General Information

| Situs Address | 1916 S YORKTOWN AV E TULSA 74104 |

|---|---|

| Owner Name |

KBH PROPERTIES LLC

|

| Owner Mailing Address | 3407 E 33RD ST TULSA , OK 741354433 |

| Account Type | Residential |

| Parcel ID | 49275-93-07-22880 |

| Land Area | 0.18 acres / 7,750 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: WOODWARD PARK ADDN (49275) Legal: LT 10 BLK 4 Section: 07 Township: 19 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

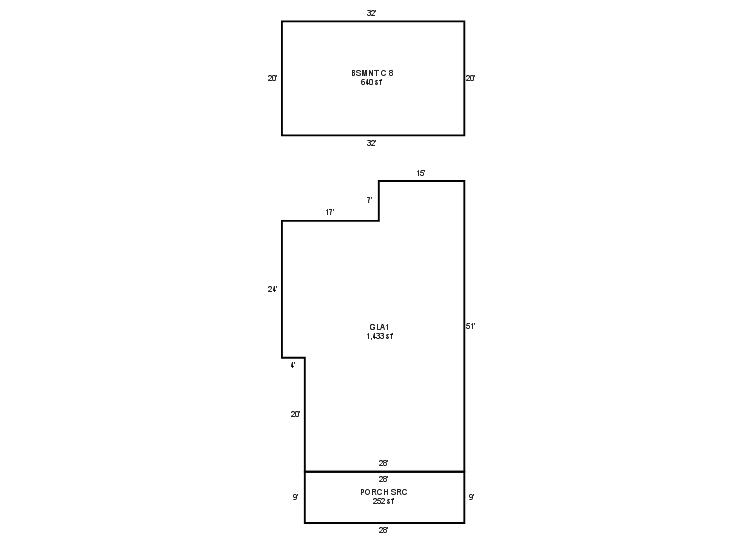

| 2025 | 1927 | Residential | 1,433 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Conventional | Frame Siding/Brick/Stone Veneer | None | |||

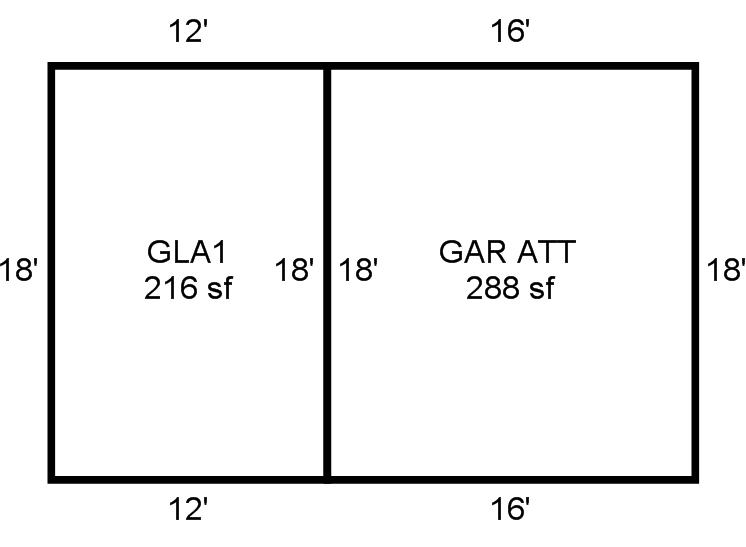

| 2025 | 1927 | Residential | 216 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1927 | Residential | 1,433 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Conventional | Frame Siding/Brick/Stone Veneer | None | |||

| 2024 | 1927 | Residential | 216 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1927 | Residential | 1,433 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Conventional | Frame Siding/Brick/Stone Veneer | None | |||

| 2023 | 1927 | Residential | 216 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $263,200 | $226,988 | $270,900 |

| Total Taxable Value (Capped) | $259,087 | $226,988 | $238,337 |

| Improvement Value | $207,536 | $171,324 | $215,236 |

| Land Value | $55,664 | $55,664 | $55,664 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $28,499 | $24,969 | $26,217 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $28,499 | $24,969 | $26,217 |

| School District | T-1A | ||

| Tax Rate | 126.91 | 129.51 | 129.51 |

| Estimated taxes | $3,617 | $3,234 | $3,395 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/11/2016 | BODENHAMER, KATRINA S | KBH PROPERTIES LLC | $235,000 | Warranty Deed | 2016046212 |

| 11/9/2011 | ALLEN, ANNA GRACE & SERENA STAIRES, C/O KATRINA BODENHAMER | ALLEN, ANNA GRACE & KATRINA S BODENHAMER | $76,000 | General Warranty Deed | 2016005831 |

| 5/17/2011 | ALLEN, ANNA GRACE AND TYNE B | ALLEN, ANNA GRACE & SERENA STAIRES | $0 | Quit Claim Deed | 2011055867 |

| 4/11/2009 | ALLEN, ANNA GRACE EST C/O SERENA STAIRES PR | ALLEN, TYNE BURDETTE EST | $0 | Personal Representative's Deed | 2016021566 |

| 11/23/1982 | $0 | Decree Of Distribution | 2000131012 BK-04652PG-00033 |

Sales/Documents

| Sale Date | 5/11/2016 |

|---|---|

| Grantor | BODENHAMER, KATRINA S |

| Grantee | KBH PROPERTIES LLC |

| Sale Price | $235,000 |

| Deed Type | Warranty Deed |

| Document Number | 2016046212 |

| Sale Date | 11/9/2011 |

| Grantor | ALLEN, ANNA GRACE & SERENA STAIRES, C/O KATRINA BODENHAMER |

| Grantee | ALLEN, ANNA GRACE & KATRINA S BODENHAMER |

| Sale Price | $76,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016005831 |

| Sale Date | 5/17/2011 |

| Grantor | ALLEN, ANNA GRACE AND TYNE B |

| Grantee | ALLEN, ANNA GRACE & SERENA STAIRES |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2011055867 |

| Sale Date | 4/11/2009 |

| Grantor | ALLEN, ANNA GRACE EST C/O SERENA STAIRES PR |

| Grantee | ALLEN, TYNE BURDETTE EST |

| Sale Price | $0 |

| Deed Type | Personal Representative's Deed |

| Document Number | 2016021566 |

| Sale Date | 11/23/1982 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Decree Of Distribution |

| Document Number | 2000131012 BK-04652PG-00033 |