General Information

| Situs Address | 3004 E 90 CT S TULSA 74137 |

|---|---|

| Owner Name |

UNITED 90TH COURT LLC C/O F BANDY

|

| Owner Mailing Address | 1195 E CAIN DR FAYETTEVILLE , AR 727032044 |

| Account Type | Residential |

| Parcel ID | 70283-83-17-45495 |

| Land Area | 0.14 acres / 5,989 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: CEDARCREST PARK HOMES RESUB L33-78 & 80-81 B1 CEDARCREST PARK (70283) Legal: LT 26 BLK 2 Section: 17 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

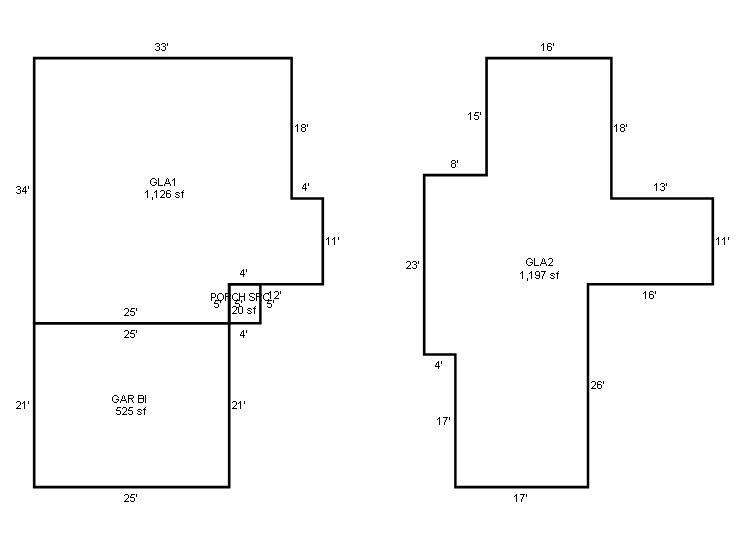

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1992 | Residential | 2,323 sqft | 1.75 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1992 | Residential | 2,323 sqft | 1.75 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1992 | Residential | 2,323 sqft | 1.75 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $285,260 | $331,551 | $356,700 |

| Total Taxable Value (Capped) | $208,923 | $219,369 | $230,338 |

| Improvement Value | $267,332 | $313,623 | $338,772 |

| Land Value | $17,928 | $17,928 | $17,928 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $22,981 | $24,131 | $25,337 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $22,981 | $24,131 | $25,337 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $3,060 | $3,276 | $3,440 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 10/1/2005 | $0 | History | 2005131213 | ||

| 6/1/2004 | CEDARCREST PARK HOMES, INC | CEDAR CREST PARK VENTURES LLC | $0 | History | 2004075194 |

Sales/Documents

| Sale Date | 10/1/2005 |

|---|---|

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2005131213 |

| Sale Date | 6/1/2004 |

| Grantor | CEDARCREST PARK HOMES, INC |

| Grantee | CEDAR CREST PARK VENTURES LLC |

| Sale Price | $0 |

| Deed Type | History |

| Document Number | 2004075194 |