General Information

| Situs Address | 8516 E 101 ST S TULSA 74133 |

|---|---|

| Owner Name |

PARK PLACE HOLDINGS LLC

|

| Owner Mailing Address | 1936 E 35TH ST TULSA , OK 741052704 |

| Account Type | Commercial |

| Parcel ID | 58365-83-25-48420 |

| Land Area | 3.04 acres / 132,295 sq ft |

| School District | BI-5A |

| Legal Description | Subdivision: STERLING HOUSE (58365) Legal: LT 1 BLK 1 Section: 25 Township: 18 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

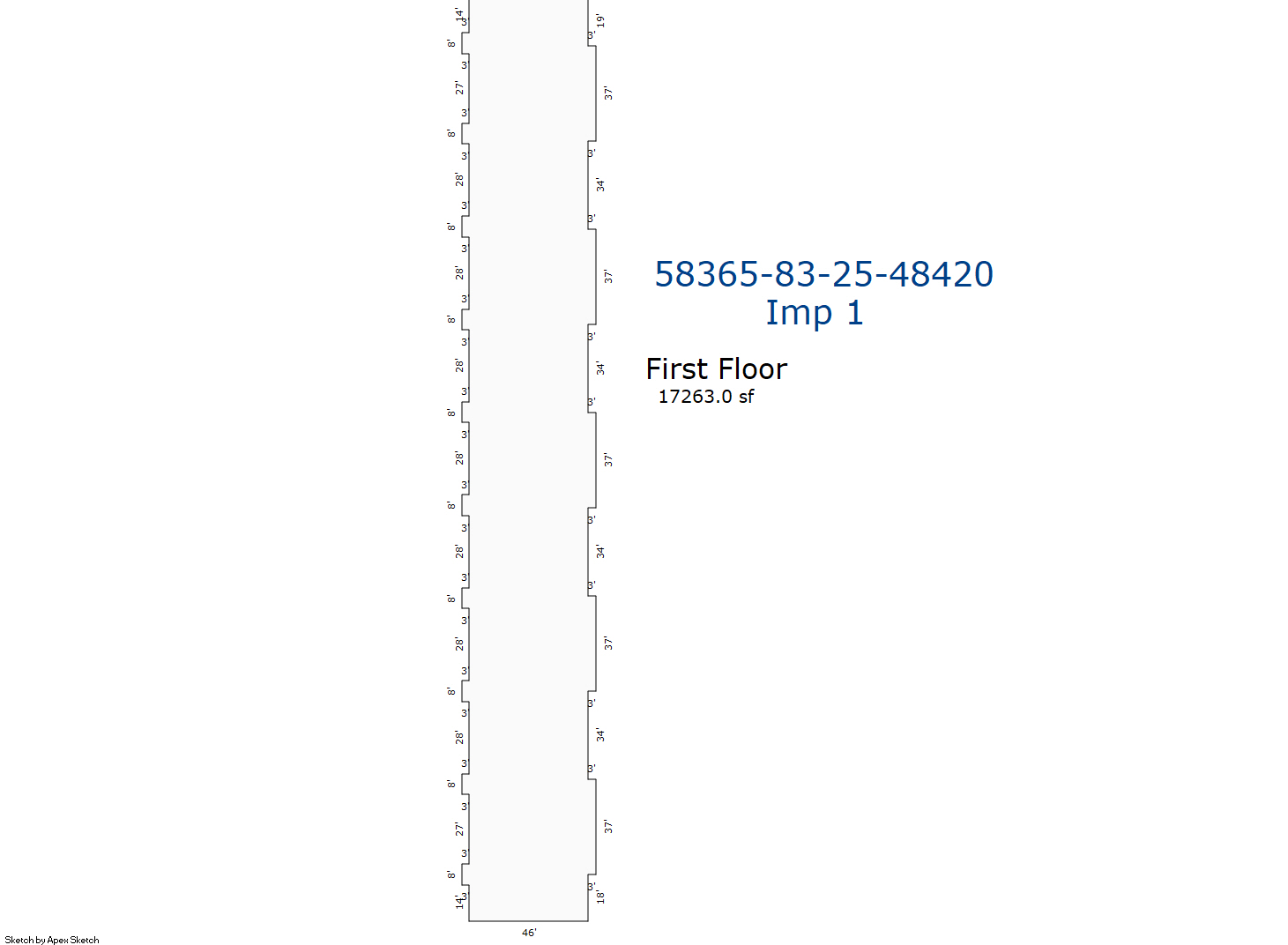

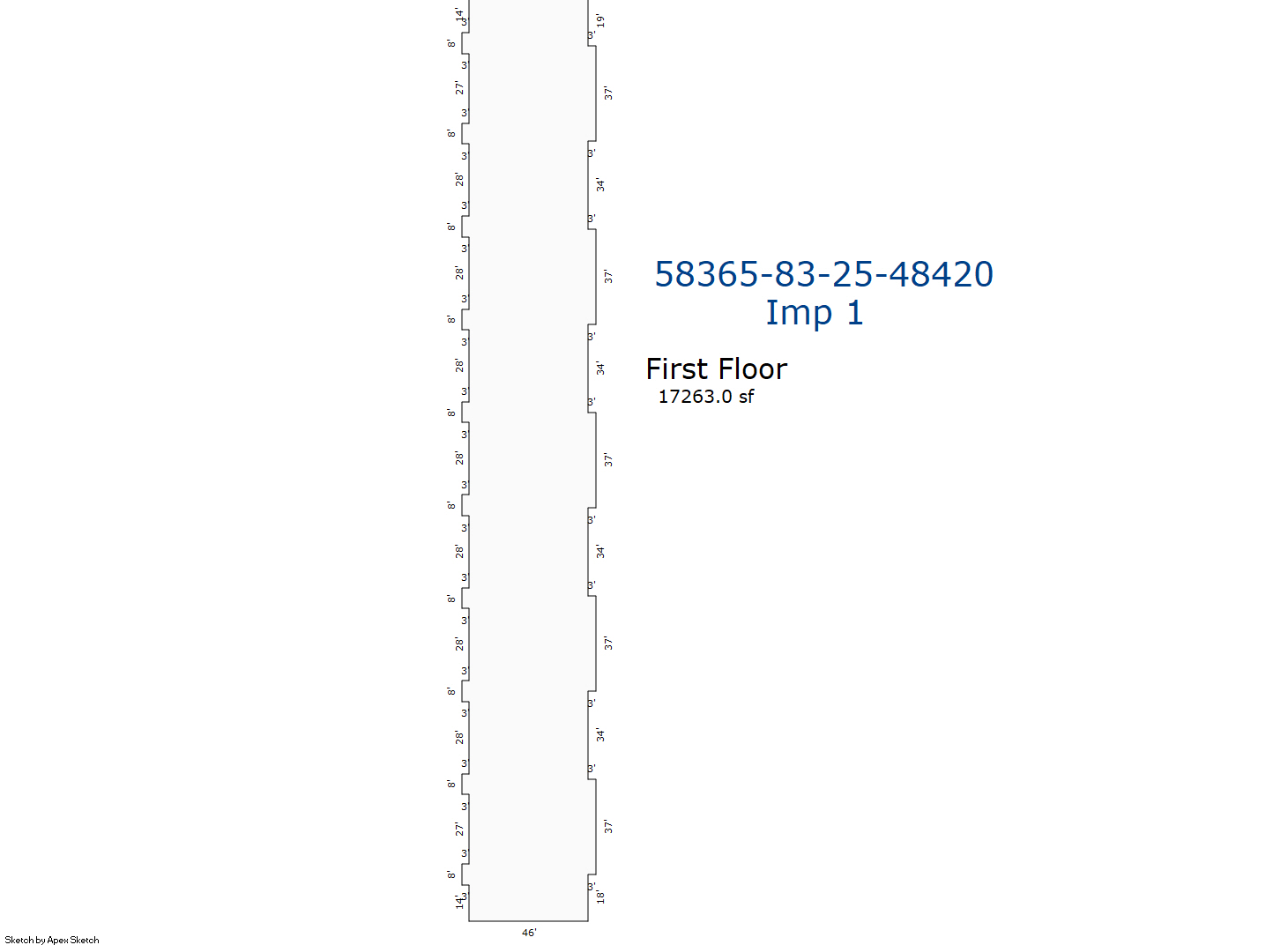

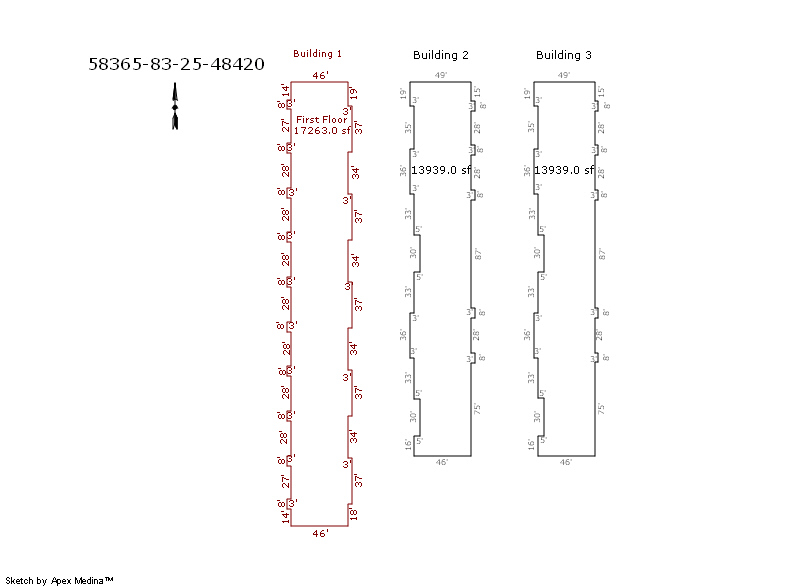

| 2025 | 2003 | Commercial | 17,263 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

