General Information

| Situs Address | 7133 S JACKSON AV W TULSA 74132 |

|---|---|

| Owner Name |

ATTIC @ TULSA HILLS LLC

|

| Owner Mailing Address | C/O ATTIC MANAGEMENT GROUP PO BOX 447 ROANOKE, TX 762620447 |

| Account Type | Commercial |

| Parcel ID | 70007-82-11-05450 |

| Land Area | 3.92 acres / 170,616 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: 71 JACKSON STORAGE (70007) Legal: LOT 1 BLOCK 1 Section: 11 Township: 18 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

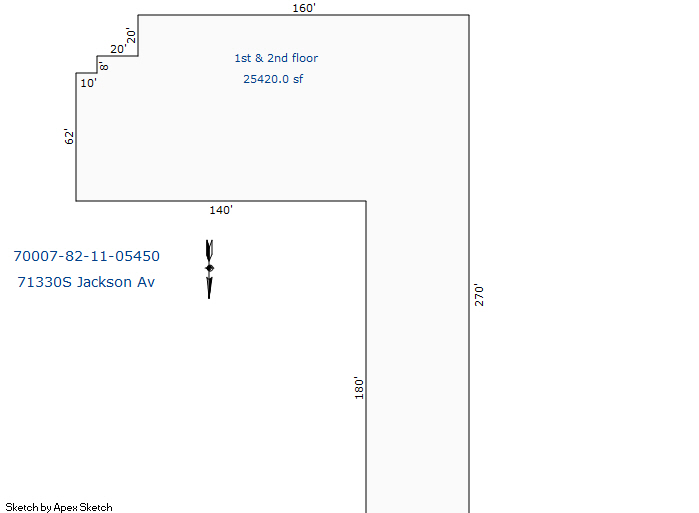

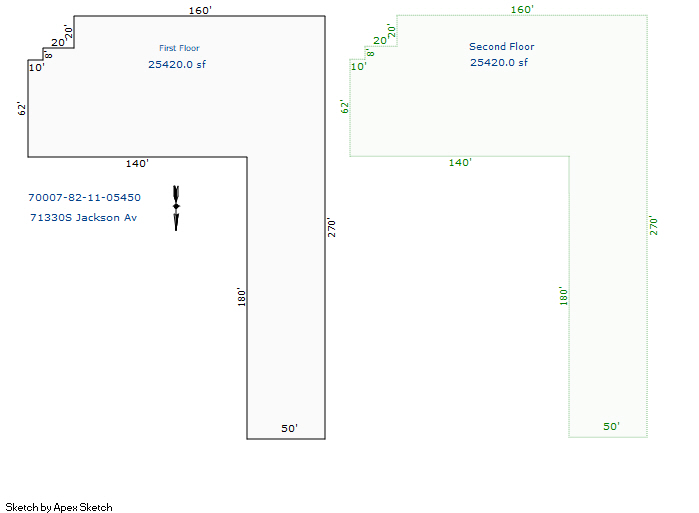

| 2025 | 2019 | Commercial | 50,840 sqft | 2.00 | 10 | 0 | |

| 1.00 | Mini Warehouse Hi-rise | Slab | Complete HVAC | ||||

| 2025 | 2023 | Commercial | 41,050 sqft | 2.00 | 18 | 0 | |

| 2.00 | Mini Warehouse Hi-rise | Complete HVAC | |||||

| 2025 | 2023 | Commercial | 41,050 sqft | 2.00 | 18 | 0 | |

| 3.00 | Mini Warehouse Hi-rise | Complete HVAC | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2019 | Commercial | 50,840 sqft | 2.00 | 10 | 0 | |

| 1.00 | Mini Warehouse Hi-rise | Slab | Complete HVAC | ||||

| 2024 | 2023 | Commercial | 41,050 sqft | 2.00 | 18 | 0 | |

| 2.00 | Mini Warehouse Hi-rise | Complete HVAC | |||||

| 2024 | 2023 | Commercial | 41,050 sqft | 2.00 | 18 | 0 | |

| 3.00 | Mini Warehouse Hi-rise | Complete HVAC | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2019 | Commercial | 50,840 sqft | 2.00 | 10 | 0 | |

| 1.00 | Mini Warehouse Hi-rise | Slab | Complete HVAC | ||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $4,736,500 | $15,549,200 | $18,836,800 |

| Total Taxable Value (Capped) | $3,946,635 | $14,436,866 | $15,158,709 |

| Improvement Value | $4,171,200 | $14,983,900 | $18,271,500 |

| Land Value | $565,300 | $565,300 | $565,300 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $434,130 | $1,588,056 | $1,667,458 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $434,130 | $1,588,056 | $1,667,458 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $57,800 | $215,579 | $226,357 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| There is no sales information for this account | |||||

Sales/Documents

| There is no sales information for this account |