General Information

| Situs Address | 10448 E 143 CT N COLLINSVILLE 74021 |

|---|---|

| Owner Name |

DIXON, TIFFANY & BYRON

|

| Owner Mailing Address | 10448 E 143RD CT N COLLINSVILLE , OK 740213704 |

| Account Type | Residential |

| Parcel ID | 60296-24-30-06200 |

| Land Area | 0.20 acres / 8,640 sq ft |

| School District | CL-6A |

| Legal Description | Subdivision: STONEGATE ESTATES EXT (60296) Legal: LT 5 BLK 2 Section: 30 Township: 22 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

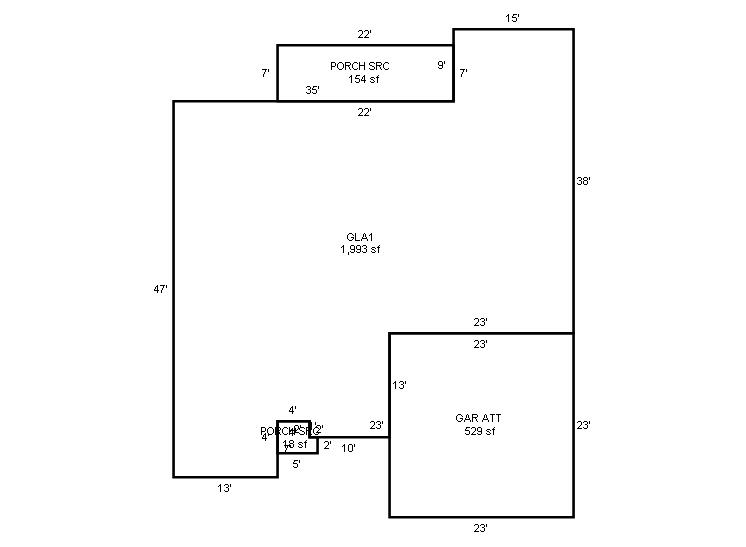

| 2025 | 2006 | Residential | 1,993 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2006 | Residential | 1,993 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2006 | Residential | 1,993 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $277,036 | $277,005 | $296,100 |

| Total Taxable Value (Capped) | $277,036 | $277,005 | $285,315 |

| Improvement Value | $254,036 | $254,005 | $273,100 |

| Land Value | $23,000 | $23,000 | $23,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $30,474 | $30,471 | $31,385 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $29,474 | $29,471 | $30,385 |

| School District | CL-6A | ||

| Tax Rate | 113.87 | 115.33 | 115.33 |

| Estimated taxes | $3,356 | $3,399 | $3,504 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/16/2022 | GIST, WAYNE | DIXON, TIFFANY & BYRON | $260,000 | General Warranty Deed | 2022121145 |

| 10/9/2018 | BAILEY, DARLA | GIST, WAYNE | $0 | Quit Claim Deed | 2018090690 |

| 11/15/2017 | ORR, KOREN | GIST, WAYNE & DARLA BAILEY | $173,000 | Warranty Deed | 2017109357 |

| 11/10/2015 | ORR, KOREN AND BRADY | ORR, KOREN | $0 | Divorce Decree | 2017021973 |

| 3/1/2007 | TYNER, KENNETH B | ORR, KOREN | $159,000 | General Warranty Deed | 2007005075 |

| 8/1/2006 | $23,000 | History | 2006105646 |

Sales/Documents

| Sale Date | 11/16/2022 |

|---|---|

| Grantor | GIST, WAYNE |

| Grantee | DIXON, TIFFANY & BYRON |

| Sale Price | $260,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2022121145 |

| Sale Date | 10/9/2018 |

| Grantor | BAILEY, DARLA |

| Grantee | GIST, WAYNE |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2018090690 |

| Sale Date | 11/15/2017 |

| Grantor | ORR, KOREN |

| Grantee | GIST, WAYNE & DARLA BAILEY |

| Sale Price | $173,000 |

| Deed Type | Warranty Deed |

| Document Number | 2017109357 |

| Sale Date | 11/10/2015 |

| Grantor | ORR, KOREN AND BRADY |

| Grantee | ORR, KOREN |

| Sale Price | $0 |

| Deed Type | Divorce Decree |

| Document Number | 2017021973 |

| Sale Date | 3/1/2007 |

| Grantor | TYNER, KENNETH B |

| Grantee | ORR, KOREN |

| Sale Price | $159,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2007005075 |

| Sale Date | 8/1/2006 |

| Grantor | |

| Grantee | |

| Sale Price | $23,000 |

| Deed Type | History |

| Document Number | 2006105646 |