General Information

| Situs Address | 9703 N 98 AV E OWASSO 74055 |

|---|---|

| Owner Name |

RR4 OPCO1 LP

|

| Owner Mailing Address | 200 E PALMETTO PARK RD 103 BOCA RATON , FL 33432 |

| Account Type | Residential |

| Parcel ID | 61119-14-18-66400 |

| Land Area | 0.27 acres / 11,638 sq ft |

| School District | OW-11A |

| Legal Description | Subdivision: HONEY CREEK AT BAILEY RANCH (61119) Legal: LT 14 BLK 6 Section: 18 Township: 21 Range: 14 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

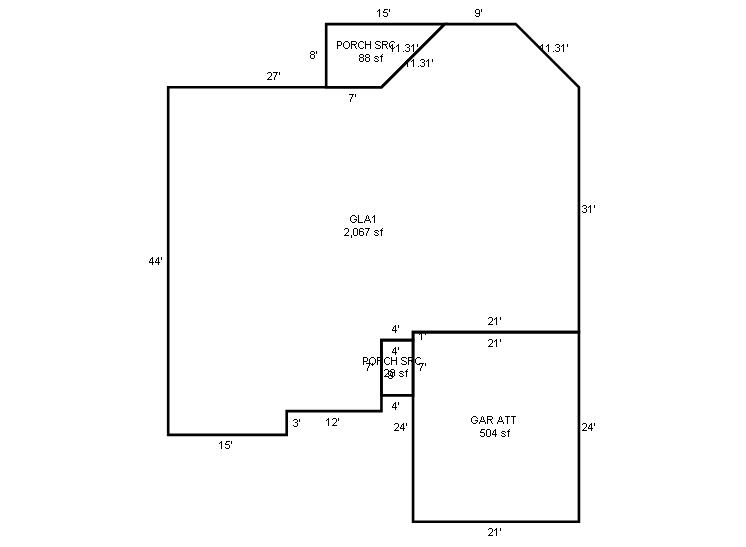

| 2025 | 2003 | Residential | 2,067 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2003 | Residential | 2,067 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2003 | Residential | 2,067 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $289,603 | $296,780 | $292,100 |

| Total Taxable Value (Capped) | $199,956 | $209,954 | $220,451 |

| Improvement Value | $262,603 | $269,780 | $265,100 |

| Land Value | $27,000 | $27,000 | $27,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $21,996 | $23,095 | $24,249 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $21,996 | $23,095 | $24,249 |

| School District | OW-11A | ||

| Tax Rate | 108.83 | 110.79 | 110.79 |

| Estimated taxes | $2,394 | $2,559 | $2,687 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/5/2022 | MOUNT FAMILY REVOCABLE TRUST | RR4 OPCO1 LP | $0 | Warranty Deed | 2022056203 |

| 6/1/2007 | LOVELESS, BEVERLY S | MOUNT, ROBERT A, TRUSTEE | $165,000 | Warranty Deed | 2007067472 |

| 8/1/2003 | $140,000 | History | 2000173723 BK-07116PG-01556 | ||

| 12/1/2002 | $24,000 | History | 2000173724 BK-06897PG-02062 |

Sales/Documents

| Sale Date | 5/5/2022 |

|---|---|

| Grantor | MOUNT FAMILY REVOCABLE TRUST |

| Grantee | RR4 OPCO1 LP |

| Sale Price | $0 |

| Deed Type | Warranty Deed |

| Document Number | 2022056203 |

| Sale Date | 6/1/2007 |

| Grantor | LOVELESS, BEVERLY S |

| Grantee | MOUNT, ROBERT A, TRUSTEE |

| Sale Price | $165,000 |

| Deed Type | Warranty Deed |

| Document Number | 2007067472 |

| Sale Date | 8/1/2003 |

| Grantor | |

| Grantee | |

| Sale Price | $140,000 |

| Deed Type | History |

| Document Number | 2000173723 BK-07116PG-01556 |

| Sale Date | 12/1/2002 |

| Grantor | |

| Grantee | |

| Sale Price | $24,000 |

| Deed Type | History |

| Document Number | 2000173724 BK-06897PG-02062 |