General Information

| Situs Address | 1502 N 105 AV E TULSA 74116 |

|---|---|

| Owner Name |

M M O LLC AND BEAVERDALE INVESTMENTS LLC

|

| Owner Mailing Address | 111 S ELGIN AVE TULSA , OK 741201816 |

| Account Type | Commercial |

| Parcel ID | 47745-04-30-42850 |

| Land Area | 5.50 acres / 239,423 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: WOLF POINT INDUSTRIAL PKWY WEST (47745) Legal: LT 2 & PRT LT 3 BEG SECR LT 2 TH W680.91 N184.18 CRV RT 228.78 SE691.30 SW18.53 CRV LF 83.93 S25 SW80 S79.72 POB BLK 1 Section: 30 Township: 20 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

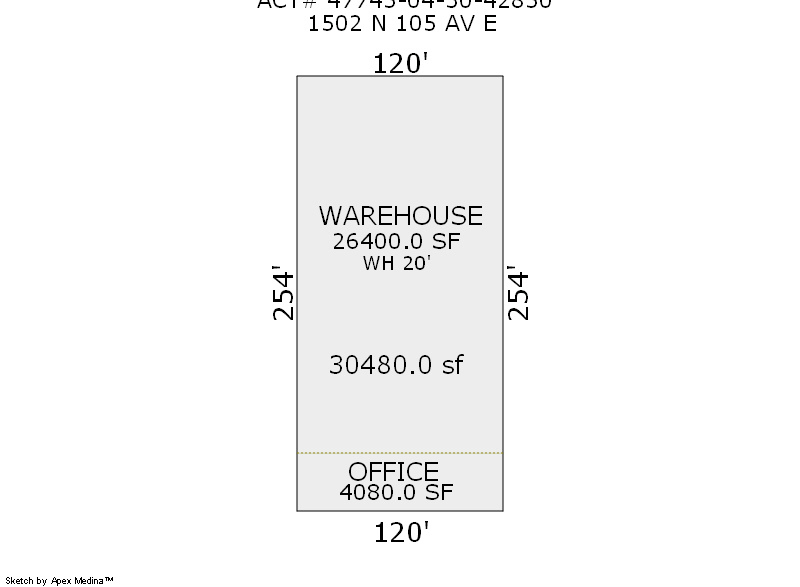

| 2025 | 1984 | Commercial | 30,480 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1984 | Commercial | 30,480 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Space Heater | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1984 | Commercial | 30,480 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Indust Lght Manufacturing | Space Heater | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $1,344,600 | $1,344,600 | $1,344,600 |

| Total Taxable Value (Capped) | $1,169,973 | $1,228,472 | $1,289,895 |

| Improvement Value | $865,800 | $865,800 | $865,800 |

| Land Value | $478,800 | $478,800 | $478,800 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $128,697 | $135,132 | $141,888 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $128,697 | $135,132 | $141,888 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $16,333 | $17,501 | $18,376 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/20/2007 | JNAG LLC | MMO LLC | $1,500,000 | Special Warranty Deed | 2007082271 |

| 12/29/2004 | $0 | Quit Claim Deed | 2005001510 |

Sales/Documents

| Sale Date | 7/20/2007 |

|---|---|

| Grantor | JNAG LLC |

| Grantee | MMO LLC |

| Sale Price | $1,500,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2007082271 |

| Sale Date | 12/29/2004 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2005001510 |