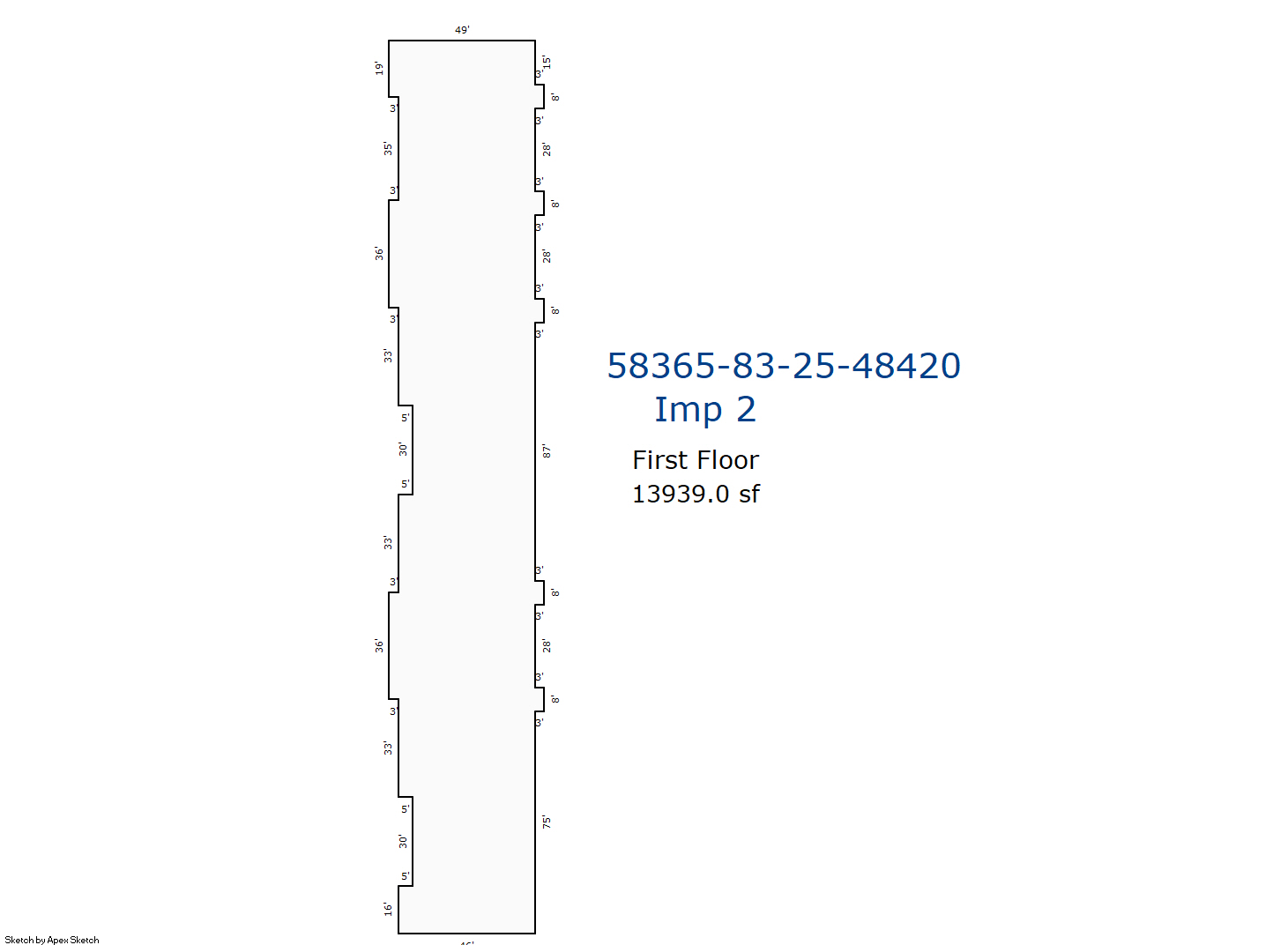

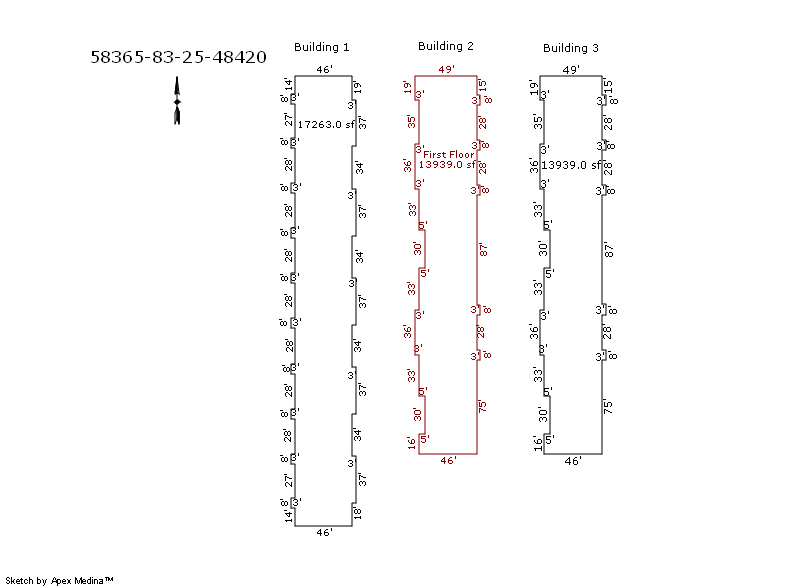

| 2025 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Package Unit | |||||

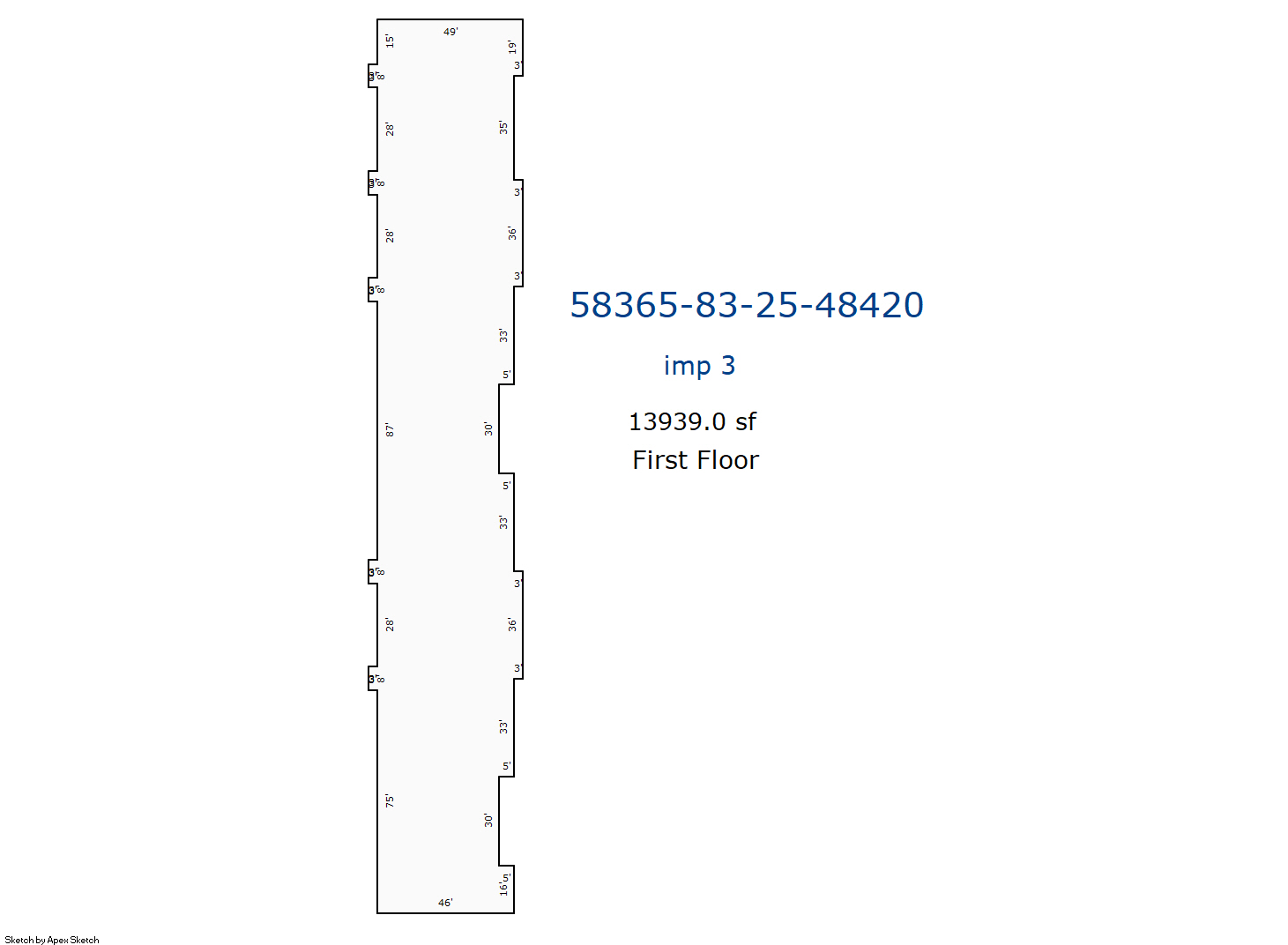

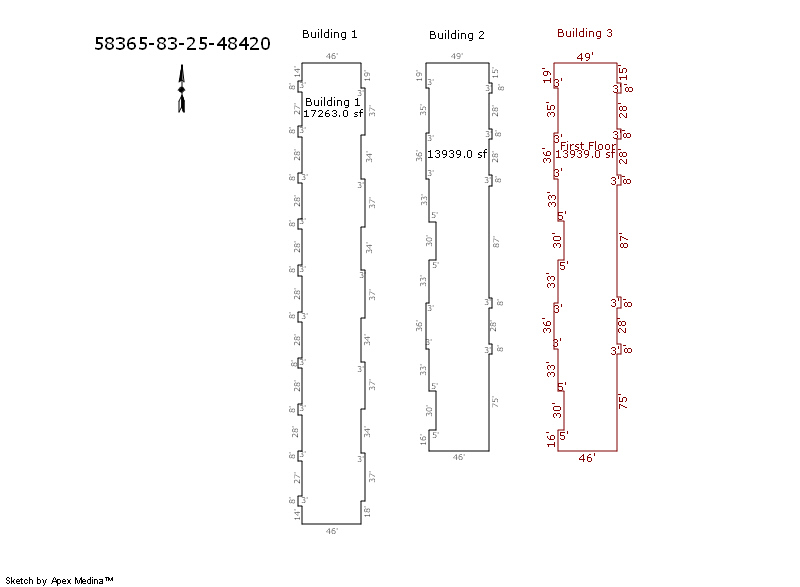

| 2025 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2003 | Commercial | 17,263 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2024 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Package Unit | |||||

| 2024 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2003 | Commercial | 17,263 sqft | 1.00 | 10 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

| 2023 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 2.00 | Office Building | Package Unit | |||||

| 2023 | 2003 | Commercial | 13,939 sqft | 1.00 | 10 | 0.00 | |

| 3.00 | Office Building | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $5,400,000 | $5,452,500 | $5,369,400 |

| Total Taxable Value (Capped) | $5,400,000 | $5,452,500 | $5,369,400 |

| Improvement Value | $4,606,200 | $4,658,700 | $4,575,600 |

| Land Value | $793,800 | $793,800 | $793,800 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $594,000 | $599,775 | $590,634 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $594,000 | $599,775 | $590,634 |

| School District | BI-5A | ||

| Tax Rate | 139.67 | 139.16 | 139.16 |

| Estimated taxes | $82,964 | $83,465 | $82,193 |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/31/2018 | PARK PLACE OFFICE SUITES LLC | PARK PLACE HOLDINGS LLC | $5,300,000 | Special Warranty Deed | 2018069777 |

| 7/1/2008 | HOME VENTURES INC | PARK PLACE OFFICE SUITES LLC | $0 | Special Warranty Deed | 2008069438 |

| 7/29/2002 | ALTERRA HEALTHCARE CORP | HOME VENTURES INC | $650,000 | Special Warranty Deed | 2000155205 BK-06799PG-01858 |

| 8/16/1999 | SIEGFRIED COMPANIES INC | ALS-CLARE BRIDGE, INC | $670,500 | Warranty Deed | 1999996505 |

Sales/Documents

| Sale Date | 7/31/2018 |

|---|---|

| Grantor | PARK PLACE OFFICE SUITES LLC |

| Grantee | PARK PLACE HOLDINGS LLC |

| Sale Price | $5,300,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2018069777 |

| Sale Date | 7/1/2008 |

| Grantor | HOME VENTURES INC |

| Grantee | PARK PLACE OFFICE SUITES LLC |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2008069438 |

| Sale Date | 7/29/2002 |

| Grantor | ALTERRA HEALTHCARE CORP |

| Grantee | HOME VENTURES INC |

| Sale Price | $650,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2000155205 BK-06799PG-01858 |

| Sale Date | 8/16/1999 |

| Grantor | SIEGFRIED COMPANIES INC |

| Grantee | ALS-CLARE BRIDGE, INC |

| Sale Price | $670,500 |

| Deed Type | Warranty Deed |

| Document Number | 1999996505 |