General Information

| Situs Address | 1419 W 51 ST S TULSA 74107 |

|---|---|

| Owner Name |

ASPEN SQUARE INC

|

| Owner Mailing Address | 3440 E HOUSTON ST STE D BROKEN ARROW , OK 740142951 |

| Account Type | Commercial |

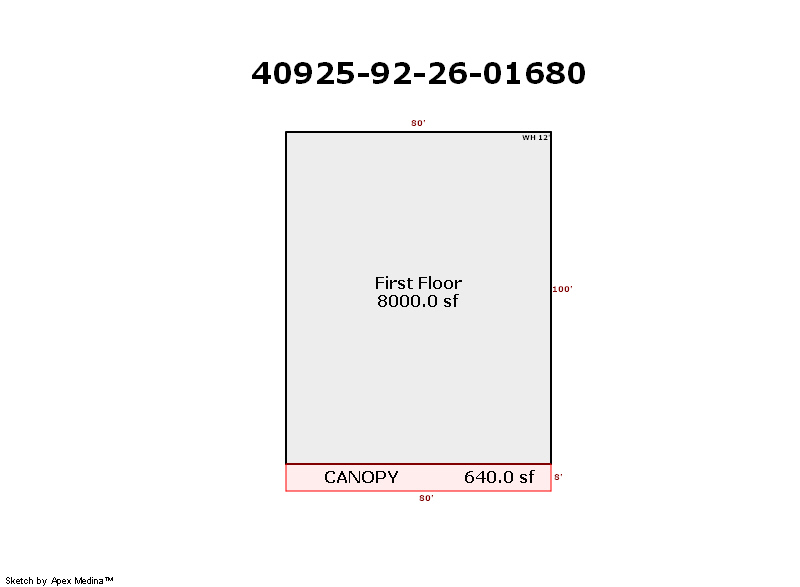

| Parcel ID | 40925-92-26-01680 |

| Land Area | 1.27 acres / 55,118 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: SUBURBAN HIGHLANDS (40925) Legal: PRT LTS 3 & 4 BLK 5 & PRT LT 3 BLK 6 & VAC SANTA FE AVE BEG NEC LT 3 BLK 6 TH S180.17 SW89.20 W185 N238.25 W414.90 WL LT 3 BLK 5 N12 NWC BLK 5 E655 POB LESS W10 FOR ST & LESS PRT LT 3 BEG 62.57S NEC LT 3 TH S117.60 SW86.25 W51.97 NE213.45 POB BLK 6 Section: 26 Township: 19 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1998 | Commercial | 8,000 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1998 | Commercial | 8,000 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1998 | Commercial | 8,000 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $458,100 | $450,200 | $450,200 |

| Total Taxable Value (Capped) | $458,100 | $450,200 | $450,200 |

| Improvement Value | $395,100 | $395,100 | $395,100 |

| Land Value | $63,000 | $55,100 | $55,100 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $50,391 | $49,522 | $49,522 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $50,391 | $49,522 | $49,522 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $6,395 | $6,414 | $6,414 |

| Last Notice Date | 2/2/2021 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/7/2013 | WAREHOUSE MARKET INC | ASPEN SQUARE INC | $0 | Corrected General Warranty Deed | 2013006847 |

| 1/8/1998 | WAREHOUSE MARKET INC CLIN | ASPEN SQUARE INC R C ROB | $110,000 | History | 2000106847 BK-06004PG-01445 |

Sales/Documents

| Sale Date | 1/7/2013 |

|---|---|

| Grantor | WAREHOUSE MARKET INC |

| Grantee | ASPEN SQUARE INC |

| Sale Price | $0 |

| Deed Type | Corrected General Warranty Deed |

| Document Number | 2013006847 |

| Sale Date | 1/8/1998 |

| Grantor | WAREHOUSE MARKET INC CLIN |

| Grantee | ASPEN SQUARE INC R C ROB |

| Sale Price | $110,000 |

| Deed Type | History |

| Document Number | 2000106847 BK-06004PG-01445 |