Exempt

This property is Partial Exemption

R73755821440330

8200 S UNIT DR W TULSA 74132

$10,961,102

$1,205,722

General Information

| Situs Address | 8200 S UNIT DR W TULSA 74132 |

|---|---|

| Owner Name |

TRANSFORMATION GROUP HOLDINGS CORPORATION

|

| Owner Mailing Address | ATTN: MS. TAMMIE MCQUARTERS 8200 S UNIT DR TULSA, OK 741325300 |

| Account Type | Partial Exempt |

| Parcel ID | 73755-82-14-40330 |

| Land Area | 14.34 acres / 624,659 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: UNIT CORPORATION (73755) Legal: LOT 1 BLOCK 1 Section: 14 Township: 18 Range: 12 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

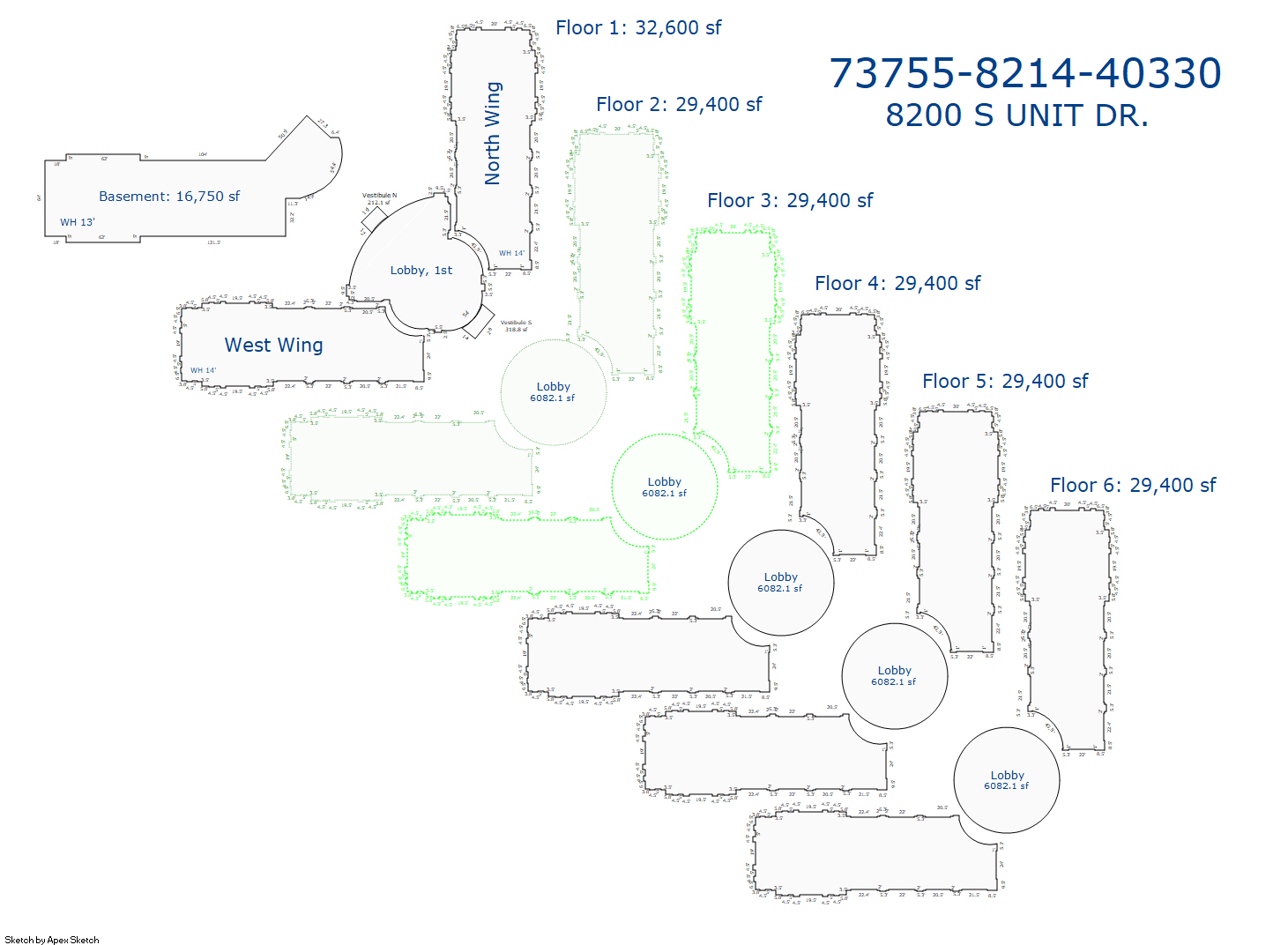

| 2025 | 2016 | Commercial | 196,350 sqft | 6.00 | 14 | 0 | |

| 1.00 | Office Building | Complete HVAC | |||||

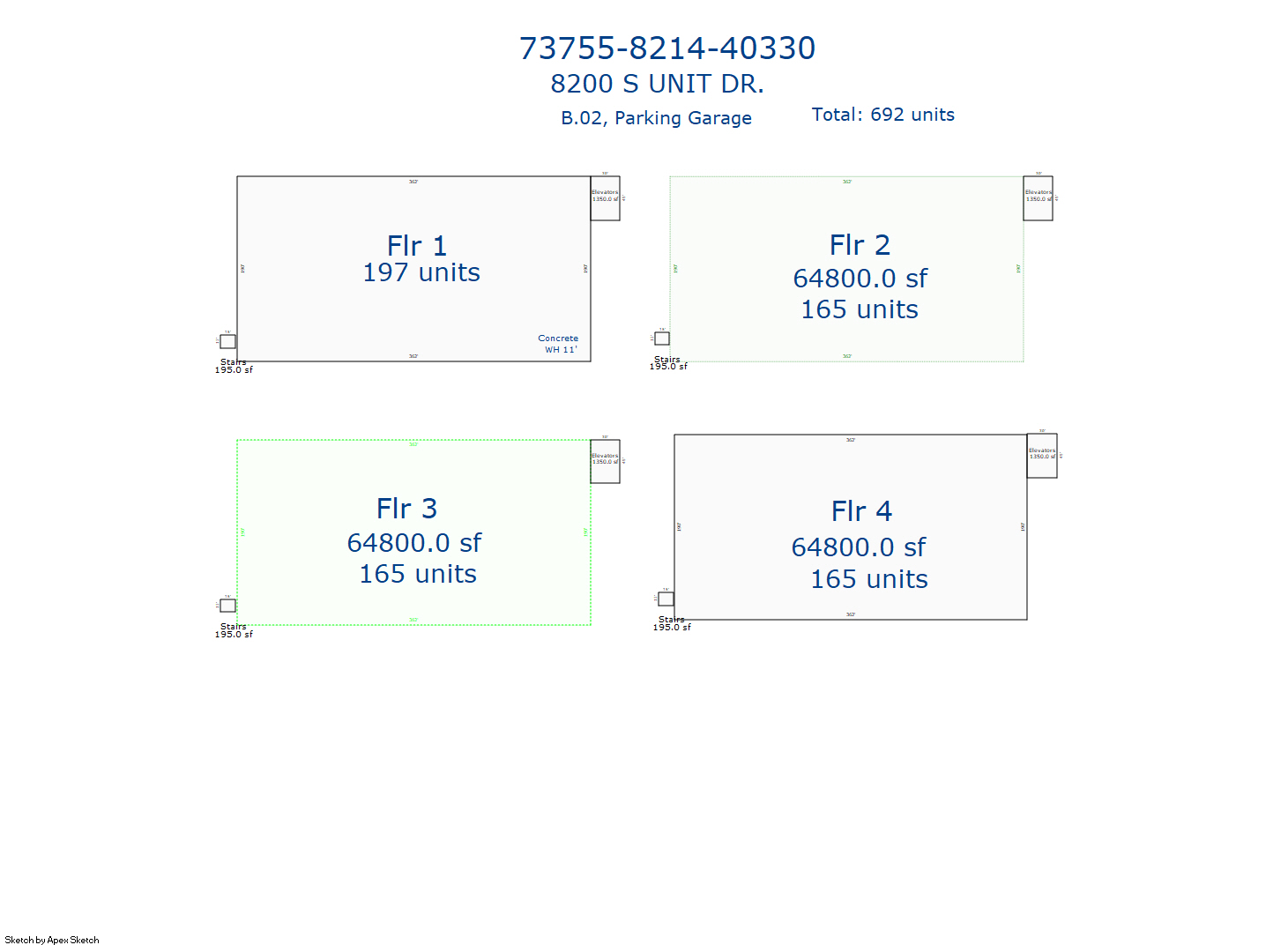

| 2025 | 2016 | Commercial | 259,200 sqft | 4.00 | 10 | 0 | |

| 2.00 | Parking Structure | None | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2016 | Commercial | 196,350 sqft | 6.00 | 14 | 0 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2024 | 2016 | Commercial | 259,200 sqft | 4.00 | 10 | 0 | |

| 2.00 | Parking Structure | None | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2016 | Commercial | 196,350 sqft | 6.00 | 14 | 0 | |

| 1.00 | Office Building | Complete HVAC | |||||

