General Information

| Situs Address | 12909 E 21 ST S TULSA 74134 |

|---|---|

| Owner Name |

KEY PLUS PROPERTIES LLC

|

| Owner Mailing Address | 1920 S MEMORIAL DR TULSA , OK 74112 |

| Account Type | Commercial |

| Parcel ID | 38375-94-09-03010 |

| Land Area | 0.86 acres / 37,668 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SKELLY HGTS ADDN (38375) Legal: LT 1 LESS BEG SWC TH N26 SE35.38 W24 POB BLK 1 Section: 09 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

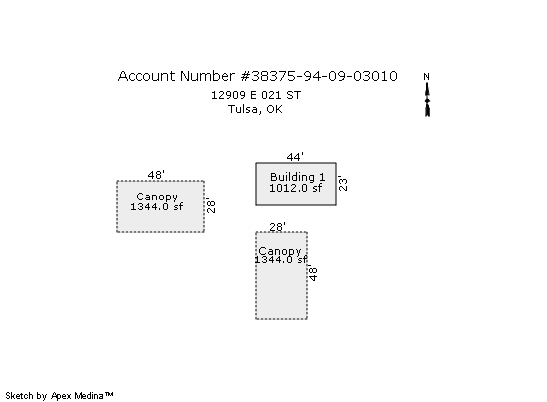

| 2025 | 1986 | Commercial | 1,012 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Convenience Store | Warm and Cool Air Zone | |||||

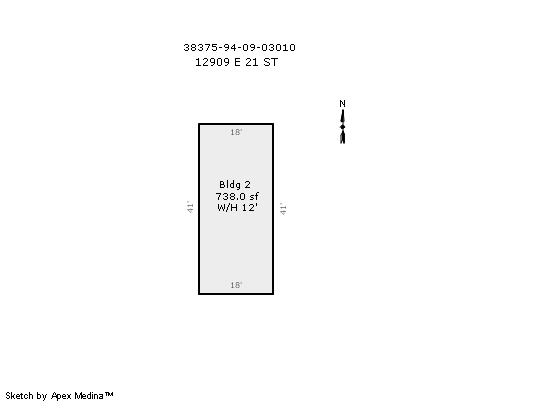

| 2025 | 1986 | Commercial | 738 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Car Wash - Automatic | None | |||||

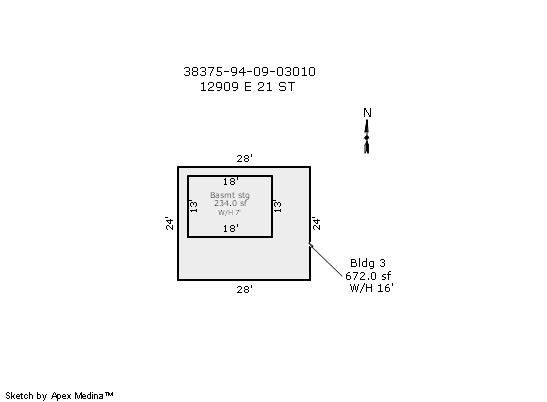

| 2025 | 1990 | Commercial | 672 sqft | 1.00 | 16 | 0.00 | |

| 3.00 | Car Wash - Drive thru | Forced Air | |||||

| 2025 | 1986 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1986 | Commercial | 1,012 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Convenience Store | Warm and Cool Air Zone | |||||

| 2024 | 1986 | Commercial | 738 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Car Wash - Automatic | None | |||||

| 2024 | 1990 | Commercial | 672 sqft | 1.00 | 16 | 0.00 | |

| 3.00 | Car Wash - Drive thru | Forced Air | |||||

| 2024 | 1986 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1986 | Commercial | 1,012 sqft | 1.00 | 9 | 0.00 | |

| 1.00 | Convenience Store | Warm and Cool Air Zone | |||||

| 2023 | 1986 | Commercial | 738 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Car Wash - Automatic | None | |||||

| 2023 | 1990 | Commercial | 672 sqft | 1.00 | 16 | 0.00 | |

| 3.00 | Car Wash - Drive thru | Forced Air | |||||

| 2023 | 1986 | Out Building | 200 sqft | 1.00 | 8 | 0.00 | |

| 4.00 | Shed - Utility | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $266,400 | $266,400 | - |

| Total Taxable Value (Capped) | $266,400 | $266,400 | - |

| Improvement Value | $78,000 | $78,000 | - |

| Land Value | $188,400 | $188,400 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $29,304 | $29,304 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $29,304 | $29,304 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $3,719 | $3,795 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/26/2011 | CSTORE INVESTORS LLC | KEY PLUS PROPERTIES LLC | $241,500 | General Warranty Deed | 2011085520 |

| 12/14/2004 | EQUILON ENTERPRISES LLC | CSTORE INVESTORS LLC | $11,863,400 | Special Warranty Deed | 2004150178 |

Sales/Documents

| Sale Date | 9/26/2011 |

|---|---|

| Grantor | CSTORE INVESTORS LLC |

| Grantee | KEY PLUS PROPERTIES LLC |

| Sale Price | $241,500 |

| Deed Type | General Warranty Deed |

| Document Number | 2011085520 |

| Sale Date | 12/14/2004 |

| Grantor | EQUILON ENTERPRISES LLC |

| Grantee | CSTORE INVESTORS LLC |

| Sale Price | $11,863,400 |

| Deed Type | Special Warranty Deed |

| Document Number | 2004150178 |