General Information

| Situs Address | 7521 S OLYMPIA AV W TULSA 74132 |

|---|---|

| Owner Name |

DRP TULSA HILLS PROPERTY OWNER LLC

|

| Owner Mailing Address | 12221 MERIT DR STE 1220 DALLAS , TX 752512202 |

| Account Type | Commercial |

| Parcel ID | 73709-82-11-62410 |

| Land Area | 12.44 acres / 541,696 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: TULSA HILLS (73709) Legal: PRT LTS 3 & 4 & 6 BEG 206.77SE NWC LT 6 TH SE27.22 NE117 SE136.02 NE31.50 SE68 SW57.33 SE220.64 NE11.01 SE89.50 NE23.98 SE143.92 SW26.69 CRV LF 35.99 SW342.45 W376.63 S61.17 S1289.13 NW120.98 N365.12 NW198.44 NE60.47 N464.98 NW141.62 NW388.31 NE68.82 NE73.87 SE35.35 SE158.04 NE35.36 NE412.32 POB BLK 2 Section: 11 Township: 18 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

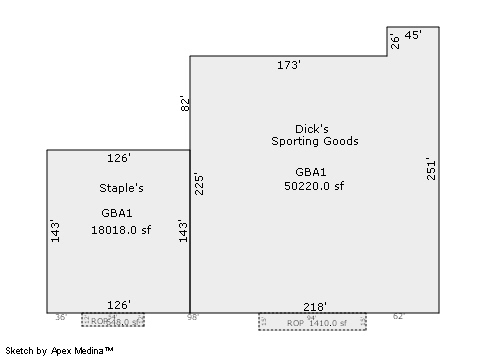

| 2025 | 2011 | Commercial | 68,238 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2011 | Commercial | 68,238 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2011 | Commercial | 68,238 sqft | 1.00 | 20 | 0.00 | |

| 1.00 | Retail Store | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $8,600,000 | $8,600,000 | $8,600,000 |

| Total Taxable Value (Capped) | $8,600,000 | $8,600,000 | $8,600,000 |

| Improvement Value | $4,763,000 | $4,763,000 | $4,763,000 |

| Land Value | $3,837,000 | $3,837,000 | $3,837,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $946,000 | $946,000 | $946,000 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $946,000 | $946,000 | $946,000 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $125,950 | $128,420 | $128,420 |

| Last Notice Date | 3/1/2022 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 4/16/2021 | RD-TULSA HILLS LP | DRP TULSA HILLS PROPERTY OWNER LLC | $74,150,000 | Special Warranty Deed | 2021043886 |

| 9/14/2018 | INLAND AMERICAN TULSA 71ST LLC; INLAND AMERICAN TULSA 71ST II, LLC | RD- TULSA HILLS LP | $70,000,000 | Special Warranty Deed | 2018084283 |

| 4/16/2012 | TULSA HILLS LLC | INLAND AMERICAN TULSA 71ST II, LLC | $10,648,500 | Special Warranty Deed | 2012039806 |

| 5/17/2006 | HATLEY KIM MARIE | TULSA HILLS LLC | $618,000 | Special Warranty Deed | 2006059211 |

Sales/Documents

| Sale Date | 4/16/2021 |

|---|---|

| Grantor | RD-TULSA HILLS LP |

| Grantee | DRP TULSA HILLS PROPERTY OWNER LLC |

| Sale Price | $74,150,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2021043886 |

| Sale Date | 9/14/2018 |

| Grantor | INLAND AMERICAN TULSA 71ST LLC; INLAND AMERICAN TULSA 71ST II, LLC |

| Grantee | RD- TULSA HILLS LP |

| Sale Price | $70,000,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2018084283 |

| Sale Date | 4/16/2012 |

| Grantor | TULSA HILLS LLC |

| Grantee | INLAND AMERICAN TULSA 71ST II, LLC |

| Sale Price | $10,648,500 |

| Deed Type | Special Warranty Deed |

| Document Number | 2012039806 |

| Sale Date | 5/17/2006 |

| Grantor | HATLEY KIM MARIE |

| Grantee | TULSA HILLS LLC |

| Sale Price | $618,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2006059211 |