General Information

| Situs Address | 3501 S SUMMIT BV W SAND SPRINGS 74063 |

|---|---|

| Owner Name |

WELDY-REED, KIMBERLIE E & MATTHEW DWAIN REED

|

| Owner Mailing Address | 3501 SUMMIT BLVD SAND SPRINGS , OK 740633810 |

| Account Type | Residential |

| Parcel ID | 61650-91-23-00890 |

| Land Area | 0.78 acres / 34,000 sq ft |

| School District | SS-2A |

| Legal Description | Subdivision: GARDEN HGTS ADDN (61650) Legal: N34.19 W340 LT 7 & S65.81 W340 LT 8 BLK B Section: 23 Township: 19 Range: 11 |

| Zoning | View INCOG's Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

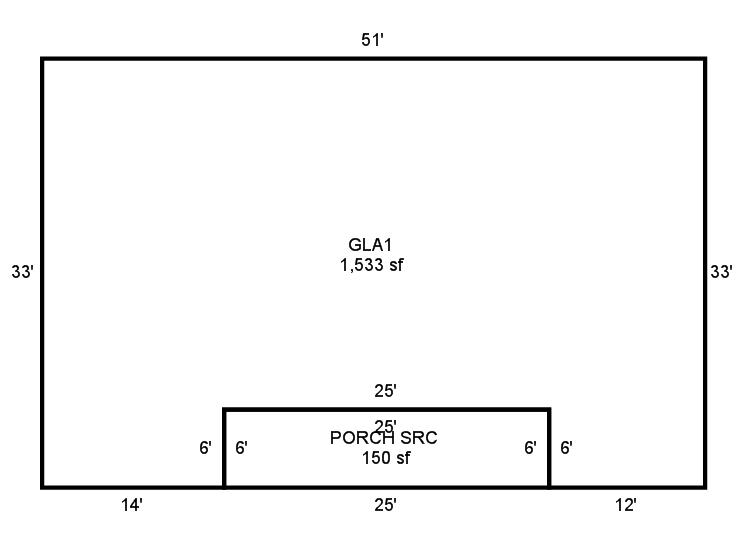

| 2025 | 1955 | Residential | 1,533 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

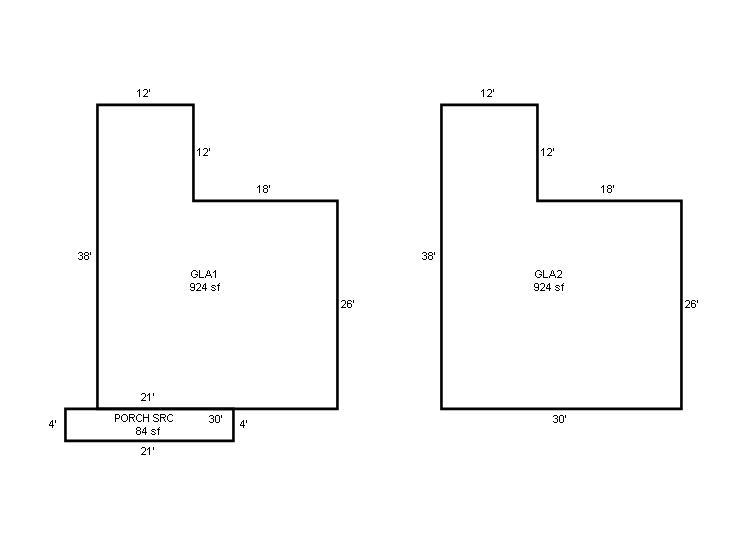

| 2025 | 1955 | Residential | 1,848 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1955 | Residential | 1,533 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2024 | 1955 | Residential | 1,848 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1955 | Residential | 1,533 sqft | 1.00 | 8 | 1.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

| 2023 | 1955 | Residential | 1,848 sqft | 2.00 | 8 | 1.00 | Composition Shingle |

| 2.00 | 2 Story | Crawl Space | Frame Siding/Brick/Stone Veneer | None | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $123,000 | $220,000 | $207,000 |

| Total Taxable Value (Capped) | $123,000 | $220,000 | $207,000 |

| Improvement Value | $97,300 | $194,300 | $181,300 |

| Land Value | $25,700 | $25,700 | $25,700 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $13,530 | $24,200 | $22,770 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $13,530 | $24,200 | $22,770 |

| School District | SS-2A | ||

| Tax Rate | 126.21 | 127.61 | 127.61 |

| Estimated taxes | $1,708 | $3,088 | $2,906 |

| Last Notice Date | 3/26/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 6/18/2025 | UNRUH LAND HOLDINGS LLC | WELDY-REED, KIMBERLIE E & MATTHEW DWAIN REED | $225,000 | General Warranty Deed | 2025054321 |

| 3/8/2023 | AOK ADVANCEMENT LLC | UNRUH LAND HOLDINGS LLC | $220,000 | General Warranty Deed | 2023018642 |

| 2/26/2013 | BACHELDER, RENE | AOK ADVANCEMENT LLC | $0 | General Warranty Deed | 2013024221 |

| 12/21/2012 | BALES, MARK P AND ASHLEY R | BACHELDER, DAPHNE RENE | $123,000 | General Warranty Deed | 2012126270 |

| 5/13/1998 | $0 | General Warranty Deed | 2000179425 BK-06050PG-02581 | ||

| 3/1/1988 | $57,500 | History | 2000179424 BK-05089PG-00524 |

Sales/Documents

| Sale Date | 6/18/2025 |

|---|---|

| Grantor | UNRUH LAND HOLDINGS LLC |

| Grantee | WELDY-REED, KIMBERLIE E & MATTHEW DWAIN REED |

| Sale Price | $225,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2025054321 |

| Sale Date | 3/8/2023 |

| Grantor | AOK ADVANCEMENT LLC |

| Grantee | UNRUH LAND HOLDINGS LLC |

| Sale Price | $220,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2023018642 |

| Sale Date | 2/26/2013 |

| Grantor | BACHELDER, RENE |

| Grantee | AOK ADVANCEMENT LLC |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2013024221 |

| Sale Date | 12/21/2012 |

| Grantor | BALES, MARK P AND ASHLEY R |

| Grantee | BACHELDER, DAPHNE RENE |

| Sale Price | $123,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2012126270 |

| Sale Date | 5/13/1998 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000179425 BK-06050PG-02581 |

| Sale Date | 3/1/1988 |

| Grantor | |

| Grantee | |

| Sale Price | $57,500 |

| Deed Type | History |

| Document Number | 2000179424 BK-05089PG-00524 |