Exempt

This property is Exempt

R52410041851150

4002 MINGO VALLEY TULSA 74116

$5,286

$555

General Information

| Situs Address | 4002 MINGO VALLEY TULSA 74116 |

|---|---|

| Owner Name |

STATE OF OKLAHOMA DEPT OF HWYS R/W DIV

|

| Owner Mailing Address | 200 NE 21ST ST OKLAHOMA CITY , OK 731053204 |

| Account Type | Exempt |

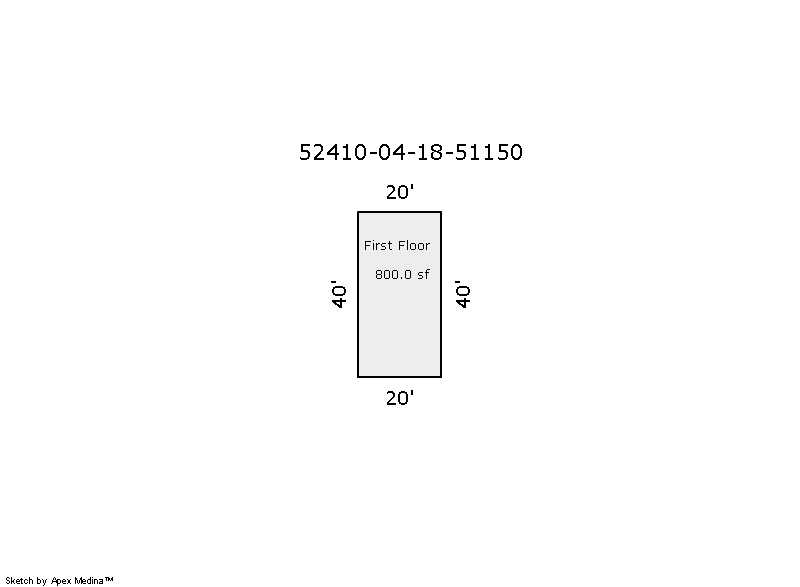

| Parcel ID | 52410-04-18-51150 |

| Land Area | 72.42 acres / 3,154,773 sq ft |

| School District | T-1A |

| Legal Description | Subdivision: OKLAHOMA HIGHWAY DEPT ADDN (52410) Legal: LOT 1 BLK 1 Section: 18 Township: 20 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

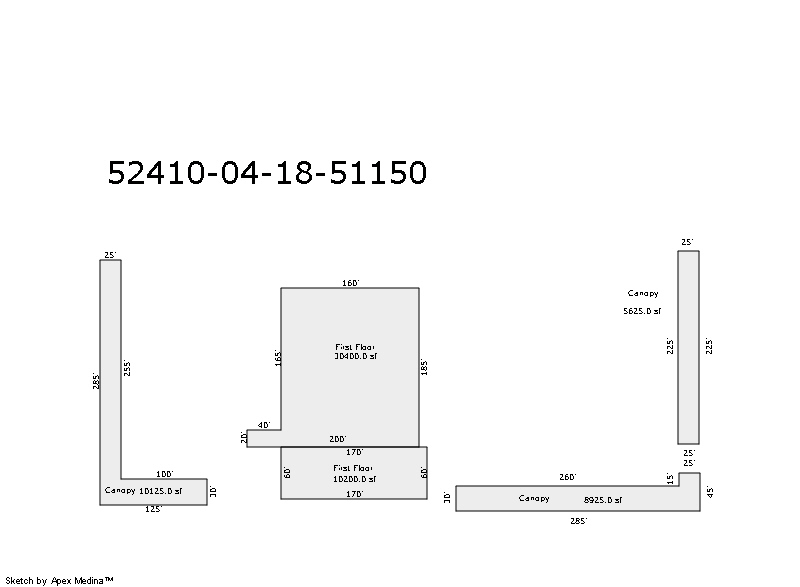

| 2024 | 1970 | Commercial | 30,400 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Garage | None | |||||

| 2024 | 1970 | Commercial | 10,200 sqft | 2.00 | 10 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

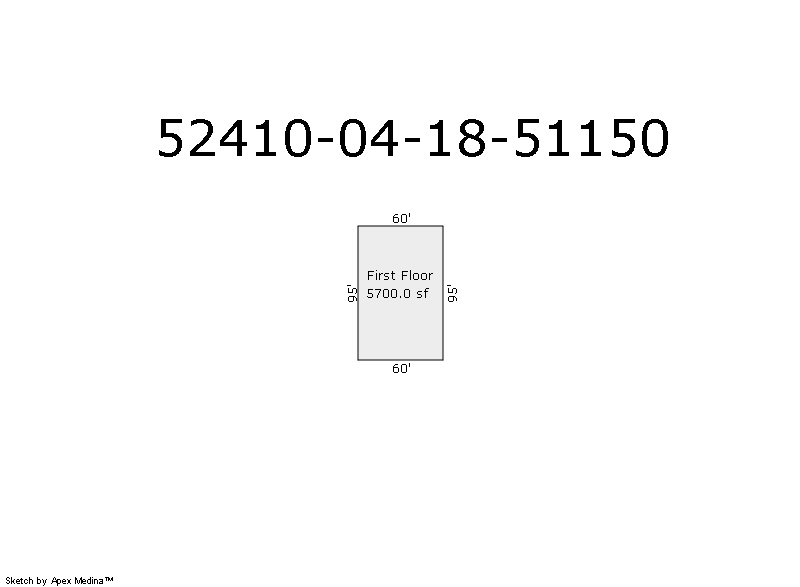

| 2024 | 2007 | Commercial | 5,700 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

