General Information

| Situs Address | 5116 E 97 CT S TULSA 741374901 |

|---|---|

| Owner Name |

SOE, MIN & SOPHIA KHIN-THET

|

| Owner Mailing Address | 5116 E 97TH CT TULSA , OK 741374901 |

| Account Type | Residential |

| Parcel ID | 73470-83-22-44920 |

| Land Area | 0.47 acres / 20,400 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: SUN MEADOW III (73470) Legal: LT 18 BLK 4 Section: 22 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

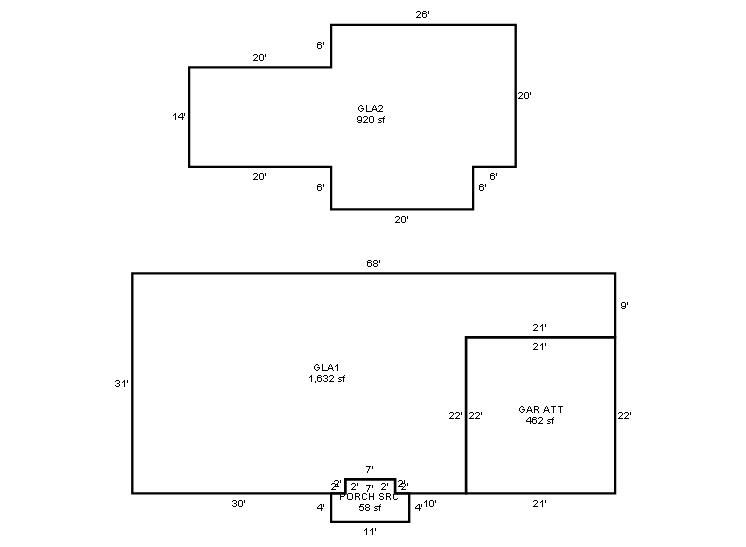

| 2025 | 1978 | Residential | 2,899 sqft | 1.50 | 8 | 3.20 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1978 | Residential | 2,552 sqft | 1.50 | 8 | 3.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1978 | Residential | 2,552 sqft | 1.50 | 8 | 3.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $298,639 | $317,237 | $421,000 |

| Total Taxable Value (Capped) | $219,822 | $226,416 | $421,000 |

| Improvement Value | $253,951 | $272,549 | $0 |

| Land Value | $44,688 | $44,688 | $44,688 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $24,180 | $24,905 | $46,310 |

| Exemptions | -$1,000 | -$1,000 | $0 |

| Net Assessed Value | $23,180 | $23,905 | $46,310 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $3,086 | $3,245 | $6,287 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | Apply | ||

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/13/2024 | HALLUM, CHRISTOPHER A & TAMMY L | SOE, MIN & SOPHIA KHIN-THET | $395,000 | Warranty Deed | 2024100107 |

| 4/4/2024 | MARS, JOHN E & ELIZABETH A TTEE JOHN & ELIZABETH MARS FAMILY TRUST | HALLUM, CHRISTOPHER A & TAMMY L | $372,500 | Warranty Deed | 2024026448 |

| 8/31/2010 | MARS, JOHN E AND ELIZABETH A | MARS, JOHN E & ELIZABETH A TTEE JOHN & ELIZABETH MARS FAMILY TRUST | $0 | Quit Claim Deed | 2010080728 |

| 9/26/1978 | $0 | General Warranty Deed | 2000203852 BK-04355PG-00467 |

Sales/Documents

| Sale Date | 11/13/2024 |

|---|---|

| Grantor | HALLUM, CHRISTOPHER A & TAMMY L |

| Grantee | SOE, MIN & SOPHIA KHIN-THET |

| Sale Price | $395,000 |

| Deed Type | Warranty Deed |

| Document Number | 2024100107 |

| Sale Date | 4/4/2024 |

| Grantor | MARS, JOHN E & ELIZABETH A TTEE JOHN & ELIZABETH MARS FAMILY TRUST |

| Grantee | HALLUM, CHRISTOPHER A & TAMMY L |

| Sale Price | $372,500 |

| Deed Type | Warranty Deed |

| Document Number | 2024026448 |

| Sale Date | 8/31/2010 |

| Grantor | MARS, JOHN E AND ELIZABETH A |

| Grantee | MARS, JOHN E & ELIZABETH A TTEE JOHN & ELIZABETH MARS FAMILY TRUST |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2010080728 |

| Sale Date | 9/26/1978 |

| Grantor | |

| Grantee | |

| Sale Price | $0 |

| Deed Type | General Warranty Deed |

| Document Number | 2000203852 BK-04355PG-00467 |