General Information

| Situs Address | 822 W 105 CT S JENKS 74037 |

|---|---|

| Owner Name |

FRIE, ALYCIA D'ANN REV TRUST

|

| Owner Mailing Address | 822 W 105TH CT S JENKS , OK 740372642 |

| Account Type | Residential |

| Parcel ID | 60610-82-25-67560 |

| Land Area | 0.49 acres / 21,473 sq ft |

| School District | JK-5A |

| Legal Description | Subdivision: ESTATES AT STONE BLUFF, THE (60610) Legal: LT 6 BLK 2 Section: 25 Township: 18 Range: 12 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

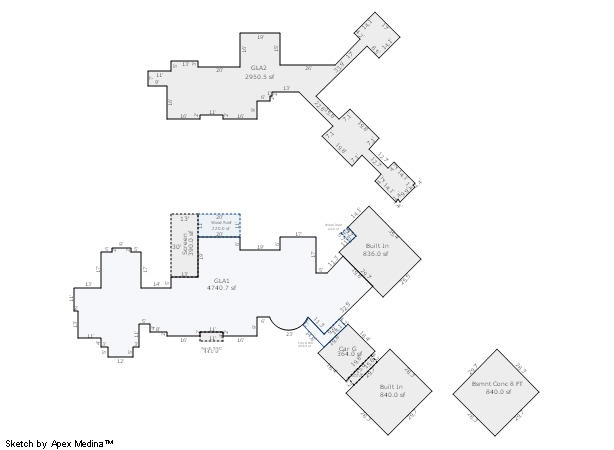

| 2025 | 2008 | Residential | 7,692 sqft | 2.00 | 8 | 6.20 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | None | |||

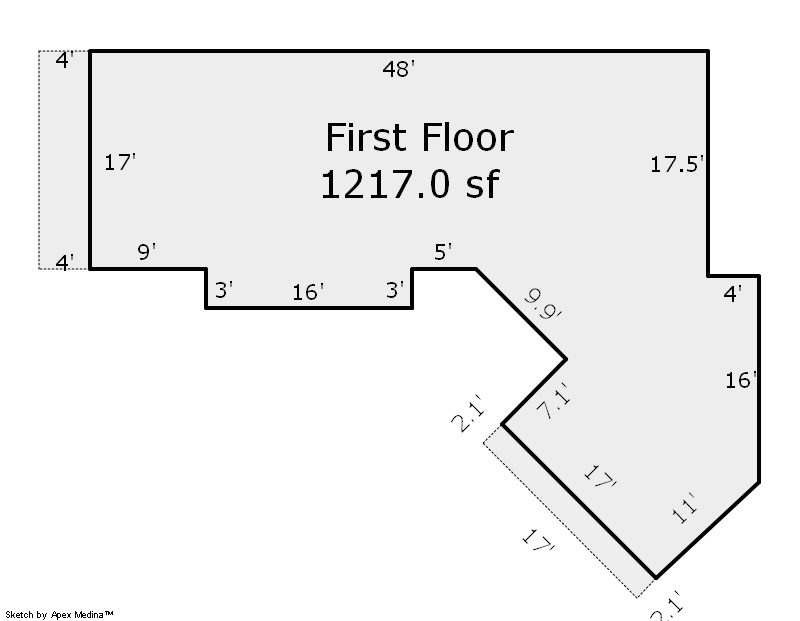

| 2025 | 2009 | Residential | 1,217 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2008 | Residential | 7,692 sqft | 2.00 | 8 | 6.20 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | None | |||

| 2024 | 2009 | Residential | 1,217 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2008 | Residential | 7,692 sqft | 2.00 | 8 | 6.20 | Composition Shingle |

| 1.00 | 2 Story | Crawl Space | Frame Masonry Veneer | None | |||

| 2023 | 2009 | Residential | 1,217 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | Ranch 1 Story | Slab | Frame Masonry Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $1,943,000 | $1,943,000 | $1,943,000 |

| Total Taxable Value (Capped) | $1,943,000 | $1,943,000 | $1,943,000 |

| Improvement Value | $1,736,200 | $1,736,200 | $1,736,200 |

| Land Value | $206,800 | $206,800 | $206,800 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $213,730 | $213,730 | $213,730 |

| Exemptions | -$1,000 | -$1,000 | -$1,000 |

| Net Assessed Value | $212,730 | $212,730 | $212,730 |

| School District | JK-5A | ||

| Tax Rate | 127.32 | 126.54 | 126.54 |

| Estimated taxes | $27,085 | $26,919 | $26,919 |

| Last Notice Date | There is no recent notice date for this property | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | |||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 1/24/2020 | FRIE, JARROD & ALYCIA | FRIE, ALYCIA D'ANN REV TRUST | $0 | Quit Claim Deed | 2020007709 |

| 6/4/2019 | MITCHELL, GINGER LAUREN LIVING TR | FRIE, JARROD & ALYCIA | $1,800,000 | Warranty Deed | 2019050929 |

| 7/6/2018 | VAN PELT, ROBERT C & CARRIE L | MITCHELL, GINGER LAUREN LIVING TR | $1,800,000 | Warranty Deed | 2018061449 |

| 3/1/2006 | SUNDERMAN, ANDREW | VANPELT, ROBERT C | $240,000 | General Warranty Deed | 2006028149 |

| 6/1/2005 | OAK PROPERTIES LLC | SUNDERMAN, ANDREW | $0 | History | 2005072914 |

Sales/Documents

| Sale Date | 1/24/2020 |

|---|---|

| Grantor | FRIE, JARROD & ALYCIA |

| Grantee | FRIE, ALYCIA D'ANN REV TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2020007709 |

| Sale Date | 6/4/2019 |

| Grantor | MITCHELL, GINGER LAUREN LIVING TR |

| Grantee | FRIE, JARROD & ALYCIA |

| Sale Price | $1,800,000 |

| Deed Type | Warranty Deed |

| Document Number | 2019050929 |

| Sale Date | 7/6/2018 |

| Grantor | VAN PELT, ROBERT C & CARRIE L |

| Grantee | MITCHELL, GINGER LAUREN LIVING TR |

| Sale Price | $1,800,000 |

| Deed Type | Warranty Deed |

| Document Number | 2018061449 |

| Sale Date | 3/1/2006 |

| Grantor | SUNDERMAN, ANDREW |

| Grantee | VANPELT, ROBERT C |

| Sale Price | $240,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2006028149 |

| Sale Date | 6/1/2005 |

| Grantor | OAK PROPERTIES LLC |

| Grantee | SUNDERMAN, ANDREW |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2005072914 |