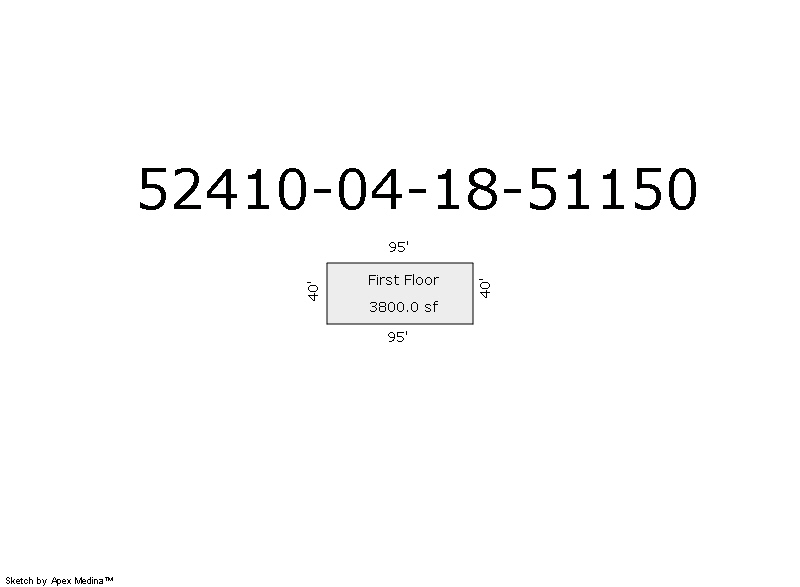

| 2024 | 2001 | Commercial | 3,800 sqft | 1.00 | 15 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

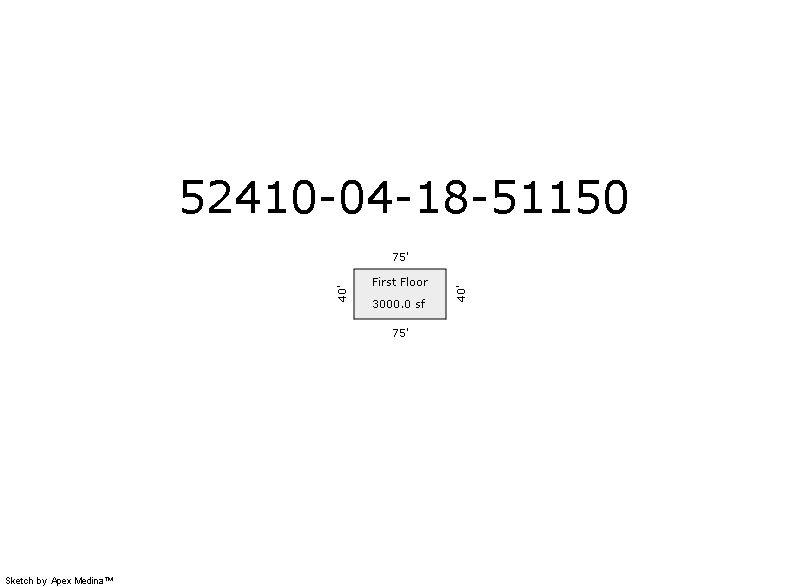

| 2024 | 1970 | Commercial | 3,000 sqft | 1.00 | 15 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

| 2024 | 1970 | Commercial | 800 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Storage Garage | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1970 | Commercial | 30,400 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Garage | None | |||||

| 2023 | 1970 | Commercial | 10,200 sqft | 2.00 | 10 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2023 | 2007 | Commercial | 5,700 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

| 2023 | 2001 | Commercial | 3,800 sqft | 1.00 | 15 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

| 2023 | 1970 | Commercial | 3,000 sqft | 1.00 | 15 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

| 2023 | 1970 | Commercial | 800 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Storage Garage | None | |||||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 1970 | Commercial | 10,200 sqft | 2.00 | 10 | 0.00 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2022 | 1970 | Commercial | 30,400 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Storage Garage | None | |||||

| 2022 | 2007 | Commercial | 5,700 sqft | 1.00 | 15 | 0.00 | |

| 2.00 | Storage Garage | None | |||||

| 2022 | 2001 | Commercial | 3,800 sqft | 1.00 | 15 | 0.00 | |

| 3.00 | Storage Garage | None | |||||

| 2022 | 1970 | Commercial | 3,000 sqft | 1.00 | 15 | 0.00 | |

| 4.00 | Storage Garage | None | |||||

| 2022 | 1970 | Commercial | 800 sqft | 1.00 | 8 | 0.00 | |

| 5.00 | Storage Garage | None | |||||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $5,285 | $5,286 | $5,286 |

| Total Taxable Value (Capped) | $5,285 | $5,286 | $5,044 |

| Improvement Value | $0 | $0 | $0 |

| Land Value | $5,285 | $5,286 | $5,286 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $581 | $581 | $555 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $581 | $581 | $555 |

| School District | T-1A | ||

| Tax Rate | 133.32 | 126.91 | 129.51 |

| Estimated taxes | $77 | $74 | $72 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |