General Information

| Situs Address | 5207 S 32 PL W TULSA 741079052 |

|---|---|

| Owner Name |

MISNER, DETRA A REV TRUST

|

| Owner Mailing Address | 5207 S 32ND WEST PL TULSA , OK 741079052 |

| Account Type | Residential |

| Parcel ID | 38760-92-34-16270 |

| Land Area | 0.50 acres / 21,649 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SNOWCREST WEST (38760) Legal: LT 6 BLK 1 Section: 34 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

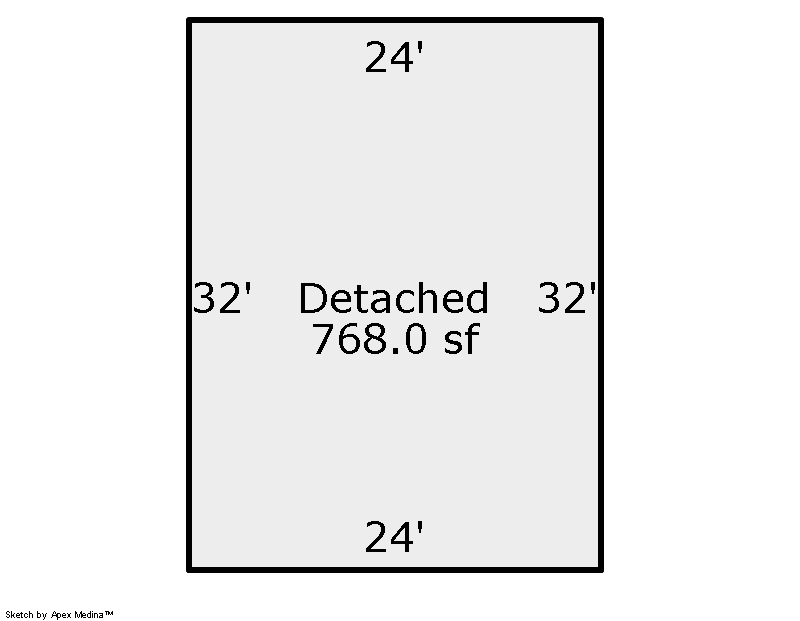

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2013 | Residential | 2,030 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2013 | Residential | 2,030 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2013 | Residential | 2,030 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $310,707 | $310,707 | $248,800 |

| Total Taxable Value (Capped) | $251,433 | $258,976 | $248,800 |

| Improvement Value | $242,307 | $242,307 | $180,400 |

| Land Value | $68,400 | $68,400 | $68,400 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $27,658 | $28,487 | $27,368 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $26,658 | $27,487 | $26,368 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $3,383 | $3,560 | $3,415 |

| Last Notice Date | 3/26/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/30/2020 | TAYLOR, DETRA A | MISNER, DETRA A REV TRUST | $0 | Quit Claim Deed | 2020010705 |

| 10/31/2018 | KEITH D & DETRA A TAYLOR REVOCABLE TRUST; TAYLOR, KEITH DAVID & DETRA ANN | TAYLOR, DETRA A | $0 | General Warranty Deed | 2018100912 |

| 5/3/2013 | TAYLOR, KEITH & DETRA | TAYLOR, KEITH D & DETRA A TRUSTEES KEITH D & DETRA A TAYLOR REV TRUST | $0 | General Warranty Deed | 2013047206 |

| 4/29/2011 | INBODY, PAULA A | TAYLOR, KEITH & DETRA | $75,000 | General Warranty Deed | 2011038071 |

| 9/11/2007 | REAVIS, RANDELL H | INBODY, PAULA A | $0 | Quit Claim Deed | 2007102318 |

Sales/Documents

| Sale Date | 1/30/2020 |

|---|---|

| Grantor | TAYLOR, DETRA A |

| Grantee | MISNER, DETRA A REV TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2020010705 |

| Sale Date | 10/31/2018 |

| Grantor | KEITH D & DETRA A TAYLOR REVOCABLE TRUST; TAYLOR, KEITH DAVID & DETRA ANN |

| Grantee | TAYLOR, DETRA A |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2018100912 |

| Sale Date | 5/3/2013 |

| Grantor | TAYLOR, KEITH & DETRA |

| Grantee | TAYLOR, KEITH D & DETRA A TRUSTEES KEITH D & DETRA A TAYLOR REV TRUST |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2013047206 |

| Sale Date | 4/29/2011 |

| Grantor | INBODY, PAULA A |

| Grantee | TAYLOR, KEITH & DETRA |

| Sale Price | $75,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2011038071 |

| Sale Date | 9/11/2007 |

| Grantor | REAVIS, RANDELL H |

| Grantee | INBODY, PAULA A |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2007102318 |