General Information

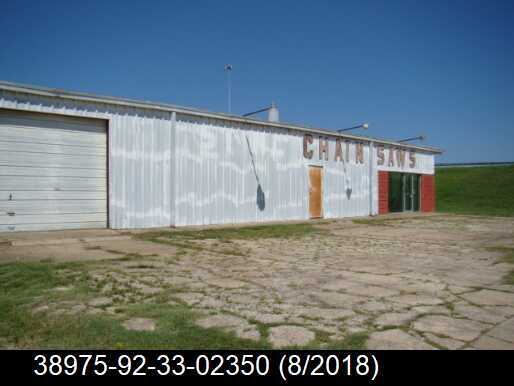

| Situs Address | 3705 W SKELLY DR S TULSA 74107 |

|---|---|

| Owner Name |

REDBIRD HOLDINGS LLC

|

| Owner Mailing Address | 10289 S 49TH WEST AVE SAPULPA , OK 740669057 |

| Account Type | Commercial |

| Parcel ID | 38975-92-33-02350 |

| Land Area | 1.07 acres / 46,625 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SOUTH HAVEN AMD (38975) Legal: LTS 1 THRU 17 LESS E10 N50 LT 1 & LESS BEG NWC LT 17 TH S50 NE306.33 W325 POB BLK 3 Section: 33 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

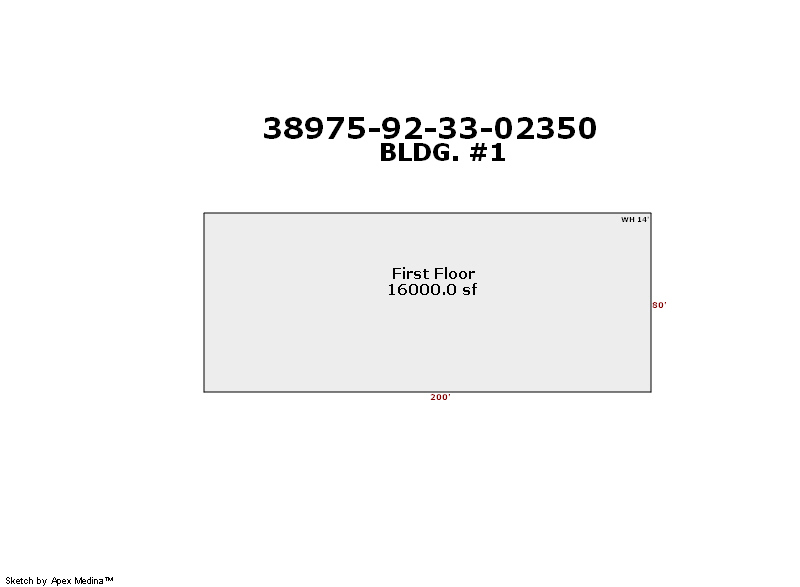

| 2025 | 1986 | Commercial | 16,000 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Floor Wall Furnace | |||||

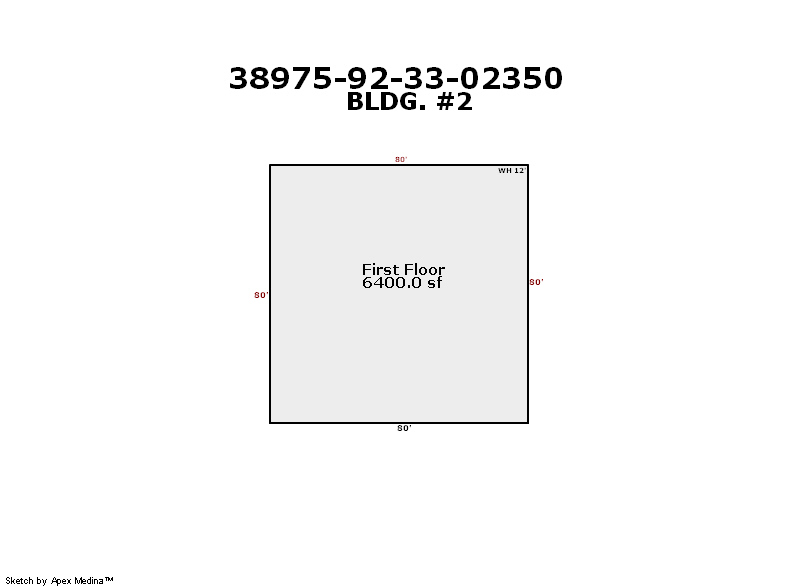

| 2025 | 1960 | Commercial | 6,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Warehouse Showroom Store | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1986 | Commercial | 16,000 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Floor Wall Furnace | |||||

| 2024 | 1960 | Commercial | 6,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Warehouse Showroom Store | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1986 | Commercial | 16,000 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Warehouse | Floor Wall Furnace | |||||

| 2023 | 1960 | Commercial | 6,400 sqft | 1.00 | 12 | 0.00 | |

| 2.00 | Warehouse Showroom Store | Space Heater | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $325,000 | $325,000 | - |

| Total Taxable Value (Capped) | $325,000 | $325,000 | - |

| Improvement Value | $278,400 | $278,400 | - |

| Land Value | $46,600 | $46,600 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $35,750 | $35,750 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $35,750 | $35,750 | - |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $4,537 | $4,630 | - |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/13/2024 | CALVERT, DANIEL E & OLETA CO-TRUSTEES DANIEL E & OLETA CALVERT REV TRUST | REDBIRD HOLDINGS LLC | $550,000 | General Warranty Deed | 2024037892 |

| 2/3/1971 | $0 | Quit Claim Deed | 2000099947 BK-03955PG-00852 |

Sales/Documents

| Sale Date | 5/13/2024 |

|---|---|

| Grantor | CALVERT, DANIEL E & OLETA CO-TRUSTEES DANIEL E & OLETA CALVERT REV TRUST |

| Grantee | REDBIRD HOLDINGS LLC |

| Sale Price | $550,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2024037892 |

| Sale Date | 2/3/1971 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000099947 BK-03955PG-00852 |