| 2023 | 2016 | Commercial | 259,200 sqft | 4.00 | 10 | 0 | |

| 2.00 | Parking Structure | None | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $10,961,102 | $10,961,102 | - |

| Total Taxable Value (Capped) | $10,961,102 | $10,961,102 | - |

| Improvement Value | $9,516,150 | $9,516,150 | - |

| Land Value | $1,444,952 | $1,444,952 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $1,205,722 | $1,205,722 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $1,205,722 | $1,205,722 | - |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $160,530 | $163,677 | - |

| Last Notice Date | 3/1/2023 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 9/16/2021 | 8200 UNIT DRIVE LLC | TRANSFORMATION GROUP HOLDINGS , CORPORATION | $35,000,000 | Special Warranty Deed | 2021109302 |

| 3/8/2016 | UNIT PETROLEUM COMPANY | 8200 UNIT DRIVE LLC | $0 | Special Warranty Deed | 2016023091 |

Sales/Documents

| Sale Date | 9/16/2021 |

|---|---|

| Grantor | 8200 UNIT DRIVE LLC |

| Grantee | TRANSFORMATION GROUP HOLDINGS , CORPORATION |

| Sale Price | $35,000,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2021109302 |

| Sale Date | 3/8/2016 |

| Grantor | UNIT PETROLEUM COMPANY |

| Grantee | 8200 UNIT DRIVE LLC |

| Sale Price | $0 |

| Deed Type | Special Warranty Deed |

| Document Number | 2016023091 |