General Information

| Situs Address | 12902 E 51 ST S TULSA 74134 |

|---|---|

| Owner Name |

QTR CORPORATION

|

| Owner Mailing Address | 4705 S 129TH EAST AVE TULSA , OK 741347005 |

| Account Type | Commercial |

| Parcel ID | 76280-94-33-29740 |

| Land Area | 33.61 acres / 1,464,068 sq ft |

| School District | T-9A |

| Legal Description | Subdivision: METROPOLITAN CENTER (76280) Legal: BLK 1 LESS BEG SECR BLK 1 TH NW210.47 ALG BA EXP ROW NW255 NW400 NW1120.40 N33.47 WL BLK 1 SE176.35 SE78.42 SE627.61 SE354.30 SE501.60 SE236.22 EL BLK 1 S58.57 POB FOR HWY & LESS BEG NWC TH E15 S34 W15 N34 POB FOR ST BLK 1 Section: 33 Township: 19 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

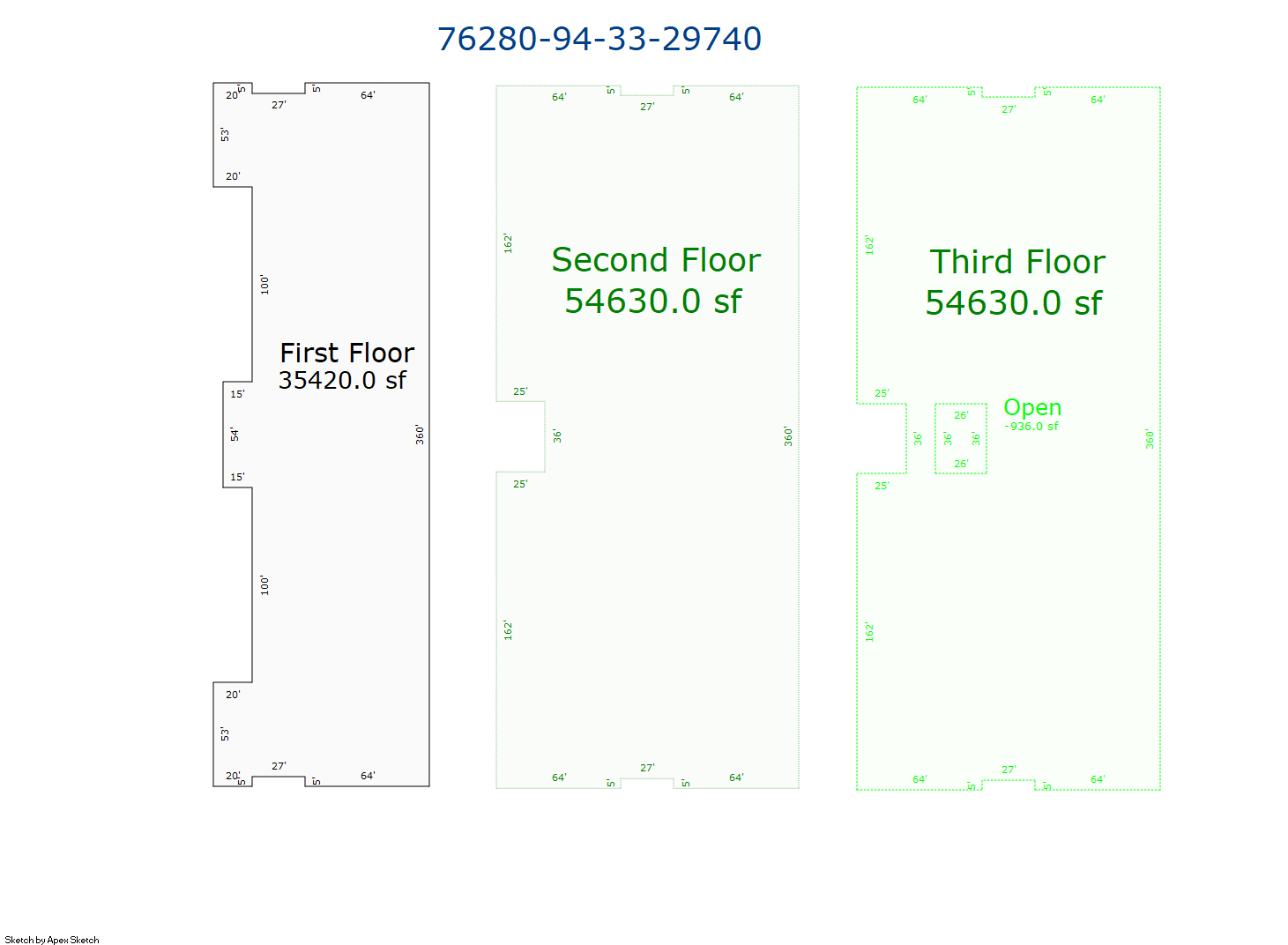

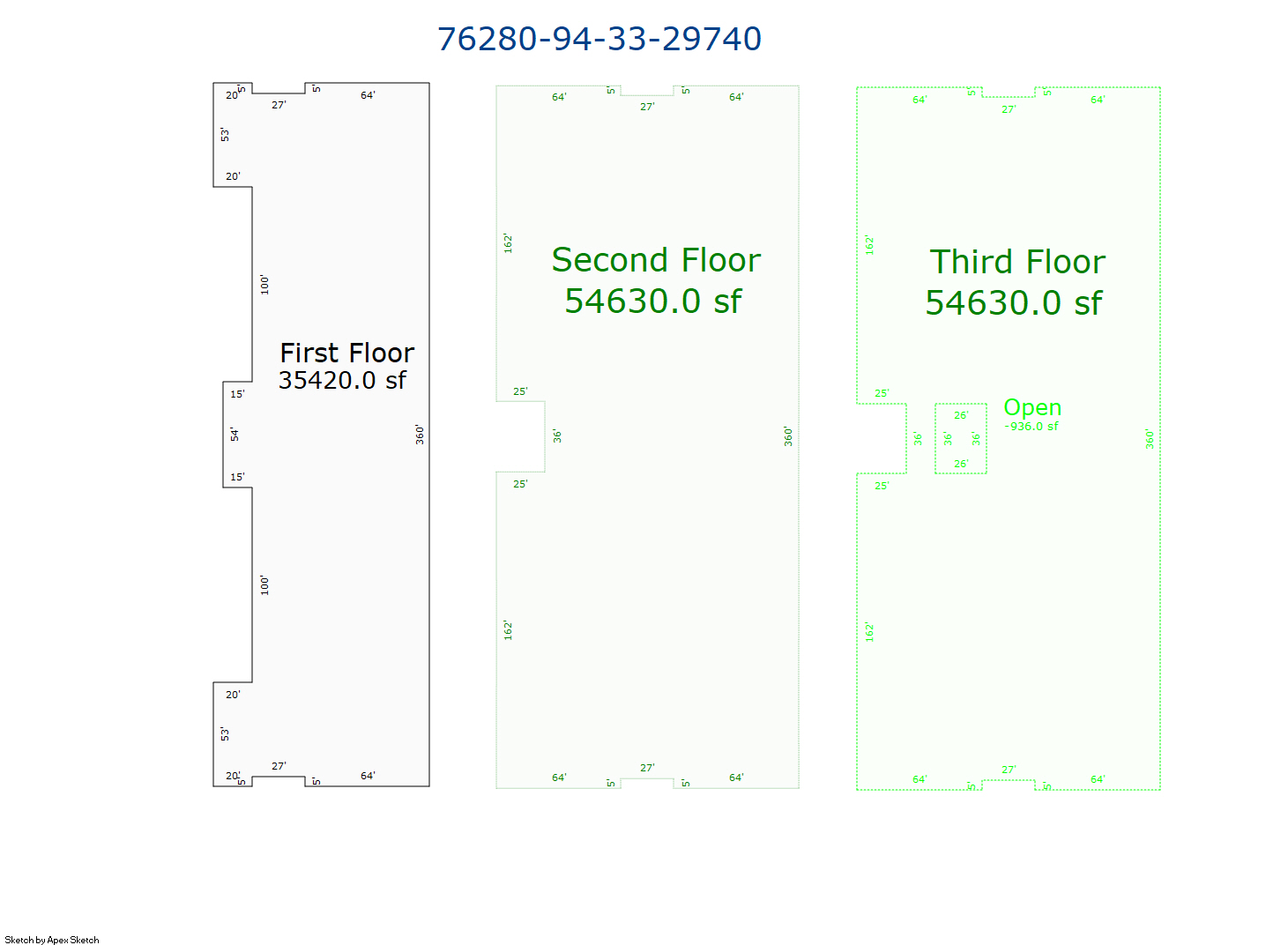

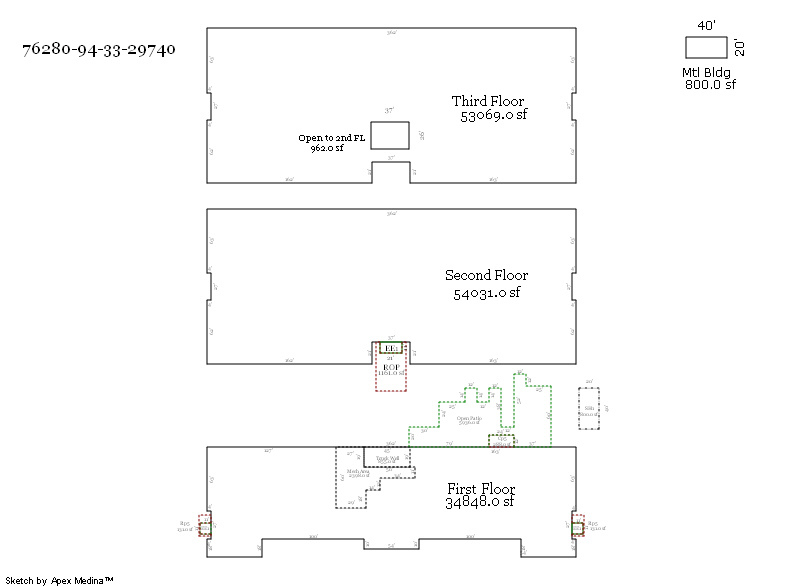

