General Information

| Situs Address | 14235 S 50 AV E BIXBY 740083758 |

|---|---|

| Owner Name |

HENSHAW, STEVEN AND SHANNON D

|

| Owner Mailing Address | 4181 OAK RD TULSA , OK 741054219 |

| Account Type | Residential |

| Parcel ID | 57628-73-15-23550 |

| Land Area | 0.39 acres / 17,197 sq ft |

| School District | BI-4A |

| Legal Description | Subdivision: CELEBRITY COUNTRY RESUB B2 SITRIN CENTER (57628) Legal: LT 14 & PRT RES A BEG SECR LT 1 BLK 8 TH NE129.52 SE29.77 SW123.71 NW CRV LF 29.77 POB BLK 7 Section: 15 Township: 17 Range: 13 |

| Zoning | View INCOG's Zoning Data |

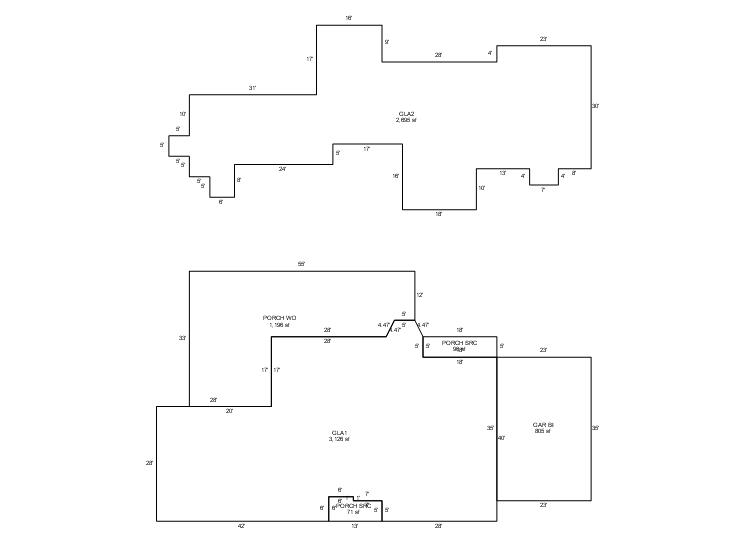

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1995 | Residential | 7,389 sqft | 1.50 | 8 | 4.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1995 | Residential | 7,389 sqft | 1.50 | 8 | 4.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1995 | Residential | 7,389 sqft | 1.50 | 8 | 4.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Conventional | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $609,830 | $733,824 | $732,100 |

| Total Taxable Value (Capped) | $609,830 | $640,322 | $672,338 |

| Improvement Value | $559,005 | $682,999 | $681,275 |

| Land Value | $50,825 | $50,825 | $50,825 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $67,082 | $70,435 | $73,957 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $67,082 | $70,435 | $73,957 |

| School District | BI-4A | ||

| Tax Rate | 139.90 | 134.70 | 134.70 |

| Estimated taxes | $9,385 | $9,488 | $9,962 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/23/2020 | HENSHAW, STEVEN AND SHANNON D REV LIVING TRUST | HENSHAW, STEVEN AND SHANNON D | $0 | Trustee's Deed | 2020059977 |

| 3/31/2005 | HENSHAW, STEVEN AND SHANNON D | HENSHAW, STEVEN AND SHANNON D REV LIVING TRUST | $0 | Quit Claim Deed | 2005044232 |

| 12/1/1993 | $37,000 | General Warranty Deed | 2000147255 BK-05579PG-01650 |

Sales/Documents

| Sale Date | 6/23/2020 |

|---|---|

| Grantor | HENSHAW, STEVEN AND SHANNON D REV LIVING TRUST |

| Grantee | HENSHAW, STEVEN AND SHANNON D |

| Sale Price | $0 |

| Deed Type | Trustee's Deed |

| Document Number | 2020059977 |

| Sale Date | 3/31/2005 |

| Grantor | HENSHAW, STEVEN AND SHANNON D |

| Grantee | HENSHAW, STEVEN AND SHANNON D REV LIVING TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2005044232 |

| Sale Date | 12/1/1993 |

| Grantor | |

| Grantee | |

| Sale Price | $37,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2000147255 BK-05579PG-01650 |