General Information

| Situs Address | 6009 S 75 AV E TULSA 741459333 |

|---|---|

| Owner Name |

ICE COMPANIES LLC

|

| Owner Mailing Address | 13417 S 68TH EAST AVE BIXBY , OK 740088265 |

| Account Type | Residential |

| Parcel ID | 49075-93-35-14320 |

| Land Area | 0.31 acres / 13,392 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: WOODLAND VIEW FIFTH ADDN (49075) Legal: LT 5 BLK 9 Section: 35 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

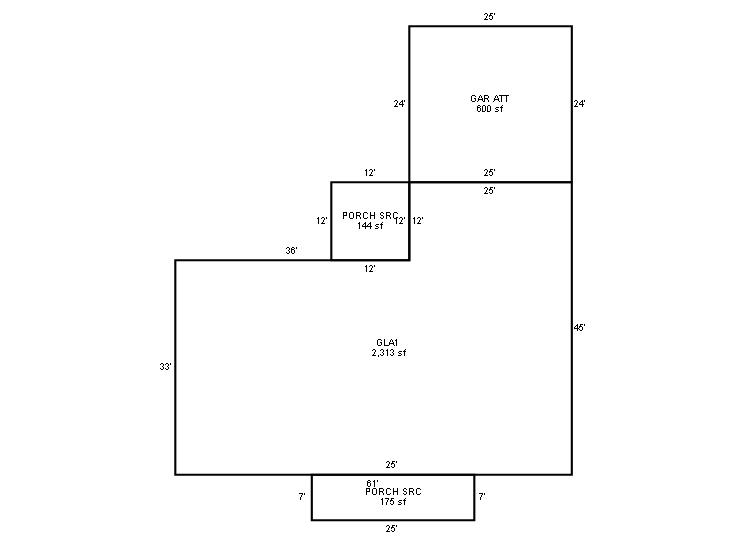

| 2025 | 1967 | Residential | 2,313 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1967 | Residential | 2,313 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1967 | Residential | 2,313 sqft | 1.00 | 8 | 3.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $263,607 | $244,537 | $282,600 |

| Total Taxable Value (Capped) | $138,915 | $145,861 | $153,154 |

| Improvement Value | $231,391 | $212,321 | $250,384 |

| Land Value | $32,216 | $32,216 | $32,216 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $15,280 | $16,045 | $16,846 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $15,280 | $16,045 | $16,846 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $1,939 | $2,078 | $2,182 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/6/2018 | SMITH, CECIL WAYNE | ICE COMPANIES LLC | $120,000 | Warranty Deed | 2018080852 |

| 9/6/2018 | SMITH, CECIL WAYNE AND, WILMA JEAN | SMITH, CECIL WAYNE | $0 | Affidavit Of Surviving Joint Tenant | 2018080851 |

| 1/4/1985 | $0 | General Warranty Deed | 2000130398 BK-04837PG-02620 | ||

| 1/1/1985 | $87,000 | History | 2000130397 |

Sales/Documents

| Sale Date | 9/6/2018 |

|---|---|

| Grantor | SMITH, CECIL WAYNE |

| Grantee | ICE COMPANIES LLC |

| Sale Price | $120,000 |

| Deed Type | Warranty Deed |

| Document Number | 2018080852 |

| Sale Date | 9/6/2018 |

| Grantor | SMITH, CECIL WAYNE AND, WILMA JEAN |

| Grantee | SMITH, CECIL WAYNE |

| Sale Price | $0 |

| Deed Type | Affidavit Of Surviving Joint Tenant |

| Document Number | 2018080851 |

| Sale Date | 1/4/1985 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000130398 BK-04837PG-02620 |

| Sale Date | 1/1/1985 |

| Grantor | |

| Grantee | |

| Sale Price | $87,000 |

| Deed Type | History |

| Document Number | 2000130397 |