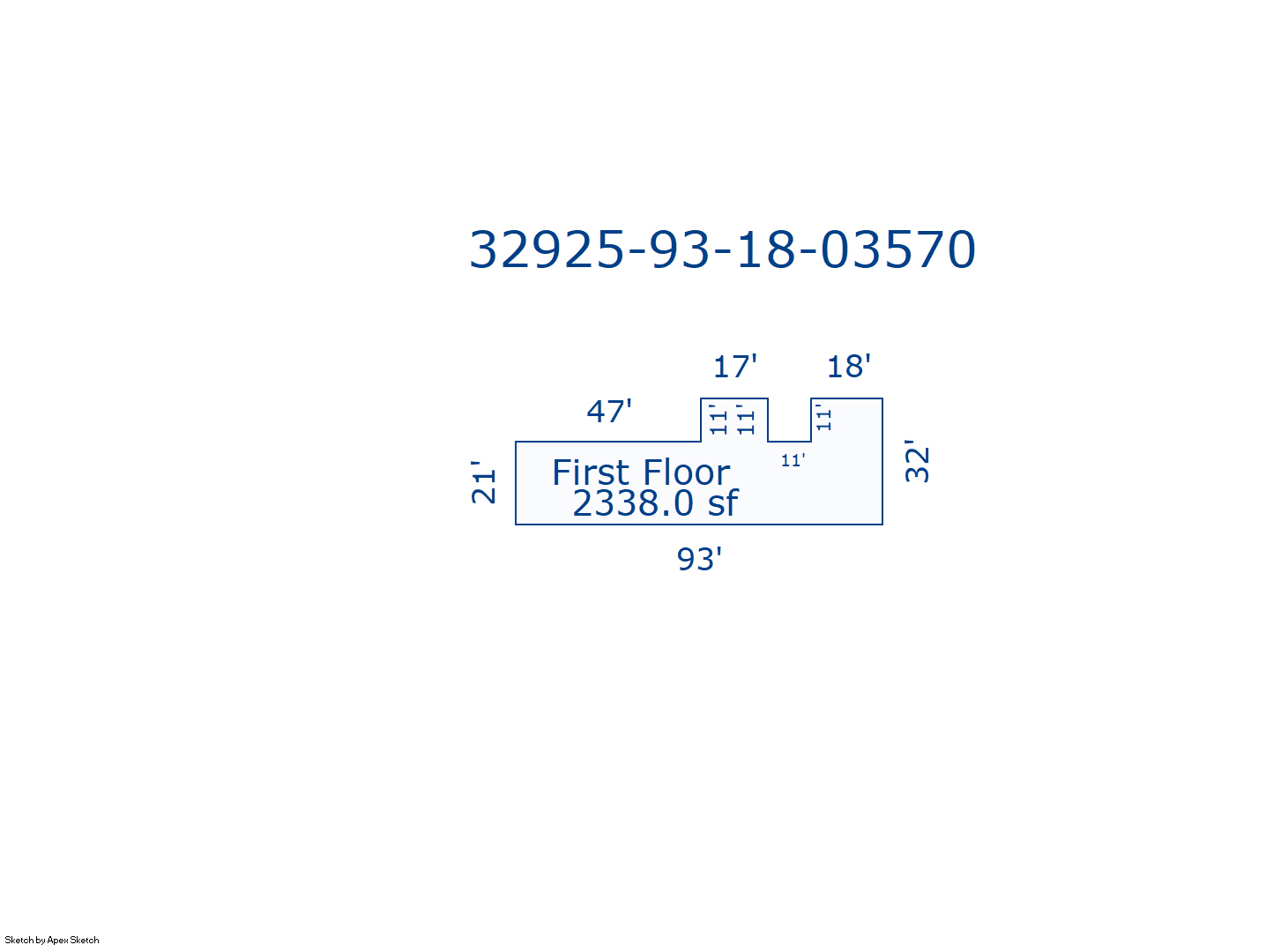

| 2025 | 1970 | Commercial | 2,338 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

