General Information

| Situs Address | 11101 E 84 ST S TULSA 74133 |

|---|---|

| Owner Name |

WILLINGHAM, MARTETO

|

| Owner Mailing Address | 11101 E 84TH ST TULSA , OK 74133 |

| Account Type | Residential |

| Parcel ID | 76452-84-18-07970 |

| Land Area | 0.16 acres / 7,040 sq ft |

| School District | T-9A |

| Legal Description | Subdivision: OAK TREE VILLAGE (76452) Legal: LT 8 BLK 2 Section: 18 Township: 18 Range: 14 |

| Zoning | View City of Tulsa Zoning Data |

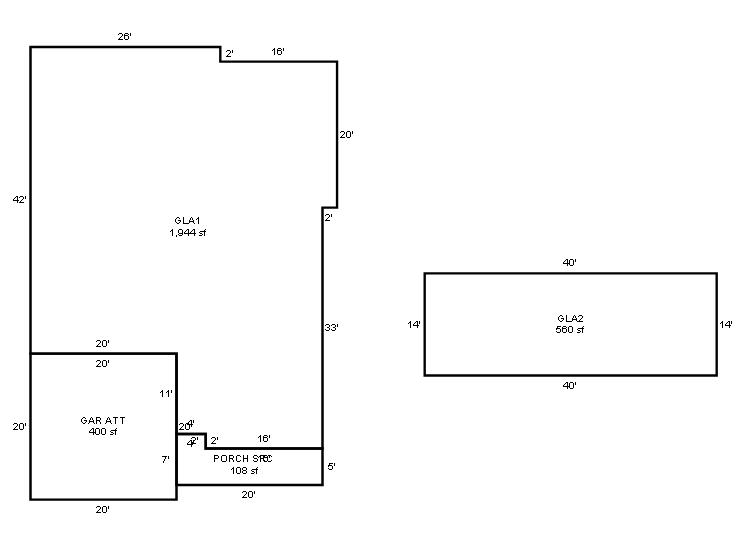

Improvements

Improvements

Tax Year: 2025

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2025 | 2000 | Residential | 2,504 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2024

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2024 | 2000 | Residential | 2,504 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Tax Year: 2023

| Tax Year | Yr Blt | Property Type | Livable | Stories | Story Height | Baths | Roof |

|---|---|---|---|---|---|---|---|

| Imp # | Use | Foundation | Exterior | HVAC Type | |||

| 2023 | 2000 | Residential | 2,504 sqft | 1.50 | 8 | 2.10 | Composition Shingle |

| 1.00 | 1½ Story Fin | Slab | Frame Siding/Brick/Stone Veneer | Cool Air in Heat Ducts | |||

Values and Tax Information

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Fair Cash(Market) Value | $295,970 | $296,096 | $321,700 |

| Total Taxable Value (Capped) | $231,525 | $243,101 | $255,256 |

| Improvement Value | $259,479 | $259,605 | $285,209 |

| Land Value | $36,491 | $36,491 | $36,491 |

| Assessment Ratio | 11% | 11% | 11% |

| Gross Assessed Value | $25,468 | $26,742 | $28,078 |

| Exemptions | $0 | $0 | $0 |

| Net Assessed Value | $25,468 | $26,742 | $28,078 |

| School District | T-9A | ||

| Tax Rate | 127.87 | 131.23 | 131.23 |

| Estimated taxes | $3,257 | $3,509 | $3,685 |

| Last Notice Date | 1/28/2025 | ||

Exemptions Claimed

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Homestead | - | - | Apply |

| Additional Homestead | - | - | - |

| Senior Valuation Limitation | - | - | - |

| 100% Disabled Veteran | - | - | - |

Sales/Documents

| Sale Date | Grantor | Grantee | Sale Price | Deed Type | Document Number |

|---|---|---|---|---|---|

| 11/27/2016 | REDMOND, JOHN T AND TAMARA L | WILLINGHAM, MARTETO | $210,000 | General Warranty Deed | 2016106640 |

| 8/1/2001 | $184,000 | Warranty Deed | 2000220908 BK-06584PG-01019 |

Sales/Documents

| Sale Date | 11/27/2016 |

|---|---|

| Grantor | REDMOND, JOHN T AND TAMARA L |

| Grantee | WILLINGHAM, MARTETO |

| Sale Price | $210,000 |

| Deed Type | General Warranty Deed |

| Document Number | 2016106640 |

| Sale Date | 8/1/2001 |

| Grantor | |

| Grantee | |

| Sale Price | $184,000 |

| Deed Type | Warranty Deed |

| Document Number | 2000220908 BK-06584PG-01019 |