General Information

| Situs Address | 3112 E 84 PL S TULSA 74137 |

|---|---|

| Owner Name |

HECK, JOSHUA ALLEN

|

| Owner Mailing Address | 501 E A ST APT 4 JENKS , OK 740374142 |

| Account Type | Residential |

| Parcel ID | 73950-83-17-13770 |

| Land Area | 0.27 acres / 11,890 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: WALNUT CREEK V (73950) Legal: LT 8 BLK 4 Section: 17 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

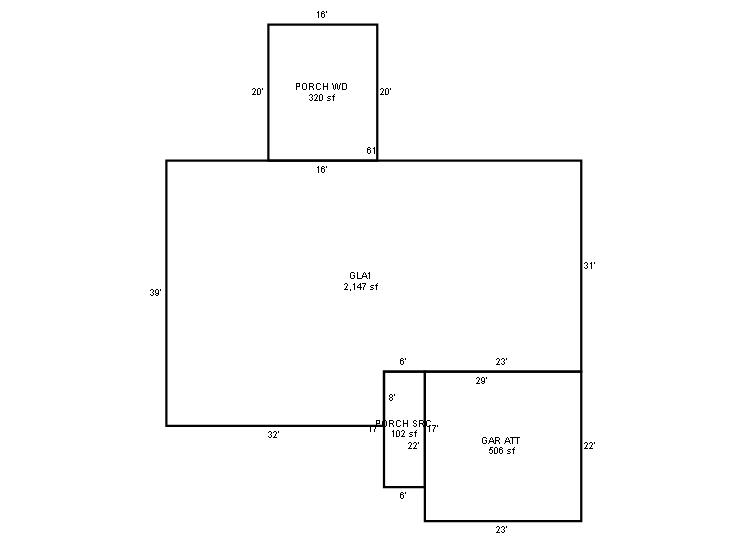

| 2025 | 1978 | Residential | 2,147 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1978 | Residential | 2,147 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1978 | Residential | 2,147 sqft | 1.00 | 8 | 2.00 | Composition Shingle |

| 1.00 | Ranch 1 Story | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $275,890 | $269,277 | $267,600 |

| Total Taxable Value (Capped) | $204,750 | $214,987 | $225,736 |

| Improvement Value | $241,890 | $235,277 | $233,600 |

| Land Value | $34,000 | $34,000 | $34,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $22,523 | $23,649 | $24,831 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $22,523 | $23,649 | $24,831 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $2,999 | $3,210 | $3,371 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 3/16/2020 | SCOTT, JACK P & SUSAN M | HECK, JOSHUA ALLEN | $195,000 | Warranty Deed | 2020026316 |

| 4/21/2011 | MILLER, ELIZABETH B AND SUSAN M SCOTT CO-TRUSTEES | SCOTT, JACK P & SUSAN M | $128,000 | General Warranty Deed | 2011036634 |

| 4/10/2006 | MILLER, ELIZABETH B | MILLER, ELIZABETH B, TRUSTEE | $0 | Quit Claim Deed | 2006039412 |

| 3/1/2006 | BENEFICIAL OKLA, INC | MILLER, ELIZABETH B | $141,000 | History | 2006034995 |

| 4/1/2000 | $134,500 | History | 2000206026 BK-06353PG-01081 | ||

| 12/1/1994 | $116,500 | History | 2000206027 BK-05678PG-00254 |

Sales/Documents

| Sale Date | 3/16/2020 |

|---|---|

| Grantor | SCOTT, JACK P & SUSAN M |

| Grantee | HECK, JOSHUA ALLEN |

| Sale Price | $195,000 |

| Deed Type | Warranty Deed |

| Document Number | 2020026316 |

| Sale Date | 4/21/2011 |

| Grantor | MILLER, ELIZABETH B AND SUSAN M SCOTT CO-TRUSTEES |

| Grantee | SCOTT, JACK P & SUSAN M |

| Sale Price | $128,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2011036634 |

| Sale Date | 4/10/2006 |

| Grantor | MILLER, ELIZABETH B |

| Grantee | MILLER, ELIZABETH B, TRUSTEE |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2006039412 |

| Sale Date | 3/1/2006 |

| Grantor | BENEFICIAL OKLA, INC |

| Grantee | MILLER, ELIZABETH B |

| Sale Price | $141,000 |

| Deed Type | History |

| Document Number | 2006034995 |

| Sale Date | 4/1/2000 |

| Grantor | |

| Grantee | |

| Sale Price | $134,500 |

| Deed Type | History |

| Document Number | 2000206026 BK-06353PG-01081 |

| Sale Date | 12/1/1994 |

| Grantor | |

| Grantee | |

| Sale Price | $116,500 |

| Deed Type | History |

| Document Number | 2000206027 BK-05678PG-00254 |