General Information

| Situs Address | 4915 S UNION AV W TULSA 74107 |

|---|---|

| Owner Name |

SHADOWBROOK PROPERTIES LLC

|

| Owner Mailing Address | 4915 S UNION AVE TULSA , OK 74107 |

| Account Type | Commercial |

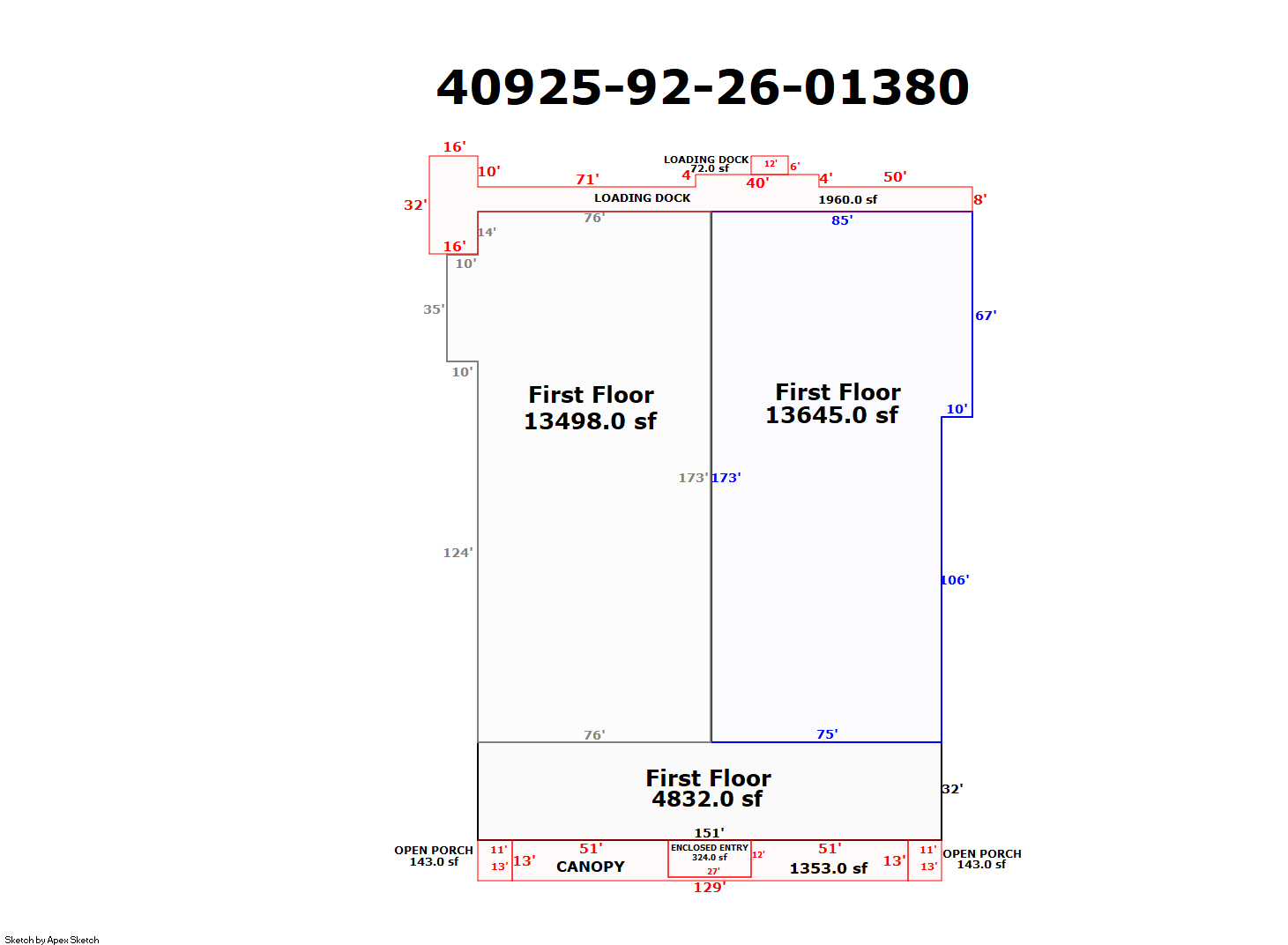

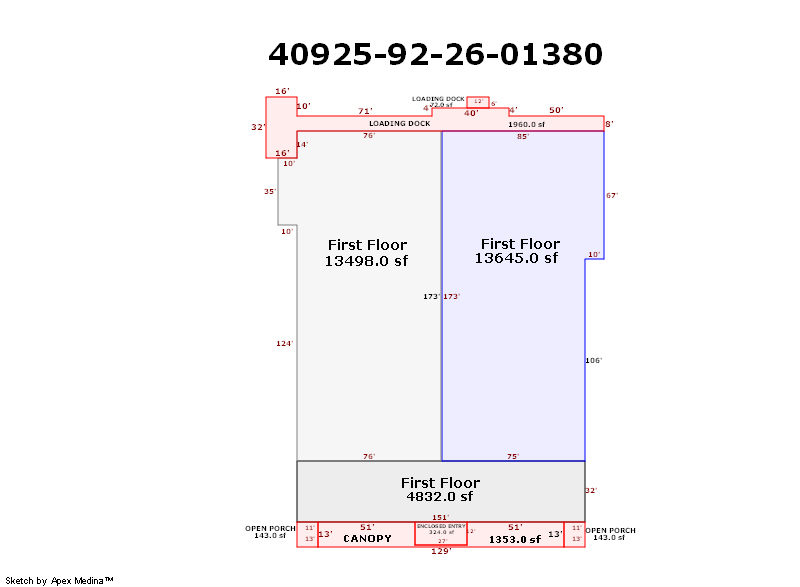

| Parcel ID | 40925-92-26-01380 |

| Land Area | 2.38 acres / 103,691 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SUBURBAN HIGHLANDS (40925) Legal: LT 1 & LT 2 LESS N10 LTS 1 & 2 & LESS E10 LT 1 & LESS W25 LT 2 & LESS BEG SECR THEREOF TH N123.6 W98 N10 W267 S TO PT ON SL LT 2 TH E365 POB BLK 4 Section: 26 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1960 | Commercial | 31,975 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1960 | Commercial | 31,975 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1960 | Commercial | 31,975 sqft | 1.00 | 14 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $1,694,400 | $2,344,800 | $2,344,800 |

| Total Taxable Value (Capped) | $1,457,548 | $1,530,426 | $1,606,947 |

| Improvement Value | $1,487,000 | $2,137,400 | $2,137,400 |

| Land Value | $207,400 | $207,400 | $207,400 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $160,330 | $168,346 | $176,764 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $160,330 | $168,346 | $176,764 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $20,347 | $21,802 | $22,893 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/30/2012 | RONGEY, PAUL D AND JOHN A SMIT | SHADOWBROOK PROPERTIES LLC | $0 | Warranty Deed | 2012030791 |

| 4/21/2000 | SANDITEN 50% ET ALL | 4915 SOUTH UNION LLC | $350,000 | General Warranty Deed | 2000106836 BK-06359PG-02349 |

Sales/Documents

| Sale Date | 3/30/2012 |

|---|---|

| Grantor | RONGEY, PAUL D AND JOHN A SMIT |

| Grantee | SHADOWBROOK PROPERTIES LLC |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2012030791 |

| Sale Date | 4/21/2000 |

| Grantor | SANDITEN 50% ET ALL |

| Grantee | 4915 SOUTH UNION LLC |

| Sale Price | $350,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2000106836 BK-06359PG-02349 |