General Information

| Situs Address | 2543 S 126 AV E TULSA 741296029 |

|---|---|

| Owner Name |

JOHNSON, SHAY

|

| Owner Mailing Address | 2543 S 126TH EAST AVE TULSA , OK 741296029 |

| Account Type | Residential |

| Parcel ID | 40325-94-17-06850 |

| Land Area | 0.18 acres / 7,862 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: STACEY LYNN ADDN (40325) Legal: LT 24 BLK 4 Section: 17 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

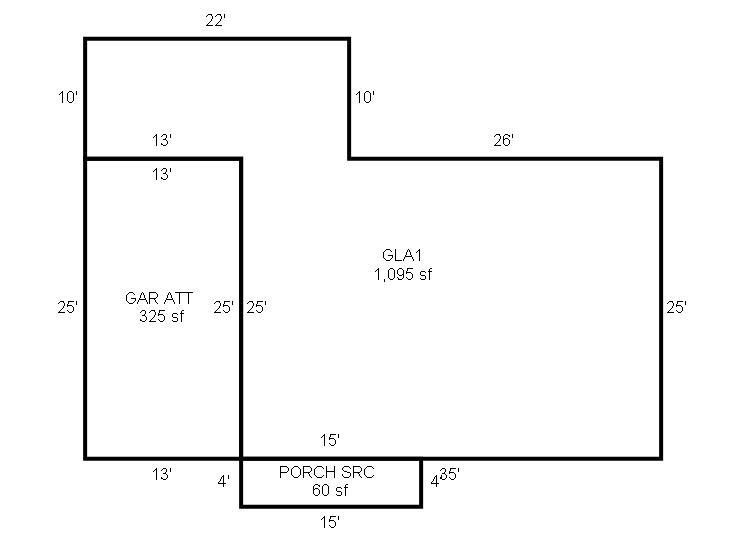

| 2024 | 1966 | Residential | 1,095 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1966 | Residential | 1,095 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 1966 | Residential | 1,095 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $95,770 | $123,862 | $127,469 |

| Total Taxable Value (Capped) | $82,425 | $123,862 | $127,469 |

| Improvement Value | $72,721 | $100,813 | $104,420 |

| Land Value | $23,049 | $23,049 | $23,049 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $9,067 | $13,624 | $14,021 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $9,067 | $13,624 | $14,021 |

| School District | T-1A | ||

| Tax Rate | 133.32 | 126.91 | 129.51 |

| Estimated taxes | $1,209 | $1,729 | $1,816 |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/12/2023 | AZUBUIKE, MICHELLE L | JOHNSON, SHAY | $110,000 | General Warranty Deed | 2023056238 |

| 5/31/2023 | ZMP OKLAHOMA LLC | AZUBUIKE, MICHELLE L | $0 | Quit Claim Deed | 2023051508 |

| 4/7/2023 | NEWREZ LLC | ZMP OKLAHOMA LLC | $96,500 | Special Warranty Deed | 2023042150 |

| 12/1/2022 | TULSA COUNTY SHERIFF | NEWREZ LLC | $0 | Sheriff's Deed | 2022126121 |

| 7/29/2019 | CHARLES, MARTHA E TRUSTEE, MARTHA E CHARLES TR | HACKER, JACOB | $78,500 | Trustee's Deed | 2019070294 |

| 5/30/2007 | CHARLES, MARTHA E | CHARLES, MARTHA E, TRUSTEE | $0 | Quit Claim Deed | 2007058968 |

Sales/Documents

| Sale Date | 7/12/2023 |

|---|---|

| Grantor | AZUBUIKE, MICHELLE L |

| Grantee | JOHNSON, SHAY |

| Sale Price | $110,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2023056238 |

| Sale Date | 5/31/2023 |

| Grantor | ZMP OKLAHOMA LLC |

| Grantee | AZUBUIKE, MICHELLE L |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2023051508 |

| Sale Date | 4/7/2023 |

| Grantor | NEWREZ LLC |

| Grantee | ZMP OKLAHOMA LLC |

| Sale Price | $96,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2023042150 |

| Sale Date | 12/1/2022 |

| Grantor | TULSA COUNTY SHERIFF |

| Grantee | NEWREZ LLC |

| Sale Price | $0 |

| Deed Type | Sheriff's Deed |

| Document Number | 2022126121 |

| Sale Date | 7/29/2019 |

| Grantor | CHARLES, MARTHA E TRUSTEE, MARTHA E CHARLES TR |

| Grantee | HACKER, JACOB |

| Sale Price | $78,500 |

| Deed Type | Trustee's Deed |

| Document Number | 2019070294 |

| Sale Date | 5/30/2007 |

| Grantor | CHARLES, MARTHA E |

| Grantee | CHARLES, MARTHA E, TRUSTEE |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2007058968 |