General Information

| Situs Address | 11915 S CEDAR CT W JENKS 740373223 |

|---|---|

| Owner Name |

HILDEBRAND, WHITNEY & IVAN A CORTES

|

| Owner Mailing Address | 11915 S CEDAR CT JENKS , OK 740373223 |

| Account Type | Residential |

| Parcel ID | 60537-83-31-43580 |

| Land Area | 0.25 acres / 11,053 sq ft |

| School District | JK-5A |

| Legal Description | Subdivision: BECKETT RIDGE (60537) Legal: LT 24 BLK 6 Section: 31 Township: 18 Range: 13 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

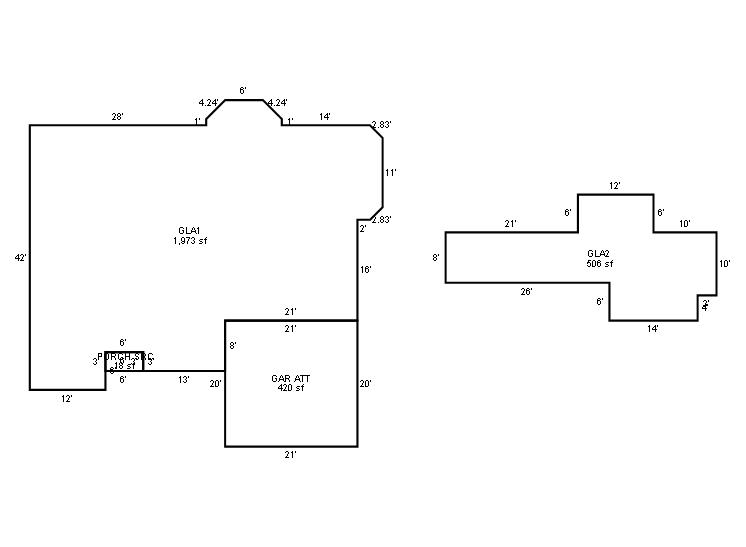

| 2024 | 2000 | Residential | 2,479 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2000 | Residential | 2,479 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2022

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2022 | 2000 | Residential | 2,479 sqft | 1.50 | 8 | 3.00 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Fair Cash(Market) Value | $275,000 | $308,794 | $334,440 |

| Total Taxable Value (Capped) | $275,000 | $283,250 | $291,747 |

| Improvement Value | $245,000 | $278,794 | $304,440 |

| Land Value | $30,000 | $30,000 | $30,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $30,250 | $31,158 | $32,092 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $29,250 | $30,158 | $31,092 |

| School District | JK-5A | ||

| Tax Rate | 128.55 | 127.32 | 126.54 |

| Estimated taxes | $3,760 | $3,840 | $3,934 |

| Last Notice Date | 2/27/2024 | ||

Exemptions Claimed

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 7/8/2021 | SMITH, ANDREW JOHN & JESSICA K | HILDEBRAND, WHITNEY & IVAN A CORTES | $275,000 | Warranty Deed | 2021086984 |

| 5/13/2016 | SMITH, GREGORY HAZELWOOD & RENEE, LEWIS TTEE SMITH FAMILY TRUST | SMITH, ANDREW JOHN & JESSICA K | $230,000 | General Warranty Deed | 2016045782 |

| 8/11/2009 | KUEHN, PATRICK A AND DANA | SMITH, GREGORY HAZELWOOD & RENEE LEWIS TTEE SMITH FAMILY TRUST | $200,000 | Warranty Deed | 2009084557 |

| 1/1/2006 | PEACHER, WILLIAM L | KUEHN, PATRICK A | $156,000 | General Warranty Deed | 2006011254 |

| 7/1/2002 | $173,000 | History | 2000159046 BK-06794PG-01716 | ||

| 2/1/2000 | $175,000 | History | 2000159047 BK-06326PG-01601 |

Sales/Documents

| Sale Date | 7/8/2021 |

|---|---|

| Grantor | SMITH, ANDREW JOHN & JESSICA K |

| Grantee | HILDEBRAND, WHITNEY & IVAN A CORTES |

| Sale Price | $275,000 |

| Deed Type | Warranty Deed |

| Document Number | 2021086984 |

| Sale Date | 5/13/2016 |

| Grantor | SMITH, GREGORY HAZELWOOD & RENEE, LEWIS TTEE SMITH FAMILY TRUST |

| Grantee | SMITH, ANDREW JOHN & JESSICA K |

| Sale Price | $230,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016045782 |

| Sale Date | 8/11/2009 |

| Grantor | KUEHN, PATRICK A AND DANA |

| Grantee | SMITH, GREGORY HAZELWOOD & RENEE LEWIS TTEE SMITH FAMILY TRUST |

| Sale Price | $200,000 |

| Deed Type | Warranty Deed |

| Document Number | 2009084557 |

| Sale Date | 1/1/2006 |

| Grantor | PEACHER, WILLIAM L |

| Grantee | KUEHN, PATRICK A |

| Sale Price | $156,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2006011254 |

| Sale Date | 7/1/2002 |

| Grantor | |

| Grantee | |

| Sale Price | $173,000 |

| Deed Type | History |

| Document Number | 2000159046 BK-06794PG-01716 |

| Sale Date | 2/1/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $175,000 |

| Deed Type | History |

| Document Number | 2000159047 BK-06326PG-01601 |