| 2025 | 1973 | Commercial | 143,593 sqft | 3.00 | 15 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 1973 | Commercial | 143,593 sqft | 3.00 | 15 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 1973 | Commercial | 143,593 sqft | 3.00 | 15 | 0.00 | |

| 1.00 | Office Building | Package Unit | |||||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $6,149,800 | $9,388,000 | $9,388,000 |

| Total Taxable Value (Capped) | $5,961,537 | $6,259,614 | $6,572,594 |

| Improvement Value | $5,183,800 | $8,422,000 | $8,422,000 |

| Land Value | $966,000 | $966,000 | $966,000 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $655,769 | $688,558 | $722,985 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $655,769 | $688,558 | $722,985 |

| School District | T-9A | ||

| Tax Rate | 127.87 | 131.23 | 131.23 |

| Estimated taxes | $83,853 | $90,359 | $94,877 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | - |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 5/2/2020 | QUIKTRIP CORPORATION | QTR CORPORATION | $0 | Quit Claim Deed | 2020039187 |

| 9/15/2017 | METROPOLITAN LF INS CO | QUIKTRIP CORPORATION | $5,150,000 | Special Warranty Deed | 2017085406 |

Sales/Documents

| Sale Date | 5/2/2020 |

|---|---|

| Grantor | QUIKTRIP CORPORATION |

| Grantee | QTR CORPORATION |

| Sale Price | $0 |

| Deed Type | Quit Claim Deed |

| Document Number | 2020039187 |

| Sale Date | 9/15/2017 |

| Grantor | METROPOLITAN LF INS CO |

| Grantee | QUIKTRIP CORPORATION |

| Sale Price | $5,150,000 |

| Deed Type | Special Warranty Deed |

| Document Number | 2017085406 |