General Information

| Situs Address | 10007 E 46 PL S TULSA 74146 |

|---|---|

| Owner Name |

WATSON, MARK A AND BRENDA G

|

| Owner Mailing Address | 25521 E 67TH ST BROKEN ARROW , OK 74014 |

| Account Type | Commercial |

| Parcel ID | 74650-94-30-00250 |

| Land Area | 0.25 acres / 10,877 sq ft |

| School District | T-9A |

| Legal Description | Subdivision: ALSUMA (74650) Legal: LTS 8 9 & 10 BLK 5 Section: 30 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

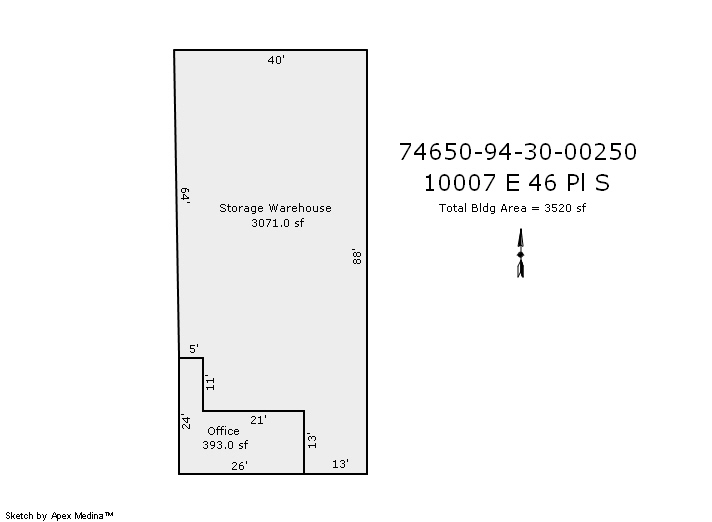

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 1971 | Commercial | 393 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

| 2025 | 1971 | Commercial | 3,464 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1971 | Commercial | 3,464 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2024 | 1971 | Commercial | 393 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1971 | Commercial | 3,464 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Storage Warehouse | Space Heater | |||||

| 2023 | 1971 | Commercial | 393 sqft | 1.00 | 12 | 0.00 | |

| 1.00 | Office Building | Warm and Cool Air Zone | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $192,900 | $192,900 | - |

| Total Taxable Value (Capped) | $124,262 | $130,475 | - |

| Improvement Value | $160,300 | $160,300 | - |

| Land Value | $32,600 | $32,600 | - |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $13,669 | $14,353 | - |

| Exemptions | $0 | $0 | - |

| Net Assessed Value | $13,669 | $14,353 | - |

| School District | T-9A | ||

| Tax Rate | 127.87 | 131.23 | 131.23 |

| Estimated taxes | $1,748 | $1,884 | - |

| Last Notice Date | 1/30/2024 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/15/1994 | AST LEON JOSEPH SR & WAND | WATSON MARK A & BRENDA 1 | $100,000 | History | 2000210126 BK-05671PG-02332 |

| 1/11/1994 | AST LEON JOSEPH SR & WANDA L R | PEBWORTH GARY | $95,000 | Warranty Deed | 1994200338 |

Sales/Documents

| Sale Date | 11/15/1994 |

|---|---|

| Grantor | AST LEON JOSEPH SR & WAND |

| Grantee | WATSON MARK A & BRENDA 1 |

| Sale Price | $100,000 |

| Deed Type | History |

| Document Number | 2000210126 BK-05671PG-02332 |

| Sale Date | 1/11/1994 |

| Grantor | AST LEON JOSEPH SR & WANDA L R |

| Grantee | PEBWORTH GARY |

| Sale Price | $95,000 |

| Deed Type | Warranty Deed |

| Document Number | 1994200338 |