General Information

| Situs Address | 655 S 127 AV E TULSA 74128 |

|---|---|

| Owner Name |

MORA, ANTONIO & SANDRA

|

| Owner Mailing Address | 523 S 129TH EAST AVE TULSA , OK 741082511 |

| Account Type | Residential |

| Parcel ID | 33100-94-05-01480 |

| Land Area | 0.40 acres / 17,360 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: PLAINVIEW HGTS ADDN (33100) Legal: N114.50 S119.50 E151.62 W156.62 LT 5 Section: 05 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

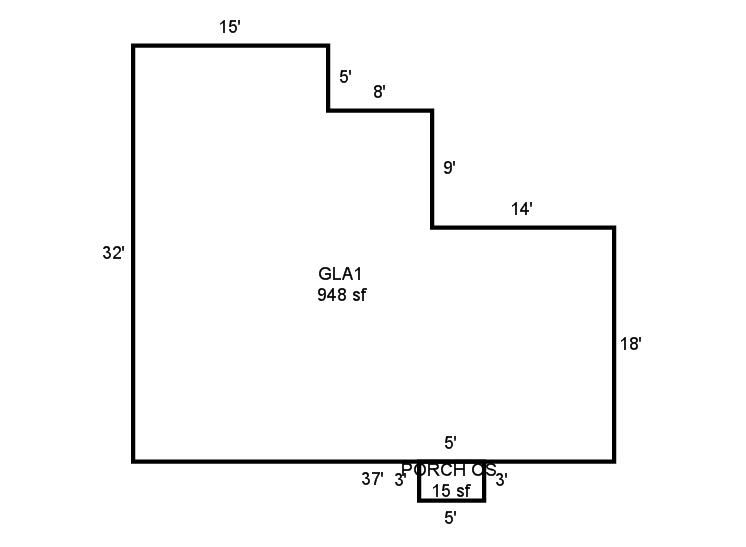

| 2025 | 1937 | Residential | 948 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1937 | Residential | 948 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1937 | Residential | 948 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $118,063 | $108,839 | $152,400 |

| Total Taxable Value (Capped) | $34,219 | $108,839 | $114,281 |

| Improvement Value | $106,263 | $97,039 | $140,600 |

| Land Value | $11,800 | $11,800 | $11,800 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $3,764 | $11,972 | $12,571 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $3,764 | $11,972 | $12,571 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $478 | $1,550 | $1,628 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/19/2023 | RIGGS, TIMOTHY LYNN TRUST | MORA, ANTONIO & SANDRA WALLIS, RANDY LEE MONDRAGON & MORENA ETAL | $245,000 | Trustee's Deed | 2023077446 |

| 11/12/2021 | TULSA BIBLE SCHOOL | RIGGS, TIMOTHY LYNN TRUST | $0 | Quit Claim Deed | 2021131502 |

Sales/Documents

| Sale Date | 9/19/2023 |

|---|---|

| Grantor | RIGGS, TIMOTHY LYNN TRUST |

| Grantee | MORA, ANTONIO & SANDRA WALLIS, RANDY LEE MONDRAGON & MORENA ETAL |

| Sale Price | $245,000 |

| Deed Type | Trustee's Deed |

| Document Number | 2023077446 |

| Sale Date | 11/12/2021 |

| Grantor | TULSA BIBLE SCHOOL |

| Grantee | RIGGS, TIMOTHY LYNN TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2021131502 |