General Information

| Situs Address | 2707 E ARCHER ST N N TULSA 74110 |

|---|---|

| Owner Name |

ROBINSON, CASEY & MARGARET ROSENE

|

| Owner Mailing Address | 1219 E ADMIRAL BLVD TULSA , OK 74120 |

| Account Type | Commercial |

| Parcel ID | 34300-03-32-15150 |

| Land Area | 0.16 acres / 7,000 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: REDDIN ADDN (34300) Legal: LT 16 BLK 4 Section: 32 Township: 20 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

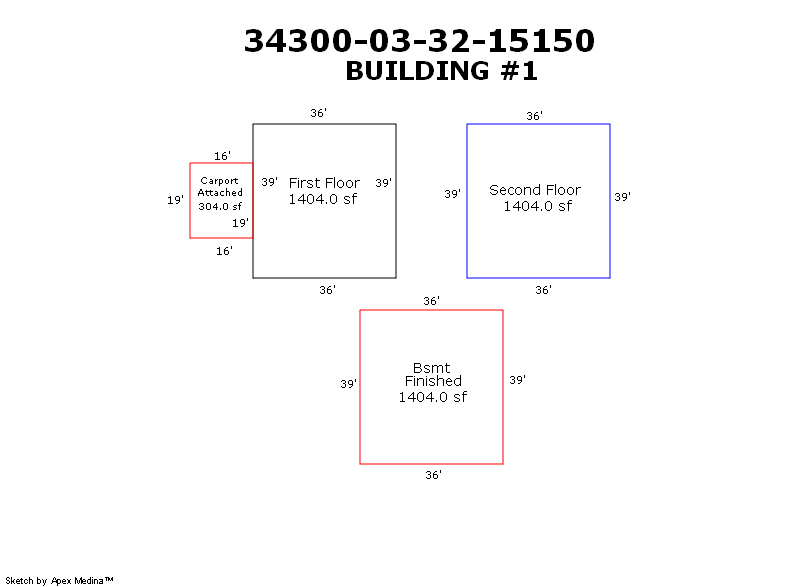

| 2025 | 1925 | Multiple Unit | 4,212 sqft | 2.00 | 8 | 0.00 | Roll Composition |

| 1.00 | Apartment <= 3 Stories | Basement | Masonry Common Brick | Electric Baseboard | |||

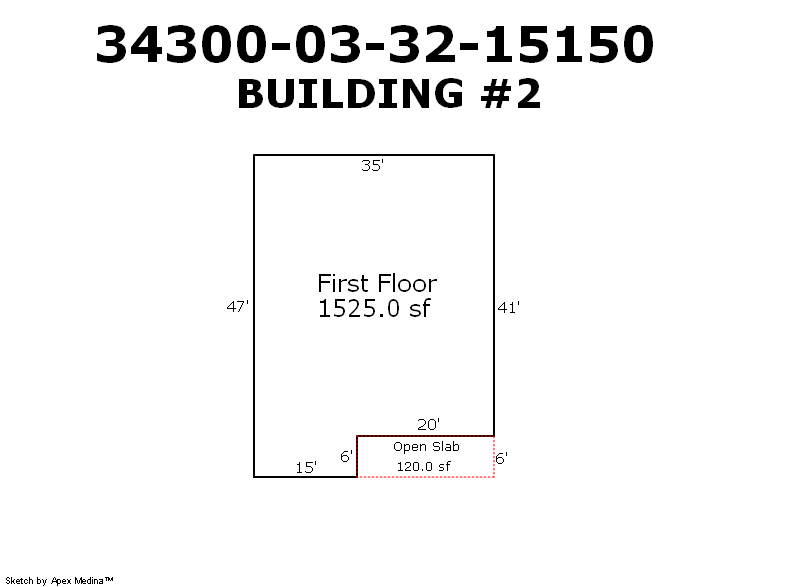

| 2025 | 1925 | Duplex | 1,525 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 2.00 | Duplex One Story | Crawl Space | Frame Masonry Veneer | Floor/Wall Furnace | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1925 | Multiple Unit | 4,212 sqft | 2.00 | 8 | 0.00 | Roll Composition |

| 1.00 | Apartment <= 3 Stories | Basement | Masonry Common Brick | Electric Baseboard | |||

| 2024 | 1925 | Duplex | 1,525 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 2.00 | Duplex One Story | Crawl Space | Frame Masonry Veneer | Floor/Wall Furnace | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1925 | Multiple Unit | 4,212 sqft | 2.00 | 8 | 0.00 | Roll Composition |

| 1.00 | Apartment <= 3 Stories | Basement | Masonry Common Brick | Electric Baseboard | |||

| 2023 | 1925 | Duplex | 1,525 sqft | 1.00 | 8 | 0.00 | Composition Shingle |

| 2.00 | Duplex One Story | Crawl Space | Frame Masonry Veneer | Floor/Wall Furnace | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $414,700 | $405,300 | $397,200 |

| Total Taxable Value (Capped) | $248,850 | $261,292 | $274,357 |

| Improvement Value | $404,200 | $394,800 | $386,700 |

| Land Value | $10,500 | $10,500 | $10,500 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $27,373 | $28,743 | $30,179 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $27,373 | $28,743 | $30,179 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $3,474 | $3,723 | $3,908 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 10/5/2021 | MALONE, DAVID H | ROBINSON, CASEY & MARGARET ROSENE | $0 | Corrected General Warranty Deed | 2022040784 |

| 10/5/2021 | MALONE, DAVID H | ROBINSON, CASEY & MARGARET ROSENE | $250,000 | General Warranty Deed | 2021119192 |

| 10/5/2021 | MALONE, DAVID H & NORMA N | MALONE, DAVID H | $0 | Affidavit Of Surviving Joint Tenant | 2021119191 |

| 5/9/2005 | $0 | Affidavit Of Surviving Joint Tenant | 2005053260 |

Sales/Documents

| Sale Date | 10/5/2021 |

|---|---|

| Grantor | MALONE, DAVID H |

| Grantee | ROBINSON, CASEY & MARGARET ROSENE |

| Sale Price | $0 |

| Deed Type | Corrected General Warranty Deed |

| Document Number | 2022040784 |

| Sale Date | 10/5/2021 |

| Grantor | MALONE, DAVID H |

| Grantee | ROBINSON, CASEY & MARGARET ROSENE |

| Sale Price | $250,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2021119192 |

| Sale Date | 10/5/2021 |

| Grantor | MALONE, DAVID H & NORMA N |

| Grantee | MALONE, DAVID H |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2021119191 |

| Sale Date | 5/9/2005 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2005053260 |