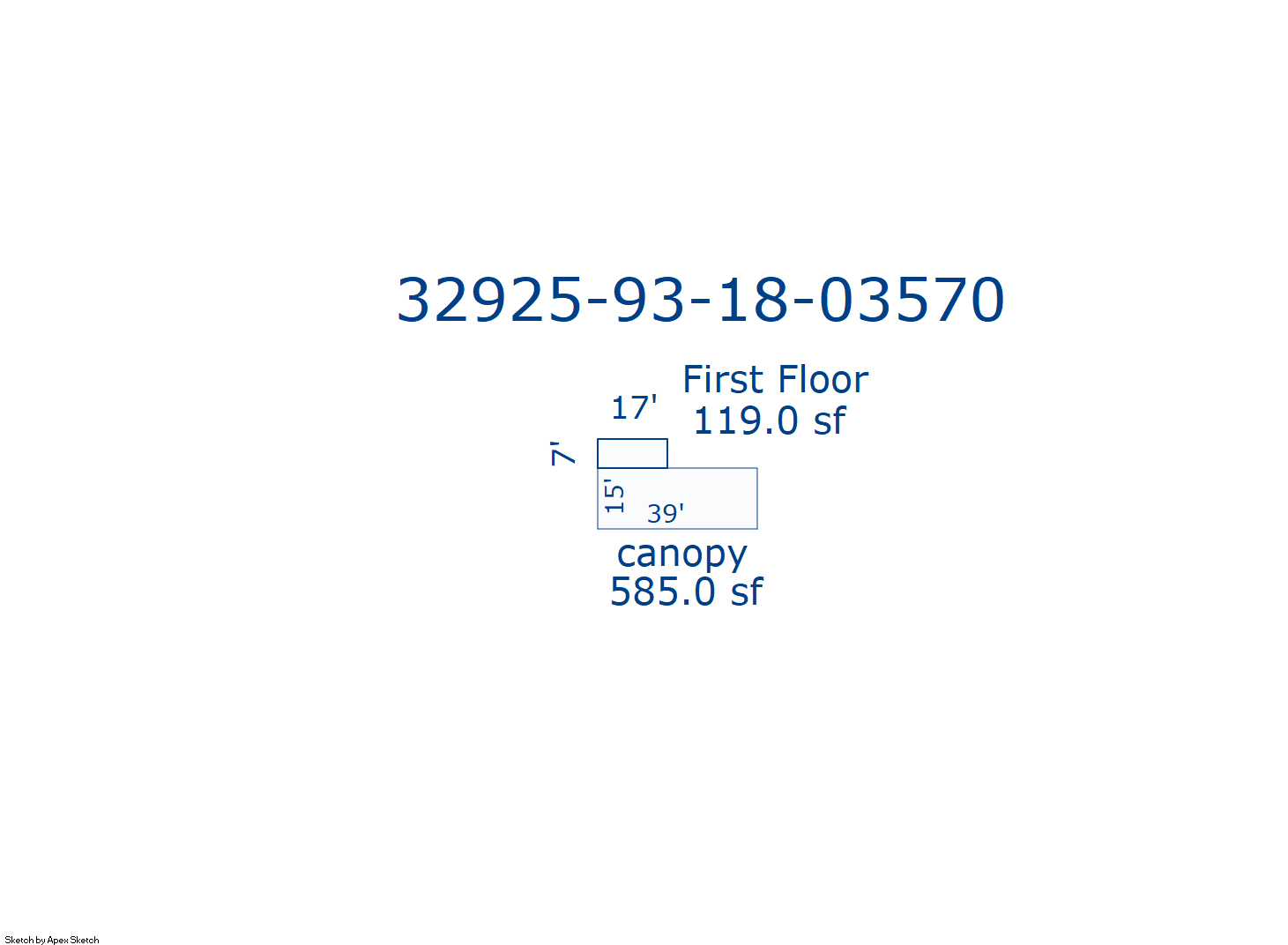

| 2025 | 1940 | Commercial | 119 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Restroom Building/Concessions | None | |||||

| 2025 | 1980 | Commercial | 23,612 sqft | 2.00 | 10 | 0.00 | |

| 4.00 | Parking Structure | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1925 | Commercial | 88,722 sqft | 2.00 | 12 | 0.00 | |

| 1.00 | Multipurpose Buildings | Complete HVAC | |||||

| 2024 | 1970 | Commercial | 2,338 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

| 2024 | 1940 | Commercial | 119 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Restroom Building/Concessions | None | |||||

| 2024 | 1980 | Commercial | 23,612 sqft | 2.00 | 10 | 0.00 | |

| 4.00 | Parking Structure | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1925 | Commercial | 88,722 sqft | 2.00 | 12 | 0.00 | |

| 1.00 | Multipurpose Buildings | Complete HVAC | |||||

| 2023 | 1970 | Commercial | 2,338 sqft | 1.00 | 8 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

| 2023 | 1940 | Commercial | 119 sqft | 1.00 | 8 | 0.00 | |

| 3.00 | Restroom Building/Concessions | None | |||||

| 2023 | 1980 | Commercial | 23,612 sqft | 2.00 | 10 | 0.00 | |

| 4.00 | Parking Structure | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $27,580,137 | $30,474,356 | $29,614,059 |

| Total Taxable Value (Capped) | $18,831,687 | $19,773,272 | $20,761,935 |

| Improvement Value | $0 | $0 | $0 |

| Land Value | $0 | $0 | $0 |

| Assessment Ratio | 0% | 0% | 0% |

| Gross Assessed Value | $0 | $0 | $0 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $0 | $0 | $0 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $0 | $0 | $0 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |