General Information

| Situs Address | 4350 E 67 ST S TULSA 74136 |

|---|---|

| Owner Name |

CHABRAK, JOHN M JR

|

| Owner Mailing Address | 4350 E 67TH ST #701 BLDG C-19 TULSA , OK 74136 |

| Account Type | Residential |

| Parcel ID | 74125-83-04-31392 |

| Land Area | 0.00 acres / 0 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: WILLOW CREEK RESUB LIVINGSTON PARK B2-3 (74125) Legal: UNIT 701 BLDG C-19 & 0.32619 INT IN COMMON ELEMENTS IN WILLOW CREEK CONDOMINIUMS III BEING A PRT OF LT 2 BLK 2 WILLOW CREEK RESUB LIVINGSTON PARK B2-3 Section: 04 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

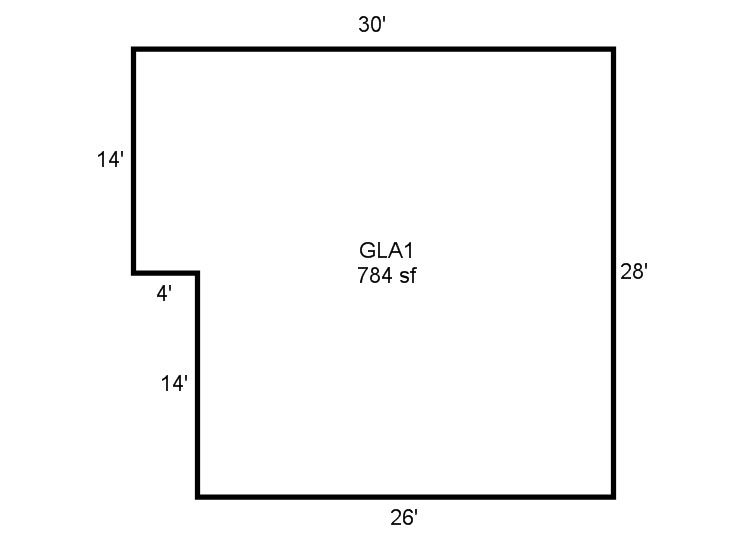

| 2025 | 1970 | Condo | 784 sqft | 1.00 | 8 | 1.00 | Built Up Rock |

| 1.00 | Condo <= 3 Stories | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1970 | Condo | 784 sqft | 1.00 | 8 | 1.00 | Built Up Rock |

| 1.00 | Condo <= 3 Stories | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1970 | Condo | 784 sqft | 1.00 | 8 | 1.00 | Built Up Rock |

| 1.00 | Condo <= 3 Stories | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $20,000 | $30,000 | $60,400 |

| Total Taxable Value (Capped) | $20,000 | $30,000 | $31,500 |

| Improvement Value | $15,000 | $25,000 | $55,400 |

| Land Value | $5,000 | $5,000 | $5,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $2,200 | $3,300 | $3,465 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $2,200 | $3,300 | $3,465 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $293 | $448 | $470 |

| Last Notice Date | 3/25/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 8/7/2023 | ROBERTSON, DONALD WAYNE & PAMELA KAY COOPER & CONNIE SUE FUENTES | CHABRAK, JOHN M JR | $30,000 | General Warranty Deed | 2023066413 |

| 4/24/2018 | ROBERTSON, LEONARD & NORMA JEAN &, DONALD WAYNE & PAMELA KAY COOPER & | ROBERTSON, DONALD WAYNE & PAMELA KAY COOPER & CONNIE SUE FUENTES | $15,000 | Quit Claim Deed | 2018036223 |

| 9/29/2005 | ROBERTSON, DONALD WAYNE | ROBERTSON, DONALD WAYNE | $0 | Quit Claim Deed | 2005115937 |

| 11/1/1983 | $38,500 | History | 2000208205 BK-04742PG-00860 |

Sales/Documents

| Sale Date | 8/7/2023 |

|---|---|

| Grantor | ROBERTSON, DONALD WAYNE & PAMELA KAY COOPER & CONNIE SUE FUENTES |

| Grantee | CHABRAK, JOHN M JR |

| Sale Price | $30,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2023066413 |

| Sale Date | 4/24/2018 |

| Grantor | ROBERTSON, LEONARD & NORMA JEAN &, DONALD WAYNE & PAMELA KAY COOPER & |

| Grantee | ROBERTSON, DONALD WAYNE & PAMELA KAY COOPER & CONNIE SUE FUENTES |

| Sale Price | $15,000 |

| Deed Type | Quit Claim Deed |

| Document Number | 2018036223 |

| Sale Date | 9/29/2005 |

| Grantor | ROBERTSON, DONALD WAYNE |

| Grantee | ROBERTSON, DONALD WAYNE |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2005115937 |

| Sale Date | 11/1/1983 |

| Grantor | |

| Grantee | |

| Sale Price | $38,500 |

| Deed Type | History |

| Document Number | 2000208205 BK-04742PG-00860 |