General Information

| Situs Address | 18013 S 129TH AV E BIXBY 74008 |

|---|---|

| Owner Name |

ACREE, MATTHEW & STEPHANIE

|

| Owner Mailing Address | 18013 S 129TH EAST AVE BIXBY , OK 740086500 |

| Account Type | Residential |

| Parcel ID | 58400-74-33-48470 |

| Land Area | 3.28 acres / 142,703 sq ft |

| School District | BI-4A |

| Legal Description | Subdivision: HICKORY CREEK ESTATES (58400) Legal: LT 5 LESS E100 THEREOF BLK 1 Section: 33 Township: 17 Range: 14 |

| Zoning | View INCOG's Zoning Data |

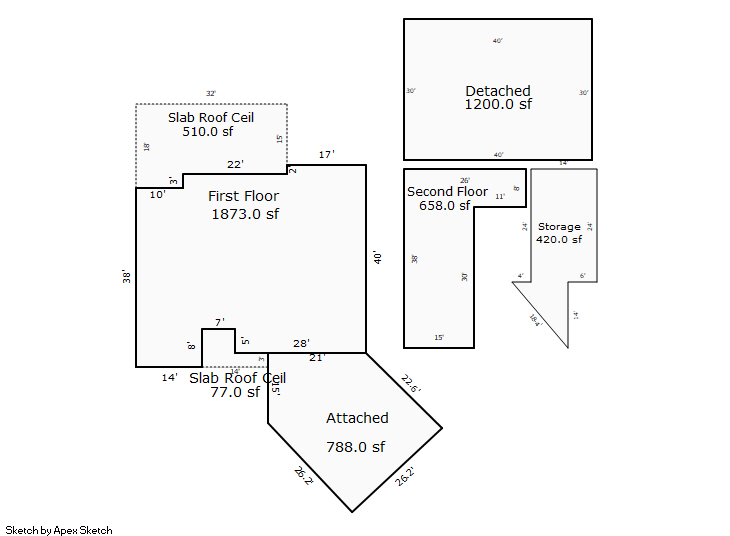

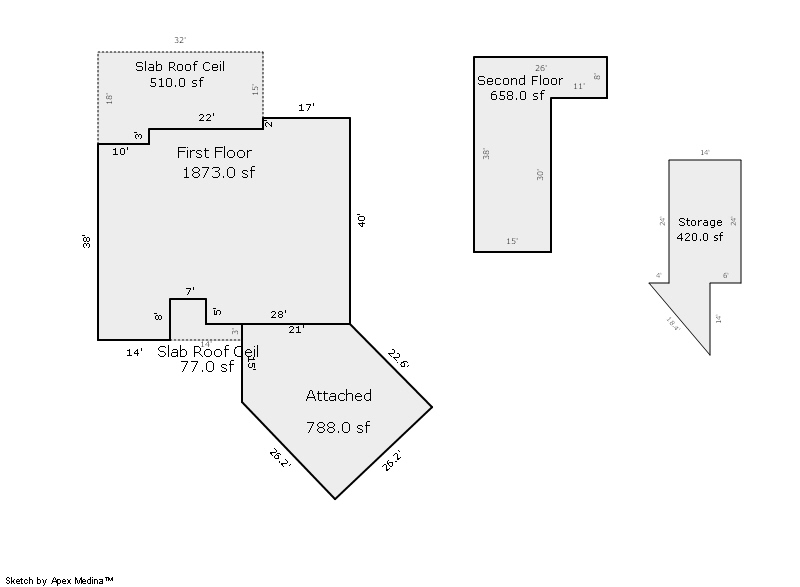

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2013 | Residential | 2,531 sqft | 1.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2013 | Residential | 2,531 sqft | 1.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2013 | Residential | 2,531 sqft | 1.00 | 8 | 2.10 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $493,981 | $502,124 | $534,400 |

| Total Taxable Value (Capped) | $462,525 | $485,651 | $509,933 |

| Improvement Value | $469,481 | $477,624 | $509,900 |

| Land Value | $24,500 | $24,500 | $24,500 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $50,877 | $53,422 | $56,093 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $50,877 | $53,422 | $56,093 |

| School District | BI-4A | ||

| Tax Rate | 139.90 | 134.70 | 134.70 |

| Estimated taxes | $7,118 | $7,196 | $7,556 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 4/26/2019 | YOUNGER, JACOB COLE AND, KATIE ELIZABETH; YOUNGER, JACOB COLE &, KATIE ELIZABETH | ACREE, MATTHEW & STEPHANIE | $450,000 | Warranty Deed | 2019035751 |

| 2/7/2012 | STEPHENS, PATRICIA J AND DONALD W CO-TRUSTEES | YOUNGER, JACOB COLE AND KATIE ELIZABETH | $0 | General Warranty Deed | 2012011818 |

| 5/15/1997 | $0 | Quit Claim Deed | 2000155211 BK-05915PG-00089 |

Sales/Documents

| Sale Date | 4/26/2019 |

|---|---|

| Grantor | YOUNGER, JACOB COLE AND, KATIE ELIZABETH; YOUNGER, JACOB COLE &, KATIE ELIZABETH |

| Grantee | ACREE, MATTHEW & STEPHANIE |

| Sale Price | $450,000 |

| Deed Type | Warranty Deed |

| Document Number | 2019035751 |

| Sale Date | 2/7/2012 |

| Grantor | STEPHENS, PATRICIA J AND DONALD W CO-TRUSTEES |

| Grantee | YOUNGER, JACOB COLE AND KATIE ELIZABETH |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2012011818 |

| Sale Date | 5/15/1997 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2000155211 BK-05915PG-00089 |