Exempt

This property is Exempt Commercial

R43305931415440

6566 E 21 PL S TULSA 74129

$8,079,076

$0

General Information

| Situs Address | 6566 E 21 PL S TULSA 74129 |

|---|---|

| Owner Name |

TULSA PYTHIAN MANOR INC

|

| Owner Mailing Address | C/O PYTHIAN MANOR WEST 1700 RIVERSIDE DR TULSA, OK 741194667 |

| Account Type | Exempt Com |

| Parcel ID | 43305-93-14-15440 |

| Land Area | 5.42 acres / 236,086 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: TULSA PYTHIAN MANOR (43305) Legal: LT 1 BLK 1 Section: 14 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

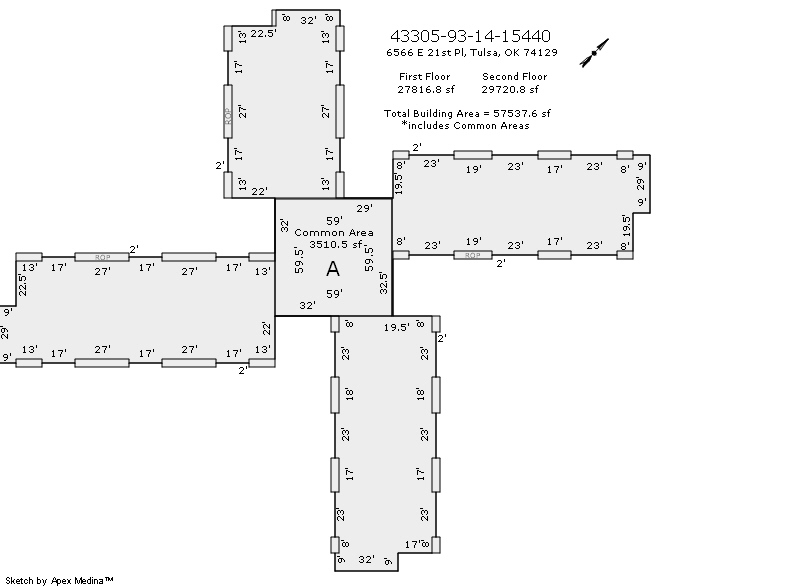

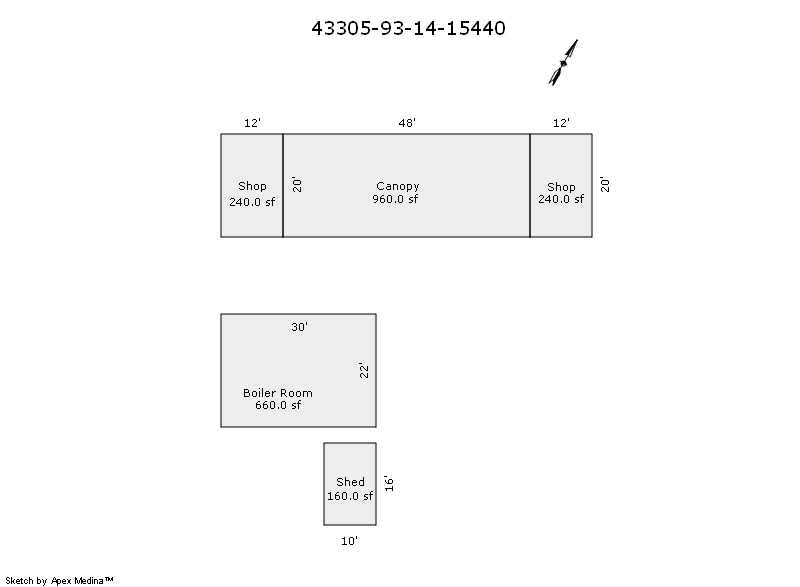

| 2025 | 1972 | Multiple Unit | 57,538 sqft | 2.00 | 8 | 96.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

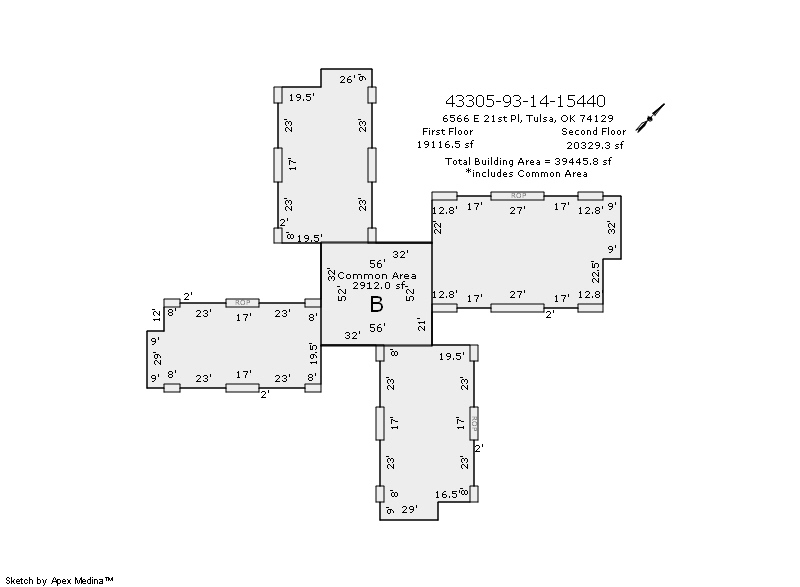

| 2025 | 1972 | Multiple Unit | 39,445 sqft | 2.00 | 8 | 54.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1972 | Multiple Unit | 57,538 sqft | 2.00 | 8 | 96.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

| 2024 | 1972 | Multiple Unit | 39,445 sqft | 2.00 | 8 | 54.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1972 | Multiple Unit | 57,538 sqft | 2.00 | 8 | 96.00 | Composition Shingle |

| 1.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

| 2023 | 1972 | Multiple Unit | 39,445 sqft | 2.00 | 8 | 54.00 | Composition Shingle |

| 2.00 | Apartment <= 3 Stories | Slab | Frame Plywood | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $8,079,100 | $8,079,100 | $8,079,076 |

| Total Taxable Value (Capped) | $3,109,333 | $3,264,800 | $3,428,040 |

| Improvement Value | $7,370,800 | $7,370,800 | $0 |

| Land Value | $708,300 | $708,300 | $0 |

| Assessment Ratio | 11% | 11% | 0% |

| Gross Assessed Value | $342,027 | $359,128 | $0 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $342,027 | $359,128 | $0 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $43,407 | $46,511 | $0 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |