General Information

| Situs Address | 10517 S 86 PL E TULSA 74133 |

|---|---|

| Owner Name |

HSUEH, YU J & KELLY KATHLEEN AGNEW

|

| Owner Mailing Address | 10517 S 86TH EAST PL TULSA , OK 741337085 |

| Account Type | Residential |

| Parcel ID | 58370-83-25-65370 |

| Land Area | 0.19 acres / 8,330 sq ft |

| School District | BI-5A |

| Legal Description | Subdivision: VILLAGE AT LEGACY, THE (58370) Legal: LT 40 BLK 1 Section: 25 Township: 18 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

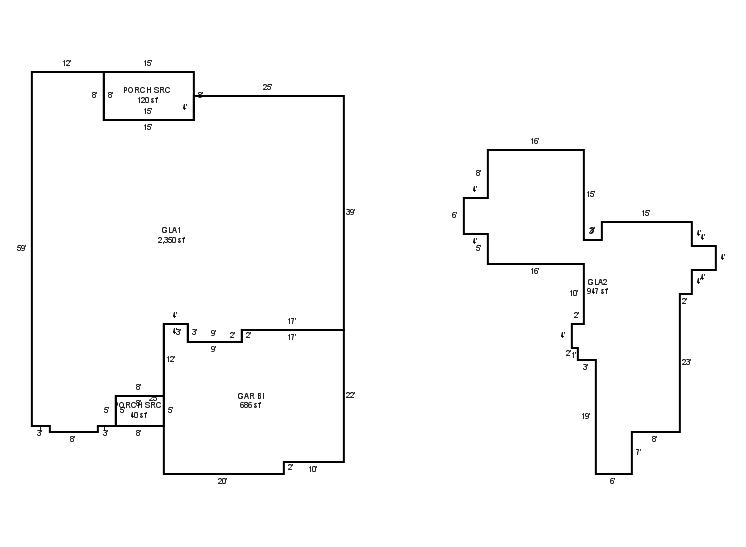

| 2025 | 2005 | Residential | 3,297 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2005 | Residential | 3,297 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2005 | Residential | 3,297 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $450,322 | $458,405 | $483,900 |

| Total Taxable Value (Capped) | $365,274 | $376,232 | $405,219 |

| Improvement Value | $377,522 | $385,605 | $411,100 |

| Land Value | $72,800 | $72,800 | $72,800 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $40,181 | $41,386 | $44,574 |

| Exemptions | $0 | -$1,000 | -$1,000 |

| Net Assessed Value | $40,181 | $40,886 | $44,074 |

| School District | BI-5A | ||

| Tax Rate | 139.67 | 139.16 | 139.16 |

| Estimated taxes | $5,612 | $5,690 | $6,133 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | ||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/24/2025 | LANDRUM, JAMES MARK & KIMBERLY SUE REV TRUST | HSUEH, YU J & KELLY KATHLEEN AGNEW | $497,000 | Warranty Deed | 2025021298 |

| 9/6/2019 | CLARK, WILLIAM E AND AMY R TRUST | LANDRUM, JAMES MARK & KIMBERLY SUE, REV TRUST | $334,500 | Trustee's Deed | 2019083986 |

| 2/24/2006 | CLARK, WILLIAM EDWARD | CLARK, WILLIAM E, TRUST | $0 | Quit Claim Deed | 2006021207 |

| 9/1/2005 | CALCO PROPERTY, INC | CLARK, WILLIAM EDWARD | $309,500 | History | 2005111876 |

| 11/1/2004 | LEGACY PARK LLC | CALCO POPERTIES, INC | $0 | History | 2004132477 |

Sales/Documents

| Sale Date | 2/24/2025 |

|---|---|

| Grantor | LANDRUM, JAMES MARK & KIMBERLY SUE REV TRUST |

| Grantee | HSUEH, YU J & KELLY KATHLEEN AGNEW |

| Sale Price | $497,000 |

| Deed Type | Warranty Deed |

| Document Number | 2025021298 |

| Sale Date | 9/6/2019 |

| Grantor | CLARK, WILLIAM E AND AMY R TRUST |

| Grantee | LANDRUM, JAMES MARK & KIMBERLY SUE, REV TRUST |

| Sale Price | $334,500 |

| Deed Type | Trustee's Deed |

| Document Number | 2019083986 |

| Sale Date | 2/24/2006 |

| Grantor | CLARK, WILLIAM EDWARD |

| Grantee | CLARK, WILLIAM E, TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2006021207 |

| Sale Date | 9/1/2005 |

| Grantor | CALCO PROPERTY, INC |

| Grantee | CLARK, WILLIAM EDWARD |

| Sale Price | $309,500 |

| Deed Type | History |

| Document Number | 2005111876 |

| Sale Date | 11/1/2004 |

| Grantor | LEGACY PARK LLC |

| Grantee | CALCO POPERTIES, INC |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2004132477 |