General Information

| Situs Address | 1554 S YORKTOWN PL E TULSA 741044918 |

|---|---|

| Owner Name |

ULIRSCH, RUDOLF AND ELIZABETH

|

| Owner Mailing Address | 1554 S YORKTOWN PL TULSA , OK 741044918 |

| Account Type | Residential |

| Parcel ID | 37400-93-07-17210 |

| Land Area | 0.31 acres / 13,509 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SEVEN ACRES PLACE (37400) Legal: LT 9 Section: 07 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

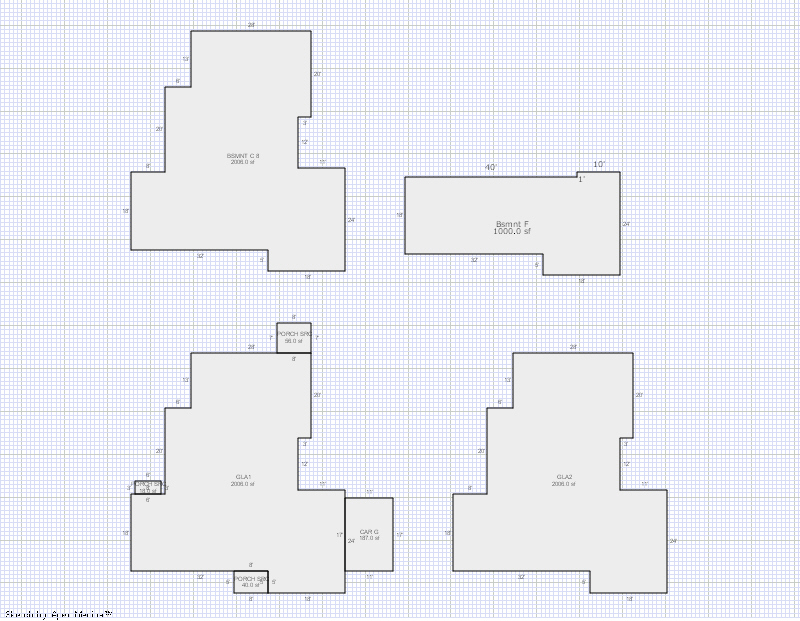

| 2025 | 1930 | Residential | 5,012 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

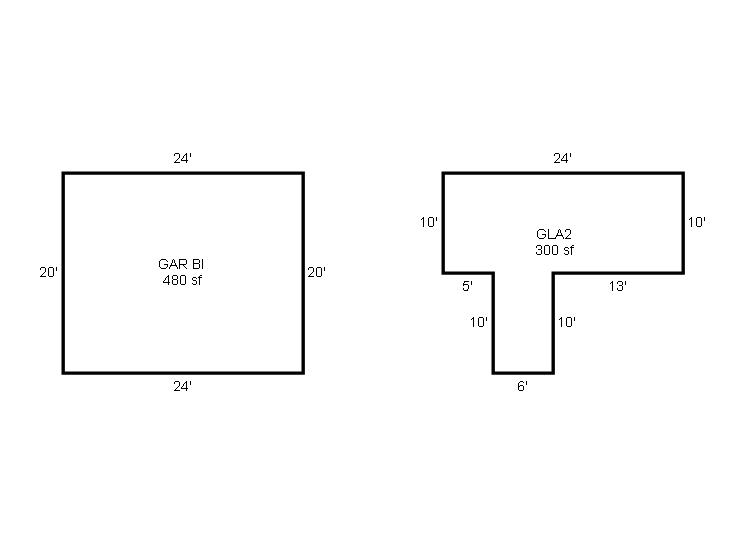

| 2025 | 1930 | Residential | 300 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1930 | Residential | 5,012 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

| 2024 | 1930 | Residential | 300 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1930 | Residential | 5,012 sqft | 2.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | 2 Story | Conventional | FrameSiding/MasonryVeneer | Cool Air in Heat Ducts | |||

| 2023 | 1930 | Residential | 300 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $615,600 | $760,327 | $895,200 |

| Total Taxable Value (Capped) | $615,600 | $646,380 | $678,699 |

| Improvement Value | $512,782 | $657,509 | $792,382 |

| Land Value | $102,818 | $102,818 | $102,818 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $67,716 | $71,102 | $74,657 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $67,716 | $71,102 | $74,657 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $8,594 | $9,208 | $9,669 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 12/12/2018 | OLSON, BARBARA LIVING TRUST | ULIRSCH, RUDOLF AND ELIZABETH | $570,000 | Warranty Deed | 2018113182 |

| 2/28/2017 | OLSON, BARBARA & DARWIN D | OLSON, BARBARA LIVING TRUST | $0 | Quit Claim Deed | 2017018216 |

| 11/3/2014 | OLSON, BARBARA & DARWIN D TTEES BARBARA OLSON TRUST | OLSON, BARBARA & DARWIN D | $0 | Quit Claim Deed | 2014099610 |

| 6/14/2010 | OLSON, DARWIN D AND BARBARA E | OLSON, BARBARA & DARWIN D TTEES BARBARA OLSON TRUST | $0 | Quit Claim Deed | 2010051725 |

| 6/8/2006 | OLSON, DARWIN D, TRUSTEE | OLSON, DARWIN D | $0 | Quit Claim Deed | 2006065094 |

| 10/1/1986 | $240,000 | History | 2000094031 BK-04975PG-01892 | ||

| 9/1/1979 | $150,000 | History | 2000094032 |

Sales/Documents

| Sale Date | 12/12/2018 |

|---|---|

| Grantor | OLSON, BARBARA LIVING TRUST |

| Grantee | ULIRSCH, RUDOLF AND ELIZABETH |

| Sale Price | $570,000 |

| Deed Type | Warranty Deed |

| Document Number | 2018113182 |

| Sale Date | 2/28/2017 |

| Grantor | OLSON, BARBARA & DARWIN D |

| Grantee | OLSON, BARBARA LIVING TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2017018216 |

| Sale Date | 11/3/2014 |

| Grantor | OLSON, BARBARA & DARWIN D TTEES BARBARA OLSON TRUST |

| Grantee | OLSON, BARBARA & DARWIN D |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2014099610 |

| Sale Date | 6/14/2010 |

| Grantor | OLSON, DARWIN D AND BARBARA E |

| Grantee | OLSON, BARBARA & DARWIN D TTEES BARBARA OLSON TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2010051725 |

| Sale Date | 6/8/2006 |

| Grantor | OLSON, DARWIN D, TRUSTEE |

| Grantee | OLSON, DARWIN D |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2006065094 |

| Sale Date | 10/1/1986 |

| Grantor | |

| Grantee | |

| Sale Price | $240,000 |

| Deed Type | History |

| Document Number | 2000094031 BK-04975PG-01892 |

| Sale Date | 9/1/1979 |

| Grantor | |

| Grantee | |

| Sale Price | $150,000 |

| Deed Type | History |

| Document Number | 2000094032 |