General Information

| Situs Address | 11617 S QUEBEC AV E TULSA 74137 |

|---|---|

| Owner Name |

WHYTAL, CHRISTOPHER GEORGE & AMANDA ANNE

|

| Owner Mailing Address | 11617 S QUEBEC AVE TULSA , OK 741376116 |

| Account Type | Residential |

| Parcel ID | 74173-83-33-31410 |

| Land Area | 0.27 acres / 11,900 sq ft |

| School District | T-5A |

| Legal Description | Subdivision: WIND RIVER (74173) Legal: LT 3 BLK 15 Section: 33 Township: 18 Range: 13 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

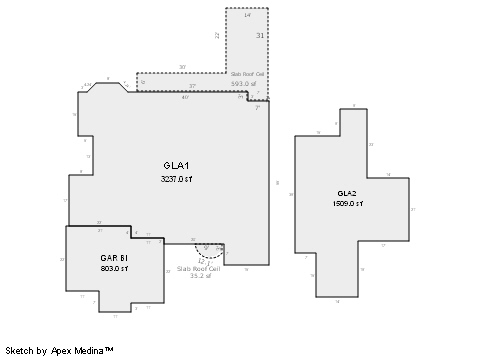

| 2025 | 2007 | Residential | 4,746 sqft | 1.50 | 8 | 4.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2007 | Residential | 4,746 sqft | 1.50 | 8 | 4.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2007 | Residential | 4,746 sqft | 1.50 | 8 | 4.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $723,330 | $775,257 | $793,400 |

| Total Taxable Value (Capped) | $723,330 | $775,257 | $793,400 |

| Improvement Value | $605,830 | $657,757 | $675,900 |

| Land Value | $117,500 | $117,500 | $117,500 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $79,566 | $85,278 | $87,274 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $79,566 | $85,278 | $87,274 |

| School District | T-5A | ||

| Tax Rate | 133.14 | 135.75 | 135.75 |

| Estimated taxes | $10,593 | $11,576 | $11,847 |

| Last Notice Date | 2/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 2/2/2023 | WINTER, JAN E | WHYTAL, CHRISTOPHER GEORGE & AMANDA ANNE | $815,000 | General Warranty Deed | 2023010247 |

| 8/2/2021 | WILLISON, FREDERICK AND NICOLE | WINTER, JAN E | $710,000 | General Warranty Deed | 2021090918 |

| 6/23/2008 | MONARCH CUSTOM HOMES LLC | WILLISON, FREDERICK AND NICOLE | $690,000 | General Warranty Deed | 2008066890 |

| 5/1/2007 | LANDMARK RESOURCES LLC | MONARCH CUSTOM HOMES LLC | $117,500 | General Warranty Deed | 2007058458 |

| 6/1/2006 | WIND RIVER ASSOCIATES LLC | LANDMARK RESOURCES LLC | $99,500 | History | 2006071439 |

Sales/Documents

| Sale Date | 2/2/2023 |

|---|---|

| Grantor | WINTER, JAN E |

| Grantee | WHYTAL, CHRISTOPHER GEORGE & AMANDA ANNE |

| Sale Price | $815,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2023010247 |

| Sale Date | 8/2/2021 |

| Grantor | WILLISON, FREDERICK AND NICOLE |

| Grantee | WINTER, JAN E |

| Sale Price | $710,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2021090918 |

| Sale Date | 6/23/2008 |

| Grantor | MONARCH CUSTOM HOMES LLC |

| Grantee | WILLISON, FREDERICK AND NICOLE |

| Sale Price | $690,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2008066890 |

| Sale Date | 5/1/2007 |

| Grantor | LANDMARK RESOURCES LLC |

| Grantee | MONARCH CUSTOM HOMES LLC |

| Sale Price | $117,500 |

| Deed Type | General Warranty Deed |

| Document Number | 2007058458 |

| Sale Date | 6/1/2006 |

| Grantor | WIND RIVER ASSOCIATES LLC |

| Grantee | LANDMARK RESOURCES LLC |

| Sale Price | $99,500 |

| Deed Type | History |

| Document Number | 2006071439 |