General Information

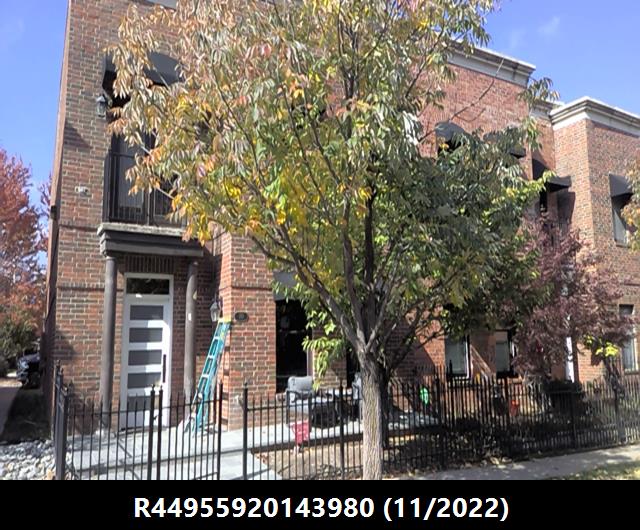

| Situs Address | 710 S OWASSO AV E TULSA 74120 |

|---|---|

| Owner Name |

WILNER, PHILLIP JAMES REV TRUST & JANICE LEE REV TRUST

|

| Owner Mailing Address | 710 S OWASSO AVE TULSA , OK 741204420 |

| Account Type | Residential |

| Parcel ID | 44955-92-01-43980 |

| Land Area | 0.05 acres / 1,963 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: VILLAGE AT CENTRAL PARK, THE (44955) Legal: LT 33 BLK 1 Section: 01 Township: 19 Range: 12 |

| Zoning | See zoning data at INCOG's website for more information. |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

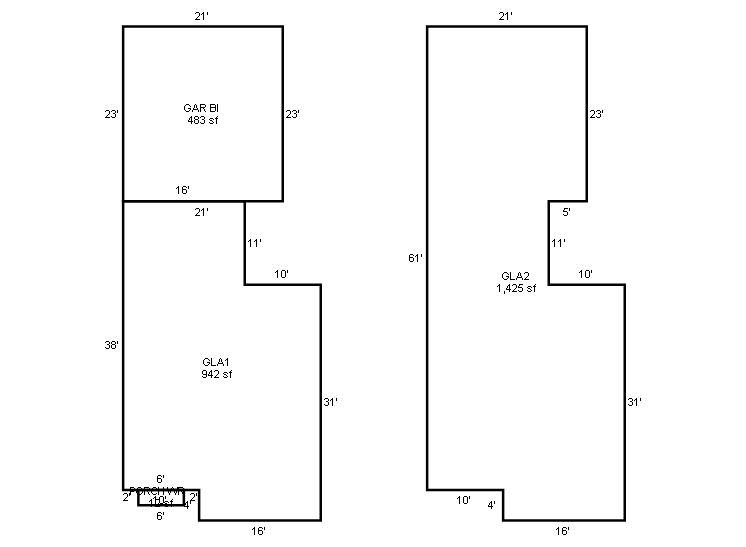

| 2024 | 2001 | Residential | 2,367 sqft | 2.00 | 8 | 2.10 | Built Up Rock |

| 1.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2001 | Residential | 2,367 sqft | 2.00 | 8 | 2.10 | Built Up Rock |

| 1.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 2001 | Residential | 2,367 sqft | 2.00 | 8 | 2.10 | Built Up Rock |

| 1.00 | 2 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $461,500 | $461,500 | $423,816 |

| Total Taxable Value (Capped) | $461,500 | $461,500 | $423,816 |

| Improvement Value | $382,600 | $382,600 | $344,916 |

| Land Value | $78,900 | $78,900 | $78,900 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $50,765 | $50,765 | $46,620 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $50,765 | $50,765 | $46,620 |

| School District | T-1A | ||

| Tax Rate | 133.32 | 126.91 | 126.91 |

| Estimated taxes | $6,768 | $6,443 | $5,917 |

| Last Notice Date | 2/2/2022 | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/27/2022 | WILNER, PHILLIP JAMES REV TRUST & JANICE LEE REV TRUST | WILNER, PHILLIP JAMES REV TRUST & JANICE LEE REV TRUST | $0 | General Warranty Deed | 2022015529 |

| 8/24/2021 | DEMIER, GEORGE S & SHERON L TTEE, DEMIER FAMILY TR | WILNER, PHILLIP JAMES REV TRUST & JANICE, LEE REV TRUST | $461,500 | General Warranty Deed | 2021101895 |

| 11/4/2011 | ABALU, ADIEL OKHIAOFE | DEMIER, GEORGE S & SHERON L TTEE DEMIER FAMILY TR | $310,000 | General Warranty Deed | 2011103605 |

| 4/10/2010 | SANDLER, DAVID | ABALU, ADIEL OKHIAOFE | $0 | Quit Claim Deed | 2010068596 |

| 7/1/2003 | $262,500 | General Warranty Deed | 2000121183 BK-07058PG-01109 |

Sales/Documents

| Sale Date | 1/27/2022 |

|---|---|

| Grantor | WILNER, PHILLIP JAMES REV TRUST & JANICE LEE REV TRUST |

| Grantee | WILNER, PHILLIP JAMES REV TRUST & JANICE LEE REV TRUST |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2022015529 |

| Sale Date | 8/24/2021 |

| Grantor | DEMIER, GEORGE S & SHERON L TTEE, DEMIER FAMILY TR |

| Grantee | WILNER, PHILLIP JAMES REV TRUST & JANICE, LEE REV TRUST |

| Sale Price | $461,500 |

| Deed Type | General Warranty Deed |

| Document Number | 2021101895 |

| Sale Date | 11/4/2011 |

| Grantor | ABALU, ADIEL OKHIAOFE |

| Grantee | DEMIER, GEORGE S & SHERON L TTEE DEMIER FAMILY TR |

| Sale Price | $310,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2011103605 |

| Sale Date | 4/10/2010 |

| Grantor | SANDLER, DAVID |

| Grantee | ABALU, ADIEL OKHIAOFE |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2010068596 |

| Sale Date | 7/1/2003 |

| Grantor | |

| Grantee | |

| Sale Price | $262,500 |

| Deed Type | General Warranty Deed |

| Document Number | 2000121183 BK-07058PG-01109 |